- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Annual STADA Report Shows Record Profit Growth for 2023

Germany-based biosimilar manufacturer STADA Arzneimittel reports strong financial performance in 2023 with double digit sales growth and billions in profits. The CEO credits the company’s success on their strong company culture and focus for innovation.

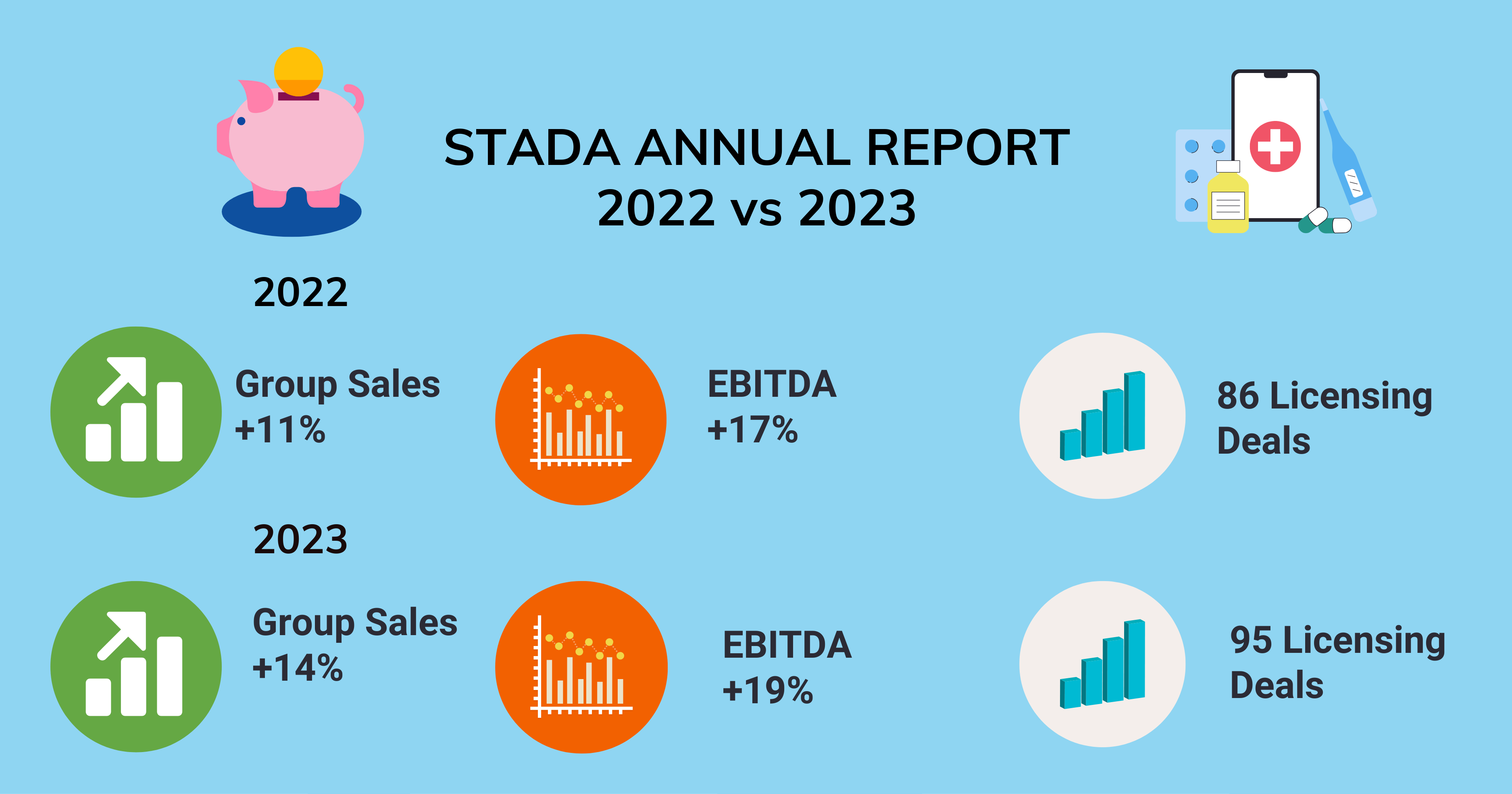

STADA Annual Report 2022 vs 2023

In 2023, STADA Arzneimittel’s group adjusted sales were up by 14% with a 19% improvement rate in earnings before interest, taxes, depreciation, and amortization (EBITDA), according to the company’s annual earnings report. Overall, 2023 sales were around $4 billion and $870 million in the annual EBITDA. Additionally, the company had a total of 95 business development and licensing deals signed in 2023.

This past November, about 91% of STADA colleagues voluntarily participated in a global employee survey on various industry benchmarks, which exceeded expectations. Around 88% of the survey participating employees expressed confidence towards the company’s successful business objectives.

Peter Goldschmidt, CEO of STADA, claimed, “Our performance continues to progress ahead of major competitors. Our culture with entrepreneurial focus is delivering new launches from our extensive pipelines, on top of strong organic growth.”

Specialty was STADA’s fastest growing product segment in 2023 and hit a company milestone as it entered the European ophthalmology market. A 25% increase in sales was achieved, leading to a total of around $8 million dollars. STADA’s sixth marketed ranibizumab biosimilar (Ximluci), is an alternative to the reference brand Lucentis (ranibizumab). Previous launches of similar biologics include Hukyndra (adalimumab biosimilar), Oyvas (bevacizumab biosimilar), and Movymia (teriparatide).

The Consumer Healthcare product segment by STADA largely drove the sales growth up in 2023, accounting for 40% of the total Group sales. Goldschmidt’s claims were supported by the company’s outperformance against other top competitors as their sales advanced up to $1.6 billion, a 17% increase.

This success has awarded STADA Europe’s fourth largest Consumer Healthcare supplier in sales. Grippostad, Silomat, Multilind, Elotrans, and Hoggar were among some of the brands that had the ability to grow significantly, establishing market leadership in Germany. In conjunction with Germany, Belgium, France, Italy, and Spain had improvements in Consumer Healthcare market positions too.

In July 2023, STADA acquired the brands known as Antistax (red-vine-leaf-extract), Lomudal (chromoglycate sodium), Omnivit (carbonyl iron, folic acid, zinc sulfate, vitamin B complex, vitamin C), and Opticrom (cromolyn sodium ophthalmic solution) from Sanofi. This status elevated STADA’s partnership appeal as they continue to build upon their existing commercialization throughout 20 European countries.

Generics were a major contributor to the 6% increase in sales, with STADA earning $1.6 billion. Launches assisting in this progress include anticoagulant apixaban, the diabetes drug sitagliptin, analgesic tapentadol, and medications that reverse the effect of muscle relaxants known as tacrolimus for transplantation and sugammadex.

Annual sales for Stelara are around $2.7 billion in Europe but STADA’s ustekinumab biosimilar, Uzpruvo, introduced competition after it received positive attributes for the first time by the European Medicines Agency. By the end of 2023, an increasing number of patients in Germany began Kinpeygo (budesonide), the first treatment approved in Europe for rare kidney diseases.

An improved independent assessment of the Group’s environmental, social, and governance (ESG) risk was reflected in December 2023. STADA was ranked as the top 6% of global pharmaceutical companies when considering ESG. An assessment compared STADA with 900 other global pharmaceutical companies and expressed their dedication to working as a trusted partner with society, customers, regulators, and capital market stakeholders to ensure success.

Goldschmidt concluded the expense report, “With our unique culture driving performance, I am confident that we have the team, the products, and the pipeline in place to maintain our strong growth momentum.”

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.