- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Dr Ivo Abraham Column: It's What We Do With the Savings—Economics and Equity

Ivo Abraham, PhD, chief scientist of Matrix45 and a professor at the University of Arizona, describes the pharmacoeconomics of biosimilars and the savings potential for practices and payers if they prioritize greater biosimilar adoption.

Recently, I was in yet another biosimilar video-meeting with “leading global providers of advisory services, analytics, and strategic solutions” inundating us with (presumably) novel information on biosimilars. I have been in (too) many of these. Typically, these talks are presented in a maelstrom of graphics – either overly general or indiscernibly specific.

Ivo Abraham, PhD

They all lead to prophetic claims of never-seen-before paradigm shifts shaking the foundations of biological pharmacotherapy. Projected savings are seldom less than $1 billion and there are occasional (curious) claims of cost-effectiveness. These talks are not much different from the downloadable brochures: glossy marketing materials, heavy on graphics and tables but pale on text, meager on statistical analysis yet disguised as scientific. The bottom line is the bottom line: biosimilars save money.

To be fair, it wasn’t rocket science when my group published the first savings estimates from biosimilar conversion for the (then) European Union G5 countries (France, Germany, Italy, Spain, United Kingdom) and later on for the United States: if something is cheaper, you save money. For biosimilars, with a twist: without compromising quality of treatment. We believe there was analytical rigor to our work, scientific objectivity, and relevance. We were not afraid to have it peer reviewed.

More fundamentally, we tried to evolve the biosimilar savings issue into a biosimilar value argument: what is the economic value of treating patients with biosimilars, but also what is its social value? How can savings from biosimilar conversion be used to provide treatment – novel or old, originator or biosimilar – to more patients? Here too, with a twist: on a budget-neutral basis. No additional money needed, just re-allocating the savings accrued from using biosimilars.

Let’s change the narrative: using biosimilars is about more than just savings. It is about what we do with the savings. It is about how we can help more patients get the health care they need— especially, when otherwise they might go without. It is about equity and reducing disparities. It is about affordability and accessibility of biological therapy—in countries rich and poor. It is about ethics.

Dispelling Cost-Effectiveness Analysis for Biosimilars

Think: same bottle of water, Whole Foods or Walmart? Cost-effectiveness analysis is about differences in costs relative to differences in effect. Same bottle of water means: there is no difference in effect—only in cost.

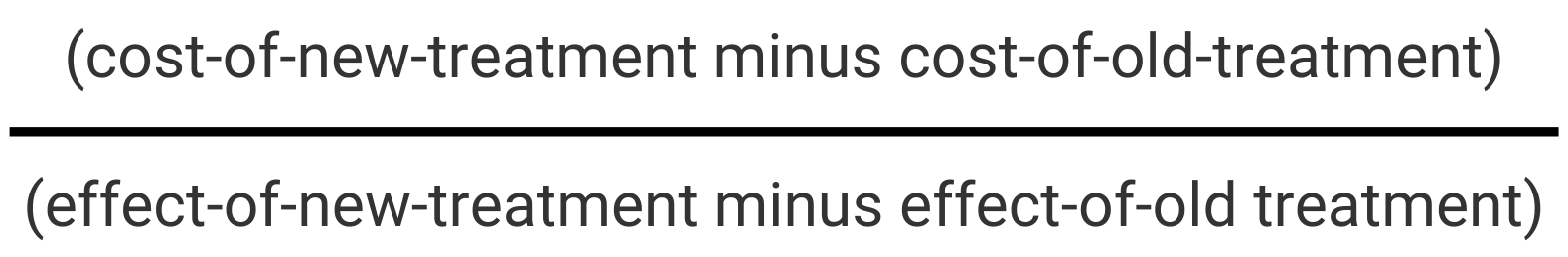

Allow me to elaborate on the (mathematical) impossibility of the claim that biosimilars are cost-effective. Let’s call our biosimilar the “new” and its reference product the “old” treatment options; each with an estimate of cost and an estimate of effect. The Pharmacoeconomics 101 definition tells us that cost-effectiveness is the ratio of the difference in cost between old and new relative to the difference in effect between old and new:

This ratio expresses how much more or how much less money we need to gain or lose one unit of difference in outcome.

If the reference product costs $1000 but the biosimilar only $700, we save $300 per patient. That (-300) takes care of the numerator of the cost-effectiveness ratio.

But what about the effects? Biosimilars tend to be approved on the basis of equivalence trials. These are clinical trials in which a narrow margin of variation relative to the known effect of the reference is adopted—plus or minus, above or below. Assume that the effect of the reference product is known to be 100 units of “good outcome” and that the regulatory agency specifies a 10% equivalence margin. Think of this margin as a “safety zone” within which the effect of the biosimilar needs to land: its “good outcome” effect can be at most 5% worse and at most 5% better. If the effect of a biosimilar is between 95 and 105 units of “good outcome”, we can assume it is equivalent to the reference. Conversely, if it is 105.1 or more, it is no longer a biosimilar but a “biobetter” (a now commonly used term). Likewise, 94.9 or less of effect is inferior and not similar.

Why allow an equivalence margin of 10% and why not just expect the biosimilar to come in at exactly 100 units of “good outcome”?

There is an old saying among statisticians that that the nice part of the job is that “you never have to say you’re certain” (something economists and meteorologists have adopted to justify what they do). A statistical result is an estimate of something based on a sample—without the guarantee that it is exact, and with the admission that it might be a bit imprecise. Compare it to telling teenage kids (as your parents told you) to be home by midnight. Do you expect them to be home right at midnight? No, you want them to be home around midnight: 15 minutes early might surprise you, 15 minutes late would not (certainly, in the case of my parents). In the end, you’re glad they’re home within a reasonable time—after a fun, responsible, and safe evening with friends.

Same for the equivalence trials. When regulators say plus or minus 5% of 100 units of “good outcome”, they admit to statistical uncertainty. For a biosimilar, they want a reasonable, responsible, and safe estimate.

Back to our equation… What do we have? On the cost side of things (numerator), there is a difference of -300. On the denominator side, we have accepted that anything plus or minus 5% of 100 units of “good outcome” will be assumed to be an “equally good outcome” and yield a zero. When I enter -300/0 on my computer’s calculator, it replies “Not a number”.

Though rather absurd, we could propose a new economic analysis just for biosimilars (and try to get it through peer review): let’s call it cost-equal-effectiveness analysis. We put 1 in the denominator to denote that the effects of originator and biosimilar are equal: (-300/1=-300). That would tell us that for every $300 in savings from using a biosimilar we gain 1 unit of equality of ”good outcome”; that is, 1 unit of no difference. We save $300 for zero difference in effect. Didn’t we already know that?

Enough explanation of why cost-effectiveness analyses of biosimilars are unfeasible and inappropriate?

Naïve and misleading parlance

Cost-Efficiency Analysis: Pathway to Expanded Access

What do we mean by cost-efficiency analysis and how is it different from cost-minimization analysis? Cost-minimization is figuring out the cheapest option: in the case of biosimilars vs their references, which has the lowest cost and therefore will minimize our cost outlay? Same bottle of water: Whole Foods or Walmart? You can figure that one out.

Cost-efficiency, on the other hand, is about ways of saving money and using the efficiencies achieved to create greater and better value. In the case of biosimilars: equally good health care at lower cost that creates opportunities for health care for other patients. Take our $300 savings example and apply it to a panel of 10,000 patients: 3 million dollars in savings. Think of what you could do with this money to benefit other patients—without spending an additional dollar.

Call it expanded access to care.

I hesitate using complex examples[1], but let’s try one, nonetheless. It illustrates nicely how intricate cost-efficiency modeling can be, but also how revealing this modeling can be in so many respects. I’ll keep it limited to the essentials (disclosure: what follows is based on a study funded by Mylan/Viatris, though, like all my columns, this contribution is not sponsored).

Reference trastuzumab (Herceptin) was a breakthrough in the treatment of human epidermal growth factor receptor 2-positive (HER2+) metastatic breast cancer (MBC). Subsequent studies showed that combining trastuzumab with reference pertuzumab (Perjeta), adding also paclitaxel in the first 4 cycles, might yield even better cancer control in HER2+ MBC. In December 2017, the FDA approved the intravenous (IV) biosimilar trastuzumab-dkst (Ogivry).

There are several additional layers of complexity. There is an intravenous and a subcutaneous (SC) Herceptin formulation. There is an initiation treatment period with higher dosing, followed by a maintenance period at lower dosing. Trastuzumab monotherapy is administered weekly (Q1W), but the combination therapy is only Q3W. Trastuzumab dosing is based on weight, so we modeled for cohorts at the 25th, 50th, and 75th percentiles of adult female weight statistics. We considered drug costs only, as well as drug costs along with administration costs because of the Q1W and Q3W schedules.

For the sake of this column, we’ll focus on one scenario. The cost of treating 1 median weight patient (73.1 kg) in monotherapy for 1 year was $71,274 with reference trastuzumab but $45,018.24 with its biosimilar, for savings of $26,256. The same patient receiving combination therapy for a year would cost $172,043. with reference trastuzumab compared to $145,391 with trastuzumab-dkst, yielding savings of $26,652. The reason why the costs are about $100,000 higher but the savings rather similar is that there is no biosimilar pertuzumab (yet).

How does this play out in a panel of 1000 patients with HER2+ MBC? Simple math (as I said, no rocket science), treating 1000 patients with biosimilar trastuzumab-dkst monotherapy would generate savings of $26,255,670. Similarly, if 1000 patients needed combination therapy that includes trastuzumab-dkst, the savings would total just a tad more at $26,651,982.

That said, what would the chief financial officers of payer organizations do? Wring their hands with an ear-to-ear smile. The savings would go into the general fund.

On the other hand, what would a responsible clinician encourage? What would a taxpayer say when the same taxes would provide care to more veterans, more elderly patients, or more poor patients? What would an employee with a (decent) health plan but rising monthly contributions, increasing co-pays, and escalating deductibles ponder? What would a healthy 20-something with youthful idealism advocate?

Back to the numbers… What would the decision of converting 1000 patients to biosimilar trastuzumab and generating over $26 million in efficiencies enable us to do? The (peer-reviewed) results are both staggering and emboldening.

In the monotherapy case, the savings would buy another 583 monotherapy regimens for a year. We would end up with a year in which 1,583 HER2+ MBC patients are treated for the same money. We use a statistic for that: numbers-needed-to-convert (NNC). In this case, we only need to convert 1.71 HER2+ MBC patients from reference to biosimilar trastuzumab-dkst, to treat 1 additional HER2+ MBC patient for 1 year.

The cost threshold is higher for combination therapy because pertuzumab is still under patent protection (rightfully so). Accounting for the $100,000 cost of pertuzumab, the savings would provide an additional 183 combination therapy regimens for 1 year—for a total of 1,183 patients treated. The NNC is higher: we need to convert 5.46 patients to biosimilar trastuzumab to treat 1 additional HER2+ MBC patient with combination therapy for 1 year.

Savings re-deployed. Budget-neutral. Essentially for free.

Equity

Another, if not the way of looking at the 583 and 183 additional HER2+ MBC patients is through the lens of social value. We are enabling care for patients who otherwise might not have gotten care. Or, if they did get care, it would have been at additional cost. Or, it might have been inferior care. What if these HER2+ MBC patients received the pre-Herceptin regimens—with worse prognosis and worse outcomes, earlier progression and earlier death?

Additional cost requires additional revenue. It is unlikely to come from taxes. It may come from higher employer and employee contributions. That may narrow the gap a little. Higher deductibles and higher out-of-pocket copays are likely, but would favor the advantaged. Certainly, in cancer, additional costs may lead to even more patients experiencing financial toxicities (as if the clinical toxicities aren’t enough).

The inequities in access to care will only get greater—worsening for some but worse-than-ever-before for many. These inequities will perpetuate and intensify the structural inequities that already ration access to care for many because of race, sex, relational preference, social class, place of residence, culture, origin, and employment, to name the major.

We may even want to think of a system in which the cost-efficiency and expanded access from biosimilar use are designated for those who otherwise would not get care.

Reducing inequity and disparities.

Responsible. Humanitarian.

Reference

[1] McBride A, MacDonald K, Fuentes-Alburo A, Abraham I.Cost-efficiency and expanded access modeling of conversion to biosimilar trastuzumab-dkst with or without pertuzumab in metastatic breast cancer. J Med Econ. 2021;24:743-746. doi:10.1080/13696998.2021.1928515

Author Bio

Ivo Abraham is chief scientist of Matrix45 and professor of Pharmacy, Medicine, and Clinical Translational Sciences at the University of Arizona, where he is associated with the Center for Health Outcomes and PharmacoEconomic Research. He has worked in biologicals since the late 1990s and in biosimilars since their introduction in the European marketplace—collaborating closely with Karen MacDonald (also his wife) on large international and national observational studies. On both the private and academic sides, their group published the first economic evaluations of biosimilars, a line of studies that continues to date and have been instrumental in the breakthrough and market adoption of biosimilars in Europe and the United States. More recently, Matrix45 has ventured into biosimilars in emerging markets, including low- and middle-income countries. Ivo Abraham may be reached at cntr4biosim@matrix45.com.

Perspective

I am a strong proponent of biosimilars. That does not mean I am against innovation—on the contrary. There would be no biosimilars without the innovators. I have worked on several of these innovators. I am working now on innovators that someday may have biosimilar analogs. I am of the generation that has had the joy of seeing treatments emerge (and some fail, unfortunately) for diseases that 40+ years ago had the poorest of poor prognoses but now are treatable. Innovation in therapeutics (that is, the originator products ) is about moving the boundaries of hope. Biosimilars are a channel for spreading even more hope to more patients.

Statement of Disclosures of Relevance to This Monthly Column

Matrix45, LLC and predecessor companies in which Ivo Abraham holds or has held equity have been contracted for research, analytics, dissemination, and consulting services by Janssen/Johnson & Johnson, Amgen, Novartis, and Roche on the originator side and by Sandoz/Novartis, Coherus Biosciences, Mylan/Viatris/Biocon, Hospira/Pfizer, and Teva Pharmaceuticals on the biosimilars side; with past and current conversations with Merck KGaA, Celltrion, Apobiologix, Apogenix, Fresenius Kabi, and Spectrum. By company policy, associates of Matrix45 cannot hold equity in sponsor organizations, nor provide services or receive compensation independently from sponsor organizations. Matrix45 provides its services on a non-exclusivity basis.

With regard to this month’s contribution, Matrix45 has been contracted by Sandoz/Novartis, Mylan/Viatris/Biocon, and Coherus Biosciences for economic studies on their respective biosimilars. This contribution was prepared independently and without funding from these sponsors.

Other Column Installments

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.