- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Assessing the Next Wave of Biosimilars

Ever since biosimilars arrived in the United States in 2015 with the launch of Sandoz’s Zarxio, a biosimilar of Amgen’s Neupogen, reference product manufacturers and biosimilar manufacturers have locked horns on pricing, patents and access policies—and the competition remains fierce. Now the industry is preparing for the next wave of biosimilars, which will launch from 2020 to 2030. At least 19 branded biologics, which grossed more than $40 billion worldwide in 2017, have around 80 biosimilars from 39 manufacturers under development in the United States and European Union.

Ever since biosimilars arrived in the United States in 2015 with the launch of Sandoz’s Zarxio, a biosimilar of Amgen’s Neupogen, reference product manufacturers and biosimilar manufacturers have locked horns on pricing, patents and access policies—and the competition remains fierce. Now the industry is preparing for the next wave of biosimilars, which will launch from 2020 to 2030. At least 19 branded biologics, which grossed more than $40 billion worldwide in 2017, have around 80 biosimilars from 39 manufacturers under development in the United States and European Union.1,2

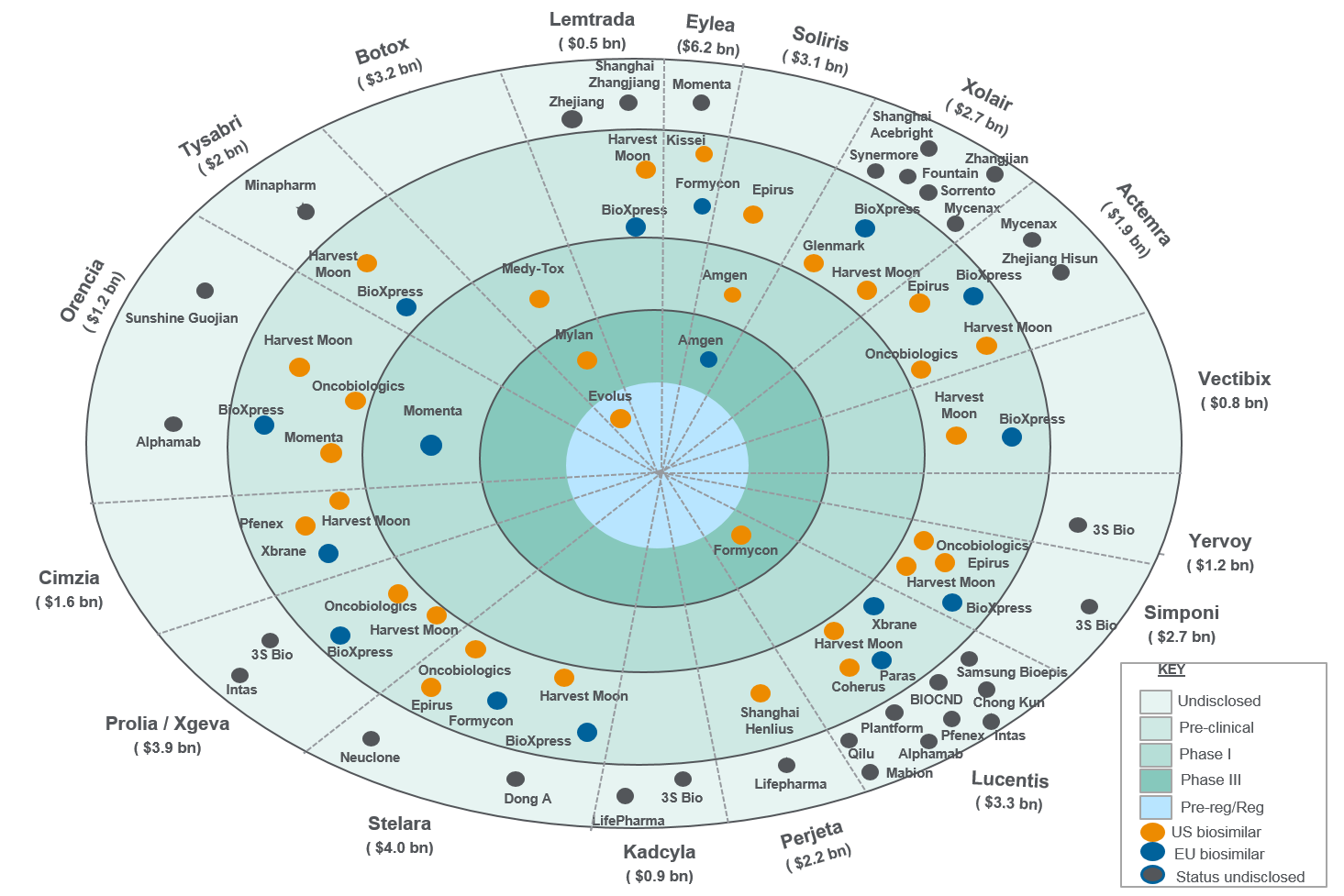

Figure 1: Next-wave biosimilars

Sources: Citeline and Evaluate Pharma.

There can be additional undisclosed molecules whose status in public domain is not available. Sales depict worldwide 2017 sales in billions. Biosimilars of adalimumab (Humira) and etanercept (Enbrel) have not been considered under the next wave owing to their potential launches in the European Union before 2020. The graphic is based on all data available on Citeline and Evaluate Pharma, and no entities were removed in order to avoid selective bias. Epirus and Harvest Moon were included to help capture the potential competition those markets could face.

This next wave of biosimilars is certain to be much different from the first wave. Here’s why:

1. New market dynamics will present a fresh set of challenges. Since regulatory authorities have been clarifying guidelines on naming, labelling, scientific and clinical data requirements, interchangeability, and reimbursement, biosimilar manufacturers now have greater clarity on the regulatory front. However, additional challenges need to be considered. As regulatory authorities strive to decrease the time and investment required to bring biosimilars to market, lower barriers to entry could increase biosimilar competition.3

On the payer side, the gross-to-net bubble may become deflated to some extent. Recently, UnitedHealthcare announced that it will pass on rebates to patients, and CMS may consider the application of rebates at the point of sale.4,5 If implemented, this policy will provide incentives for lower—net-priced biosimilars over high-priced, highly rebated products.

Payers also will have more control of the self-injectable pharmacy benefit drugs [biosimilars of abatacept (Orencia), certolizumab pegol (Cimzia) and golimumab (Simponi)] relative to current biosimilars of physician-administered “buy-and-bill” drugs.

Moreover, (in the United States) interchangeable biosimilars may ease the ability for payers to exert control to drive the switch, including nonmedical switching, therefore increasing the importance of the pharmacist in the distribution chain.

2. New players. For originators, there are some manufacturers that will draw upon their early experience of facing biosimilar competition in the earlier wave, while others will face biosimilar competition for the first time. The right mix of effort and timing will be critical for these companies to successfully defend their markets.

Manufacturers that will face biosimilar competition for the first time include the following, for a total revenue at risk, based on 2017 sales, of $21 billion:

- Alexion, eculizumab (Soliris)

- Allergan, onabotulinumtoxinA (Botox)

- Biogen, natalizumab (Tysabri)

- Bristol-Meyers Squibb, abatacept (Orencia), ipilimumab (Yervoy)

- Novartis, omalizumab (Xolair)

- Regeneron, aflibercept (Eylea)

- UCB, certolizumab pegol (Cimzia)

Manufactures that are experienced with biosimilar competition include the following, for a total revenue at risk, based on 2017 sales, of $22 billion:

- Amgen, panitumumab (Vectibix), denosumab (Xgeva, Prolia)

- Janssen, golimumab (Simponi), ustekinumab (Stelara)

- Roche/Genentech, omalizumab (Xolair), tocilizumab (Actemra), ranibizumab (Lucentis), trastuzumab emtansine (Kadcyla), pertuzumab (Perjeta)

The next wave will be interesting from the biosimilar manufacturers’ perspective as well. While the biggest biosimilar manufacturers have some partnerships (Pfizer and Celltrion, for example) as well as a “go it alone” model, many emerging or smaller biosimilar manufacturers are entering into partnerships to support successful commercialization. The most recent example is Mylan’s collaboration with Revance Therapeutics for a Botox biosimilar to enter the next wave.6

Companies will need to be efficient in their research and development and manufacturing processes, and bring down costs to be able to absorb discounting and rebating pressures. Differentiation strategies could set a biosimilar manufacturer apart, but are also costly, and it’s unclear what aspects of differentiation payers and physicians value. Lastly, scenario planning—particularly around contracting and the ability to apply agility to contracting (in the United States)—will be critical to success, particularly in situations where multiple biosimilars launch at the same time.

3. Biosimilars will enter new therapy areas. In the current wave, biosimilars have been limited to inflammatory diseases, oncology, and diabetes (follow-ons of insulins will be regulated as biosimilars in the United States in 2020). In the next wave, we’ll see biosimilars enter different therapy areas, such as neurology, respiratory diseases, ophthalmology, and rare diseases in other therapy areas. Since some specialists will have no experience and limited awareness of biosimilars, this change could bring new challenges. Orphan and ultra-orphan biosimilars will face unique challenges in the landscape given limited patient populations, higher-cost products, just-in-time ordering, and unique contracting requirements. Despite improved awareness of biosimilars, ensuring that physicians in these specialties are comfortable with biosimilars may require that manufacturers deploy specific sales roles or support programs.

Among the new therapy areas, indications, and reference products that will be targeted are the following:

- Neuroimmunology, including the multiple sclerosis drugs alemtuzumab (Lemtrada) and natalizumab (Tysabri), and the myasthenia gravis drug eculizumab (Soliris)

- Neuromodulation, including the bladder dysfunction, chronic migraine, and aesthetics drug onabotulinumtoxinA (Botox)

- Ophthalmology, including the macular edema, retinal vein occlusion, age-related macular degeneration drugs ranibizumab (Lucentis) and aflibercept (Eylea)

- Osteology, including the cancer-related bone loss and osteoporosis drug denosumab (Prolia, Xgeva)

- Rare hematology, including the paroxysmal nocturnal hemoglobinuria and atypical hemolytic-uremic syndrome drug eculizumab (Soliris)

- Respiratory, including the asthma drug omalizumab (Xolair)

While there are lessons to be learned from the current wave of biosimilars, the next wave will certainly bring surprises. For the next-wave defenders, planning for uncertainty will be critical, particularly if they’re unfamiliar with the unique biosimilar landscape. Next-wave biosimilar developers also will face uncertainty and uncharted territory as they face originator developers with sharpened defense skills and launch into increasingly crowded markets. Will some originators surrender their defense efforts? Will some biosimilar manufacturers drop out of the race? Given market shake-ups, we believe that either scenario is in the realm of possibility.

Authors: Sandeep Sangwan, MPharm, and Tamal Taru, PGDM

Sandeep Sangwan, MPharm, is a consultant in ZS’s New Delhi office. He supports multiple biotechnology clients specifically on biosimilars and also is responsible for creating ZS’s internal knowledge base on biosimilars. He has 8 years of experience within the pharmaceuticals industry, including areas such as business consulting, intellectual property research and regulatory affairs.

Tamal Taru, PGDM, is a consultant in ZS’ New Delhi office. He has more than 7 years of experience in business research for multiple pharmaceutical clients, with a focus on oncology and biosimilars. He has worked on projects spanning areas such as competitive intelligence, opportunity assessment/business development and licensing, and brand strategy.

Advisors: Tucker Herbert, MBA, and Christina Corridon, MPH, MBA

Tucker Herbert, MBA, is a manager in ZS’s Los Angeles office. He has advised major biotechnology firms on a broad range of sales and marketing strategy issues, with an emphasis on oncology and biosimilars. His experience has focused on global quantitative and qualitative primary market research and secondary data analytics. In addition, Tucker was one of the founding members of ZS’s biosimilars vertical, and he has led more than 30 training sessions across North America and Asia on the topic.

Christina Corridon, MPH, MBA is an associate principal in ZS’s Boston office and a leader in the firm’s oncology practice. She has more than a decade of experience working in the pharmaceutical and biotech industries, with specific expertise in oncology and biosimilars. During her consulting career, she has worked on US and global projects spanning many facets of commercialization strategy, including launch strategy and planning, go-to-market strategy, commercial models, marketing strategy and brand planning.

References

1. Citeline. Pharma Intelligence website.https://pharmaintelligence.informa.com/products-and-services/data-and-analysis/citeline.

2. Evaluate Pharma website. http://www.evaluategroup.com/default.aspx.

3. Healthy Innovation, Safer Families. FDA website. https://www.fda.gov/downloads/AboutFDA/ReportsManualsForms/Reports/UCM592001.pdf. Accessed May 2018.

4. New Data Shows the Gross-to-Net Rebate Bubble Growing Even Bigger. DrugChannels.net website. https://www.drugchannels.net/2017/06/new-data-show-gross-to-net-rebate.html. Accessed May 2018.

5. Department of Health and Human Services Centers for Medicare & Medicaid Services website. https://s3.amazonaws.com/public-inspection.federalregister.gov/2017-25068.pdf#page=305. Accessed May 2018.

6. Mylan to Bring a Biosimilar of BOTOX to the Market Through a Collaboration and License Agreement With Revance Therapeutics. FirstWordPharma.com website. Accessed May 2018.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.