- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Can Congress Speed Biosimilars to Market by Limiting Patent Litigations?

Using data compiled for BiologicsHQ.com, we analyzed 2 bills that propose changes to patent litigation by limiting the number of patents a reference product sponsor can assert in a patent litigation to see how many biosimilar cases they would have impacted so far and whether they would really help bring biosimilars to market sooner.

Ha Kung Wong, JDPartner, Venable LLPApril Breyer Menon, JDFounder, April Breyer Consulting

Introduction

Biosimilar uptake has been low in the United States so far, with market shares for most biosimilars under 10%. Given the cost savings potential, trying to increase biosimilar uptake has been high on Congress’ agenda. There are many bills pending in Congress dealing with issues from a variety of angles, such as changes to the FDA Purple Book listing of biologic drugs, limits on patent litigation, changes to patent office proceedings, and ways to combat anticompetitive behavior, such as innovator product sponsors inappropriately withholding samples. But will they actually help bring biosimilars to market more quickly?

Using data compiled for BiologicsHQ.com, we analyzed 2 bills that propose changes to patent litigation by limiting the number of patents a reference product sponsor can assert in a patent litigation to see how many biosimilar cases they would have impacted so far and whether they would really help bring biosimilars to market sooner.

Affordable Prescriptions for Patients Act of 2019 (S.1416) and Affordable Prescriptions for Patients Through Improvements to Patent Litigation Act (HR.3991)

The Affordable Prescriptions for Patients Act of 2019 (S.1416) was introduced in the Senate on May 29, 2019 and amended June 27, 2019. Its sponsors intended it to prevent “product hopping” and “patent thicketing” by codifying the definitions of these terms and considering them anticompetitive behavior for which the Federal Trade Commission (FTC) could take enforcement actions against. In the amendment, the “patent thicketing” definition was removed, and it was replaced with limits on the biologic drug patents that could be asserted in patent litigation. These same patent litigation limits are also included in the House version of this bill, the Affordable Prescriptions for Patients Through Improvements to Patent Litigation Act (HR.3991), introduced July 25, 2019.

Focusing on the provisions related to biologic drugs, the Senate bill first defines “product hopping” as a reference product sponsor (RPS) either: (1) making a “hard switch” or (2) making a “soft switch” between the time it receives notice that a manufacturer has submitted an abbreviated Biologic License Application (aBLA) to the FDA and 180 days after the biosimilar has been marketed. According to the bill, such actions will be considered anticompetitive behavior for which the RPS may be enjoined or disgorged of any unjust enrichment, unless the RPS can demonstrate one of the allowable procompetitive, safety or supply disruption justifications apply.

A “hard switch” is when the RPS either (1) requests that approval for the reference product be withdrawn or that the reference product be placed on the discontinued product list, and the RPS markets/sells a follow-on product, or (2) announces it is withdrawing or discontinuing the reference product or destroys the inventory of the reference product in a manner that impedes biosimilar competition, and markets/sells a follow-on product.

A “soft switch” is when an RPS takes actions (other than those defined as a hard switch) that unfairly disadvantage the reference product in a manner that impedes biosimilar competition and sells a follow-on product.

Both the House and Senate bills place limits on certain types of patents that an RPS can assert against a biosimilar applicant in an infringement litigation if the biosimilar applicant completes all the actions required of it under the Biologics Price Competition and Innovation Act (BPCIA) patent dance provisions (42 U.S.C. § 262(l)).

Under these bills, the RPS would be limited to asserting a maximum of 20 patents that claim a biological product, a use of that product, or a method or product used in manufacture, that also meet the following criteria: (1) the patent is disclosed on the RPS’s list that it gives to the biosimilar applicant as part of the patent dance (described in 42 U.S.C. § 262(l)(3)(A)); and (2) the patent has an actual filing date of more than four years after the reference product was approved by the FDA, or the patent includes a claim to a manufacturing process not used by the RPS. Additionally, no more than 10 of the 20 patents could have issued after the RPS gave its list of patents to the biosimilar applicant during the patent dance exchange. The patents limited to 20 do not include indication/method of use patents.

The 20-patent limit can be increased if it is in the interest of justice, or good cause has been shown by the RPS. Good cause is established if the biosimilar applicant fails to provide information required under 42 U.S.C. § 262(l)(2)(A) that would enable the RPS to form a reasonable belief about whether it could assert an infringement claim. Good cause may be established if (1) there is a material change to the biologic product/process; (2) for a particular patent, if it would have issued prior to the RPS providing its patent list but for a delay by the patent office; or (3) for another reason determined by the court.

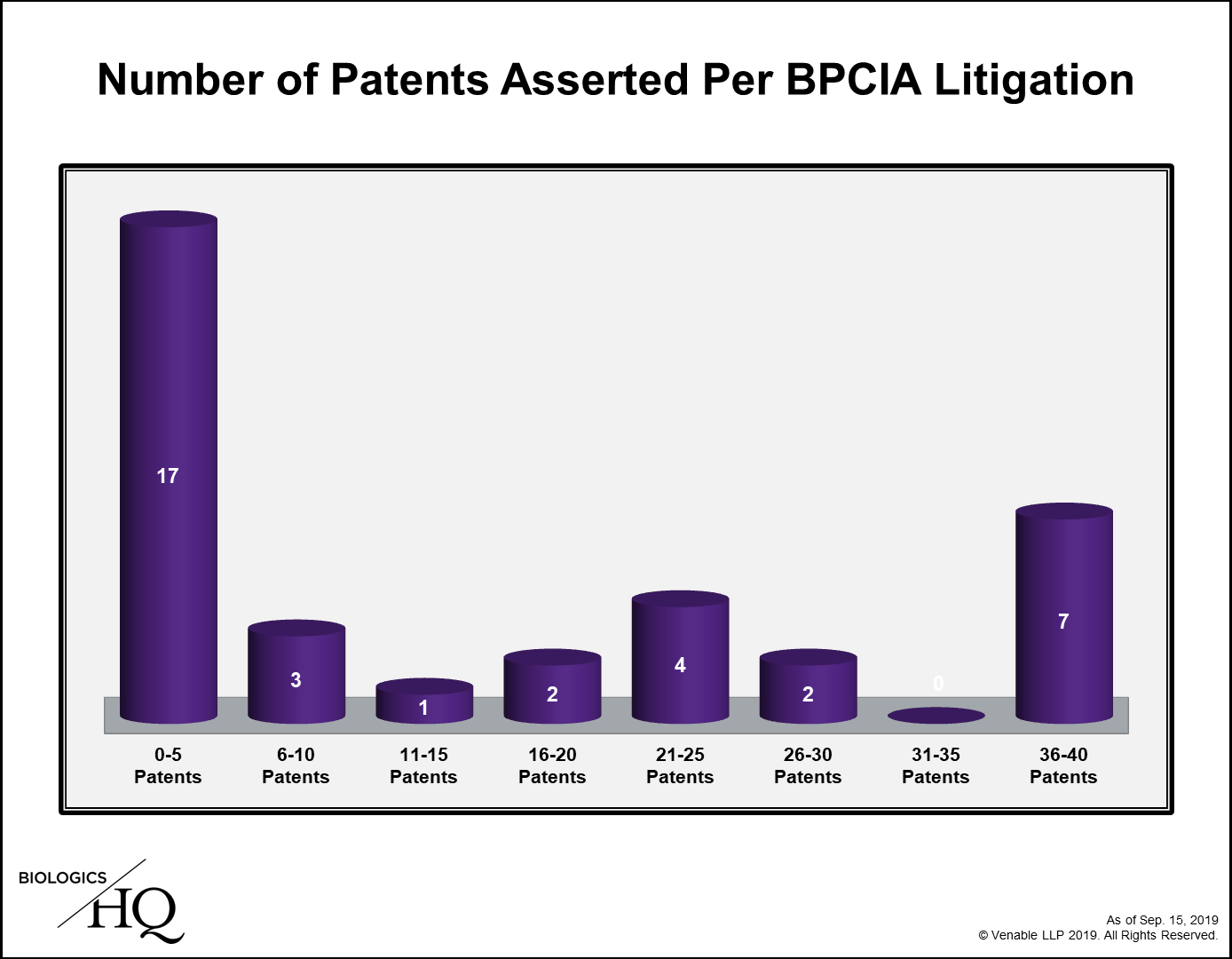

Limiting the patents that an RPS could assert during a patent litigation is likely to be very concerning for patent owners, as this would arbitrarily impede their ability to assert their duly issued patents against a potential infringer and force them to limit their litigations to what they perceive to be their strongest patents prior to having fully conducted discovery on the biosimilar product. To determine how concerned patent owners need to be with respect to this litigation, we have analyzed the 36 biosimilar-related litigations filed under the BPCIA to date, which involve 9 reference products, to determine how many would have been impacted if this law was already enacted.

We determined that while about two-thirds of cases asserted 20 or fewer patents total, 13 of the 36 cases (36%) asserted over 20 patents. Removing method of treatment patents from the total, which are not limited under the pending legislation, 10 cases (28%) remain that could have been impacted by this legislation based on the number of patents asserted. These 10 cases relate to 3 of the 9 reference products (Avastin, Rituxan, and Herceptin) and 5 biosimilars (Mvasi, Truxima, Herzuma, Kanjinti, and Trazimera).

Since many of the biosimilar disputes under the BPCIA have involved multiple cases filed between the same parties relating to the same biosimilar, these 10 cases really boil down to just 5 disputes, 1 each for Avastin and Rituxan, and 3 for Herceptin. After removing the method of treatment patents, the greatest number of patents at issue in any case was 32, the majority of which covered manufacturing processes.

In order for the asserted patents to be included in the 20-patent limit, they must have an actual filing date of more than 4 years after the reference product was approved. When the earlier filed patents are removed from the totals in the 10 cases under analysis, no case has more than 20 patents at issue. Therefore, it is possible that none of the cases filed so far would have been impacted by the pending legislation. However, without being able to analyze the manufacturing information for the reference products (which is not publicly available), it is not possible to say that no cases would have been impacted, because patents including even 1 claim to a manufacturing process not used by the RPS are also limited to 20. This means that the legislation may have impacted a limited number of patents.

Another important note is the legislation’s 20 patent limit only applies when the biosimilar applicant completes all of its steps in the patent dance. Patent owners in each of the disputes with over 20 patents have alleged that the biosimilar did not complete all of the steps in the patent dance. Although the biosimilar applicants may have navigated the patent dance differently had this legislation already passed, it is possible this limitation would have brought these cases outside of the patent cap as well.

It appears from our analysis that, at least so far, patent owners may have not been significantly impacted from these pending bills, and that their enactment would not have likely sped up patent litigation or time to market by an appreciable amount. Although this is instructive, drawing any firm conclusions from this analysis may be dangerous, as IP protection surrounding RPS products are highly fact- and technology-specific.

Conclusion

Drug pricing is high on Congress’ agenda, and we are likely to see even more proposed legislation as different groups seek solutions. Currently, it is unclear which legislation will be passed, if any, and whether it will actually bring biosimilars to market more quickly. In the ever-changing landscape, it is important for patent owners and patent challengers to keep potential changes to the law in mind when conducting intellectual property diligence on patent portfolios.

Patent owners should consider investigating early which of their patents may be the strongest in case limits are put on the number of patents that can be asserted in litigations. They should also carefully consider the timing of patent applications relative to BLA filing in case limits are made to patents that can be asserted based on when they are filed. Patent challengers should be mindful of how they navigate the patent dance and, in cases in which the exchanged lists include more than 20 patents, consider the impact of completing all of their obligations. Everyone should be mindful of the pending legislation and prepare early for anticipated changes in the law so there is more time to mitigate unfavorable changes.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.