- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

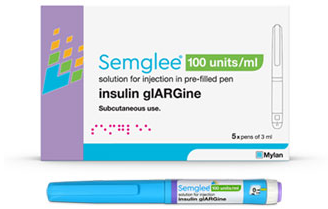

Biocon Updates on Semglee Interchangeable Status

Biocon reports on its revenues from biosimilars and the FDA status of its insulin glargine product.

In an update on the possibility of an interchangeable designation for its insulin glargine biosimilar candidate (Semglee), Biocon of Bengaluru, India, said in an earnings statement this week that an “end of July 2021” FDA decision is possible.

The much-anticipated interchangeable designation could potentially be the first awarded for a biosimilar, which is a copy biologic that has no clinically meaningful differences from the originator, or reference, product. The interchangeable designation would allow pharmacists to substitute the insulin product for the reference product (Lantus) without the express authorization of the prescribing physician.

In August 2020, Biocon Biologics and Mylan (now Viatris), launched Semglee on the US market but did not have biosimilar or interchangeable status for it because it wasn’t approved under the biosimilar pathway in the Biologics Price Competition and Innovation Act (BPCIA). They have since sought biosimilar and interchangeable status for this product. Biocon Biologics is a subsidiary of Biocon.

Potentially, these designations would help to build acceptance and use of this product in the medical community, leading to increased revenues and, if the product helps to lower the cost of insulin, broader access to this medicine for patients who currently have difficulty paying for it.

“The regulatory process for the grant of ‘interchangeability’ designation to our [glargine; Semglee] is progressing under the 351(k) pathway in the United States,” Biocon said. Biologics license applications for biosimilar and interchangeable status must be submitted under the 351(k) pathway of the Public Health Service Act, which encompasses the BPCIA.

Insulin Aspart Candidate

In addition, Biocon has submitted an application to the FDA for a biosimilar form of insulin aspart. Whereas glargine is a “long-acting” insulin, aspart takes effect in the body with rapidity and is considered “short-acting.”

The company said there are no pending requirements from the FDA for technical or clinical information about the aspart biosimilar candidate and the FDA has scheduled a “pre-approval inspection” of Biocon’s manufacturing facility in Malasia, where the insulin aspart would be manufactured. That inspection would occur in the final business quarter of this year, Biocon said.

Total revenue was up for the year just ended but total profits were down at Biocon. The company said biosimilar revenues have grown and highlighted those as a growth driver.

Profit and Loss

Biocon Biologics reported $102 million in revenues for the quarter just ended, up from $93 million in the comparable year-ago quarter, representing a 10% increase. These figures include biosimilar revenues predominantly, but also sales of novel biologics marketed in India. Biocon's net profit for the just-ended quarter was $11.3 million vs $20 million a year earlier, down 44%. Generics income for the company was down 22%.

The company attributed the decline in profits partly to losses associated with Bicara Therapeutics, a start-up novel drug development subsidiary based in Boston, Massachusetts; as well as COVID-19–related operational challenges for the company’s facilities in Bengaluru and Hyderabad, which produce key ingredients for drugs, known as active pharmaceutical ingredients, or APIs.

“Globally, we see a strong demand for biosimilars and generic drugs, given the growing emphasis on affordable drug pricing,” company officials said in their earnings statement.

Read about expert opinion on the potential for competition in the insulin market here.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.