- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Hospital System Boosts Biosimilar Use With EHR System

Providence St. Joseph Health used Toyota’s Kaizen system of nonvariance and standardization to build a model that increased use of biosimilars among physicians. The model employed the electronic health record system to guide physicians toward use of biosimilars, thereby increasing savings.

American healthcare spending reached $3.65 trillion in 2018. Of that, $344.5 billion was spent on prescription medications, a 30% increase compared with 2013. This was largely due to significant drug price increases over the past 5 years. Notably, the price of brand-name medications increased 60% on average, while the price of generic medications decreased. According to the IQVIA Institute for Human Data Science, new specialty medications are among the primary drivers for this increase in overall drug costs. The majority of these high-cost specialty medications are large-molecule biologic medications. There are generic alternatives for small-molecule chemical medications, but not for biologic medications. However, there are biosimilar medications that compete with these high-cost reference compounds.

Providence St. Joseph Health (PSJH) is the third largest nonprofit healthcare system in the country, with 51 hospitals and over 800 clinics. The PSJH system pharmacy division developed a medication utilization management (MUM) program that promotes biosimilar acceptance, supports contracting negotiation, streamlines physician workflows, simplifies pharmacy operations, and improves performance evaluations. This program saved PSJH nearly $10 million in biologic medication spending in 2019. This article shares the details of PSJH’s real world success in promoting biosimilar uptake.

Growing Acceptance of Biosimilars

Since the first biosimilar product was approved by the FDA in 2015, increasing numbers of biosimilars have been approved each year. There were 3 approvals in 2016 and 5 in 2017. In the past 2 years, we observed significantly higher interest in biosimilars, which was accompanied by more FDA approvals: 7 in 2018 and 10 in 2019. Many more agents are in the pipeline. As of the end of 2019, the FDA had approved 26 biosimilars for 9 reference compounds. Sixteen biosimilars are now on the US market.

These biosimilars are highly similar in efficacy, safety, and immunogenicity to the reference compounds. They cost significantly less than the reference compounds. Thus, they create more competition in the biologic medication market and force the reference compound manufacturers to lower prices.

Biosimilars have been widely used in Europe since 2006. In the past 13 years, they have been used for 400 million patient days. The biosimilar products for filgrastim increased patient access in the United Kingdom by 44% between the years 2006 and 2013. IQVIA projected the European Union will see almost US $11 billion in savings on biologic medications between 2016 and 2022, contributing to the utilization of biosimilars.

Unfortunately, the biosimilar uptake in the United States has not been as robust as in Europe. One reason is that United States law regulates biosimilars and interchangeable biosimilars differently. In many states, a pharmacist may not switch a reference compound for its biosimilar product without the prescribing physician’s authorization, unless it is an interchangeable biosimilar. Currently, there are no interchangeable biosimilars approved by the FDA. The FDA finalized its guidance to the industry for interchangeable biosimilars only recently, in May of 2019, which explains why we have not seen any interchangeable biosimilars.

Biosimilars often face patent litigation. Thus, many FDA-approved products have a delayed launch date. Reference compound manufacturers also offer significant financial incentives to third-party payers in the form of a rebate, which slows down payer uptake of biosimilars. Furthermore, healthcare systems often face volume-based tier prices, rebates, and other contracting methodologies utilized by reference compound manufacturers to maintain market share. These can hinder biosimilar adoption. In addition, physicians and patients have limited experience with biosimilars. Their slow acceptance can be another hindering factor for biosimilar uptake.

Healthcare system pharmacy leadership teams should establish various policies, procedures, and MUM programs to reduce cost without sacrificing the quality of patient care. The emergence of biosimilars has introduced new challenges and opportunities. The following discussion outlines strategies for successful utilization management of biosimilars.

Employing Japanese Principles to Increase Savings

The design of the PSJH MUM program was based on Toyota’s kaizen principle. We aimed at reducing variation, increasing efficiency, and standardizing practice. In order to achieve that, we built tools in the electronic health record (EHR) system (PSJH’s EHR system is Epic) to guide the physicians to preferred biosimilars. The EHR-guided prescribing streamlined physician and pharmacist workflow, simplified the biosimilar ordering process, and improved efficiency. However, we used a different EHR model for outpatient infusion centers. This used the PSJH-preferred product as the default biosimilar, but outpatient physicians were still allowed the freedom to prescribe reference compounds or different biosimilars, if the patient’s payer preferred them.

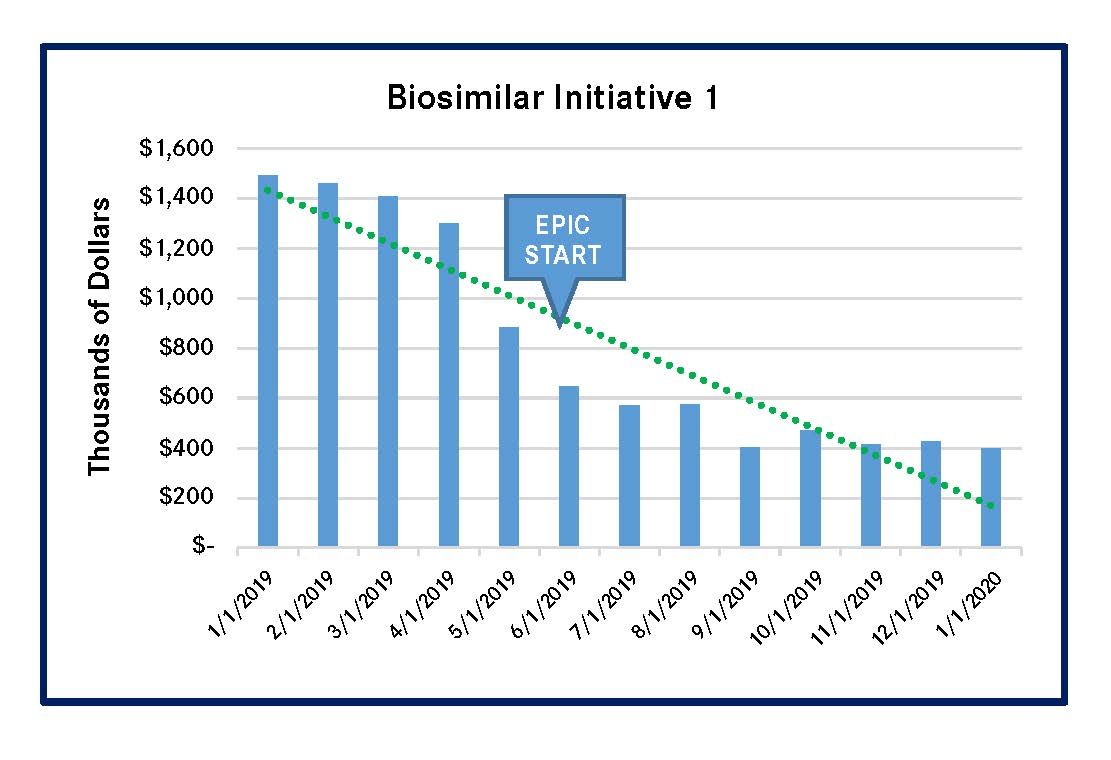

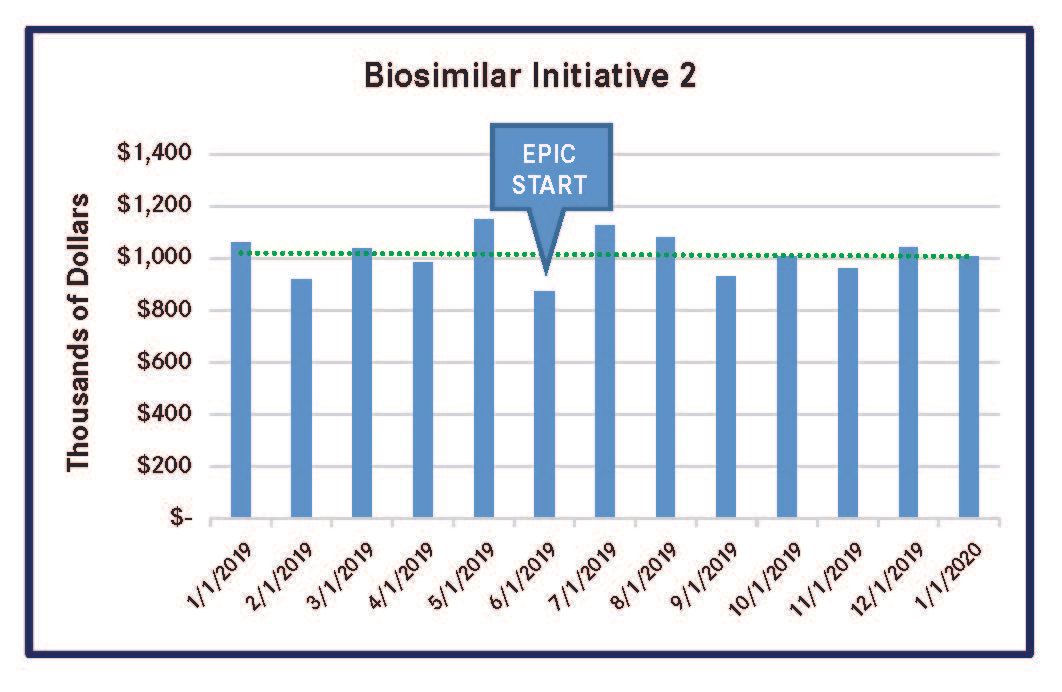

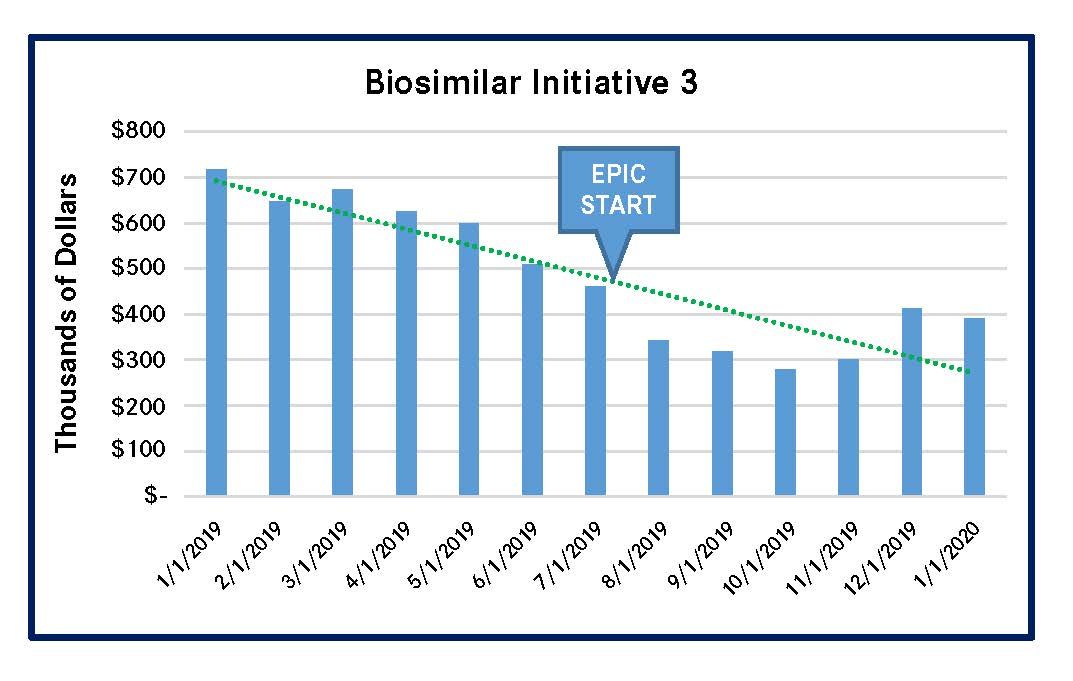

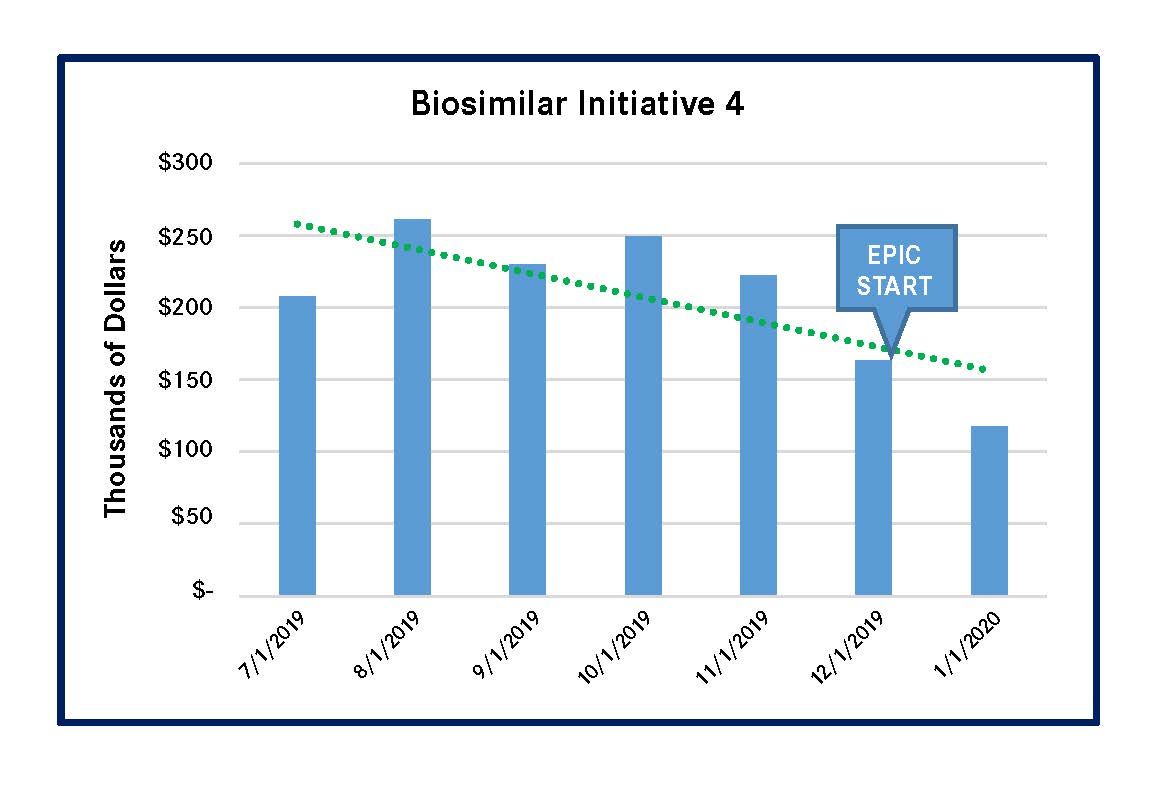

PSJH implemented 4 biosimilar-focused MUM initiatives in 2019. These initiatives reduced spending on high-cost biologic medications that had biosimilars in the US market. Three of the initiatives led to significantly lower outlay for the reference compounds, and the remaining initiative for a single reference compound had a less-meaningful spending reduction (Figures 1-4). All of these results were achieved by using Epic-guided prescribing to lower cost via the use of equally efficacious biosimilars instead of more expensive reference compounds. The following graphs summarize the correlation between the changes of biologic medication spending and the Epic-guided prescribing go-live date, which is marked “Epic” in the figures below. All medication spending is displayed in thousands of dollars. In some cases, declines in the use of reference biologics began prior to the initiation of the Epic system, although pronounced declines generally followed Epic implementation.

Figure 1. Spending Decline for Pegfilgrastim Reference Biologic (Neulasta & Neulasta Onpro)

Figure 2. Spending for Infliximab Reference Biologic (Remicade)

Figure 3. Spending Decline for Epoetin Alfa Reference Biologic (Procrit/Epogen)

Figure 4. Spending Decline for Filgrastim Reference Biologic (Neupogen)

It is important to closely monitor the biologic medication pipeline, evaluate relevant clinical data, and develop an expedited formulary review and approval process. The formulary status of all biosimilar products for the reference compounds should be approved, before products launch. In this way, multiple biosimilars will be on the formulary. This can enhance the negotiation power of contracting teams and improve the ability of healthcare systems to choose biologics on the basis of cost, other things being equal.

Healthcare systems should also build tools in their EHR systems to guide physician prescribing of the preferred biosimilars. EHR-guided prescribing streamlines physician and pharmacist workflow, simplifies the biosimilar ordering process, and improves efficiency.

Choose the Lowest-Cost Biosimilar

Pharmacoeconomic analysis is a crucial part of medication utilization management. The pharmacy team must evaluate the full financial benefit of biosimilars in different healthcare settings. Inpatient and outpatient billing and reimbursement methodologies are different; therefore, the financial impact of biosimilars will vary. Inpatient reimbursement is usually based on diagnosis-related group, or DRG, so the lowest-cost biosimilar should be chosen as the preferred product. In contrast, outpatient reimbursement depends on payer preferences. Before switching a patient from the reference compound to a biosimilar, the pharmacy should work closely with the business office and revenue cycle teams to obtain prior authorization and evaluate net profit.

The impact of biosimilars can also vary depending on the account types. Healthcare systems pay one price for a group purchasing organization purchase and a different price for a wholesale acquisition cost purchase. 340B Drug Pricing Program accounts are particularly interesting. Pursuant to the new CMS reimbursement methodology, biosimilar products within the “pass-through period” will be reimbursed at the average sales price (ASP) plus 6%, instead of ASP minus 22.5% for the reference compound. Thus, by selecting a newer biosimilar product (within the pass-through period) for 340B-qualifying patients, a healthcare facility will save money by purchasing a lower-cost product and receiving a greater reimbursement than for the reference compound or older biosimilars (which are no longer in the pass-through period).

This type of program requires collaboration among pharmacists, physicians, data scientists, finance analysts, business office personnel, and healthcare informatics professionals. The resulting cost reductions and the increased access to care will help improve patient clinical outcomes.

In conclusion, this comprehensive, multidisciplinary medication utilization management model can enhance system-wide acceptance of biosimilars, decrease biologic medication cost, simplify physician workflow, and improve overall pharmacy sustainability.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.