- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Coherus Aims to Chip Away at Onpro Dominance

With COVID-19 on the retreat, Coherus BioSciences sees the advantage wearing off for Amgen's pegfilgrastim injector kit.

With the pandemic tapering off in the United States and its sales force vaccinated, Coherus BioSciences, of Redwood City, California, hopes that returning its sales representatives to the field this spring will counter relatively flat sales of its pegfilgrastim biosimilar (Udenyca).

Udenyca is the company’s sole product thus far, and its market share has hovered around the 20% mark for about a year, while pricing competition from other products, including Amgen’s originator (Neulasta), and inventory buildups have caused revenues to decline to $83 million in the just-ended quarter from $116 million in the comparable year-ago quarter.

Turnaround Expected

Company CEO Dennis Lanfear said he anticipates a turnaround for Udenyca this year and the strength of additional product launches in coming years to drive revenues higher.

“Over the next 2 years, we anticipate bringing forward new products to market in the United States, complementing Udenyca in our commercial portfolio,” he said.

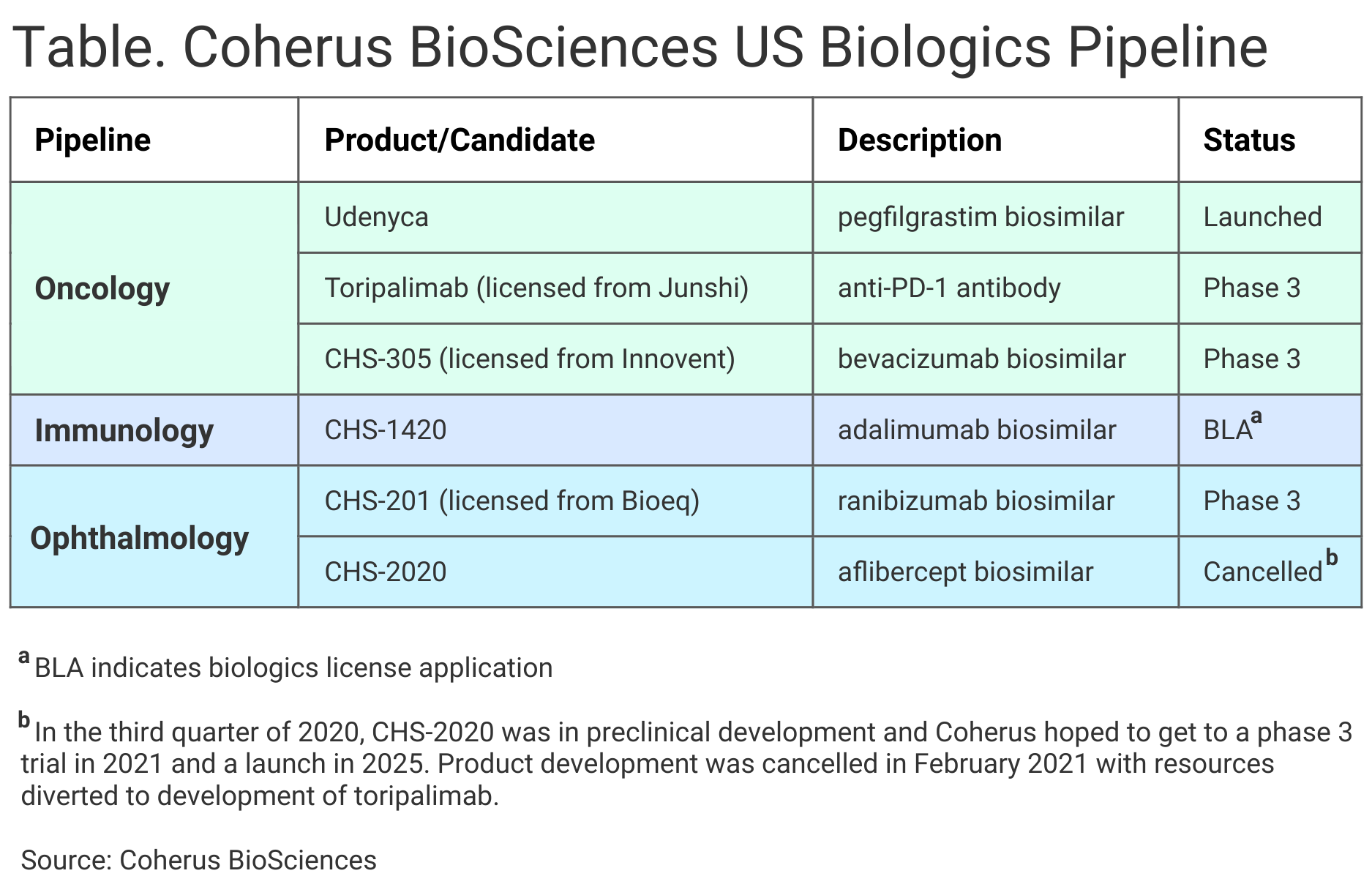

Coherus BioScience aims to bring 3 biosimilars to market, along with an anti–programmed death 1 (PD-1) antibody, toripalimab, which would target various solid tumors, the company said in its first quarter 2021 earnings statement (Table).

Click here to enlarge.

The company has ranibizumab (CHS-201), adalimumab (CHS-1420), and bevacizumab (CHS-305) biosimilar candidates in late-stage development. These would reference Lucentis, Humira, and Avastin, respectively.

Coherus reported a net loss of $173 million for the quarter, mainly because of a $145 million payment to Junshi Biosciences for the US and Canada marketing rights to toripalimab and charges associated with the recent cancellation of plans to bring an aflibercept ophthalmology biosimilar candidate (CHS-2020) to market. The product would have referenced Eylea.

Although the pegfilgrastim market grew 1% in the first quarter of 2021, revenues for Udenyca did not, and in an investor conference call, Lanfear attributed the declining sales and flat market share for Udenyca partly to pricing pressure from competing products, particularly the originator product Neulasta (Amgen), “which now has the lowest average sales price of any type of pegfilgrastim.”

Neulasta has a 67% share of the pegfilgrastim market, and Amgen has achieved a 55% market share for the Onpro wearable pegfilgrastim injector kit, Coherus officials stated. Paul Reider, executive vice president of commercial operations and market access for Coherus, predicted that Onpro dominance would now begin to deteriorate with the slackening pandemic and patients being able to visit their doctors more safely.

“Now that COVID-19 is receding, the medical imperative to use Onpro is greatly reduced,” he said.

Sales Calls Resume

Another reason the company is counting on increased Udenyca sales is that its sales force can get into the field again and make in-person visits.

“The majority of our field team has now been vaccinated and has resumed in-person sales calls,” Reider said.

The company hopes to have biosimilars referencing Lucentis, Humira, and Avastin on the market by 2023. A midyear 2021 biologics license application (BLA) filing is anticipated for the company’s ranibizumab candidate. The FDA has accepted the company’s BLA for the adalimumab biosimilar candidate, and FDA action is anticipated in December 2021. Lastly, a pharmacokinetics study is underway for Coherus’ bevacizumab candidate, although the pandemic has slowed patient enrollment and the BLA filing for this candidate has been pushed forward to the first part of 2022, Lanfear said.

Coherus said the FDA has granted breakthrough status for its toripalimab product, for which a BLA has been submitted with an FDA action anticipated in the first half of 2022.

For further reading about Coherus’ struggle to overcome the Onpro advantage, click here.

For an earlier story about Coherus and how the pandemic has influenced its operations, click here.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.