- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BioRationality: Efficacy Testing and Interchangeability of Biosimilar Remains a Dogma for Most

Sarfaraz K. Niazi, PhD, comments on a poll he conducted revealing that many are still hesitant to remove clinical efficacy study requirements for biosimilars in his latest column.

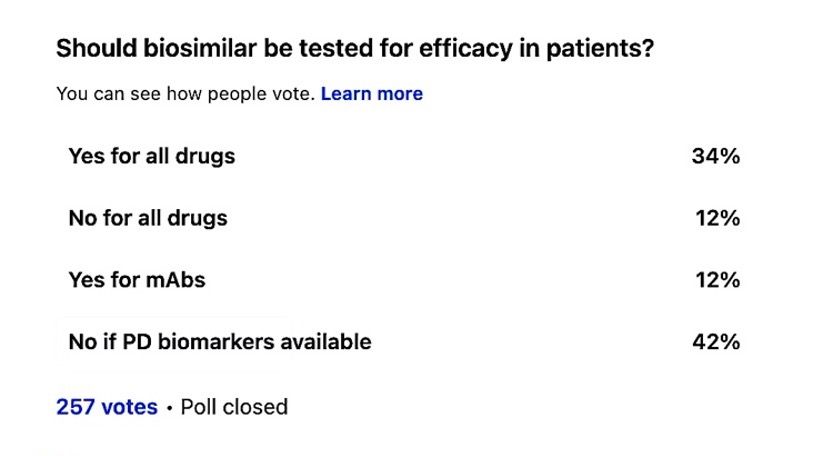

While much has been written about the futility of comparative efficacy testing of biosimilars, the mindset of stakeholders that efficacy testing is a golden slate remains alive. I conducted a poll of my LinkedIn connections, with surprising results. Only 12% agreed that there is no need for efficacy testing; others considered pharmacodynamic (PD) biomarkers or differentiated the monoclonal antibodies (mAbs). This was not what I had expected. Although it is a smaller poll and may include biased participants, the divide is remarkable.

Niazi's Linkedin poll

The reasons for these results may come from the shared knowledge of statistics. In lay terms, the acceptable margin of difference must be smaller than the variability ever to fail a product; for all such testing, an arbitrary difference of 30% to 40% is accepted as “clinical judgment” while the real difference is almost close to zero. These trials can never fail, as thousands of such reports tell us. The reason for removing efficacy trials is not just to reduce the development cost by two-thirds, but to ensure no human abuse, according to the US 21CFR320.25(a)(13).

This issue becomes more significant when discussing interchangeability; why would 3 trials fail if 1 trial can never fail? The FDA has acknowledged that interchangeability does not ensure better biosimilar safety or efficacy. The only thing I can think of is the political concerns. Recently, Safe Biologics has begun a campaign to block the FDA from considering the removal of interchangeability. Their conference in collaboration with Generics and Biosimilars Initiative Journal conducted on November 30 was based on what I perceive to believe are misconceptions as those who presented their views had no qualification to question the FDA initiatives, in my opinion. This could be a political issue. We need to educate stakeholders that biosimilars are safe and should be affordable, if possible, without having an overwhelming focus on the development cost.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.