- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Opinion: Biosimilars Offer Savings and Access for US Patients

In this column, officials from the Biosimilars Forum and Xcenda discuss how biosimilar competition has lowered prices of originator biologics and improved patient access.

More than 1 year after the COVID-19 pandemic was declared a national emergency, we are at a critical point for the US health care system. As Americans recover from the overall economic downturn caused by the pandemic, patients and taxpayers need savings. Access to more-affordable pharmaceutical products, like biosimilars, would be a reprieve from high health care costs.

Biologics are complex injectable treatments that fully revolutionized the health care industry and changed the course of treatment for many diseases, including certain cancers, multiple sclerosis, and rheumatoid arthritis. The innovative and curative nature of some of these products, along with the rigorous research and development and manufacturing that went into creating them, has led to significant costs. So, for many Americans, biologics can be expensive, costing tens of thousands of dollars per year. They represent a substantial driver of prescription drug spending, making up 40% of all drug spending, despite accounting for just 2% of prescriptions. In fact, a 2020 report from the Medicare Payment Advisory Committee (MedPAC) found that originator biologics make up the top 10 most expensive drugs in Medicare Part B.

Fortunately, there is a ready-made solution to tackle this issue: biosimilars. A biosimilar is highly similar to and has no clinically meaningful differences from an FDA-approved innovator biologic. Biosimilars offer lower-cost choices to health care providers treating patients with a wide range of conditions.

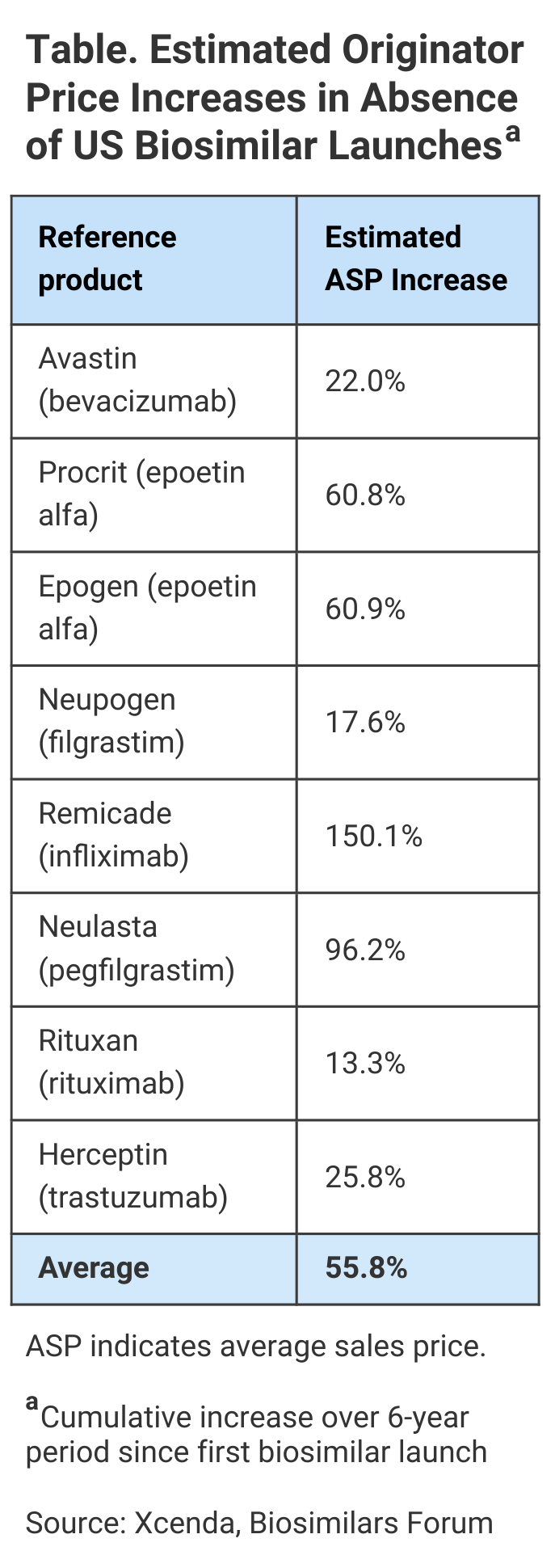

Biosimilars hold much promise in keeping prices steady for therapies across complex disease states. In fact, new research from Xcenda shows that biosimilars not only cost less, but the competition they create in the market helps to drive down the cost of the biologics they reference. Without biosimilars, 8 brand name biologics (reference products) were on track to see average sales price (ASP) increases of 56% over the 6-year period ending April 2021, according to this report (Table).

To determine how biosimilar competition affects the ASPs for brand name biologics, Xcenda, AmerisourceBergen’s consulting arm, examined the ASP of brand name biologics beginning 2 years before the first biosimilar competitor for each entered the market, along with the ASP trends for these biologics when the first biosimilars became available.

Of course, for some drugs, the numbers are even higher than the 56% average price increase; in some cases, biosimilar competition helped patients avoid paying double or more for the same treatment.

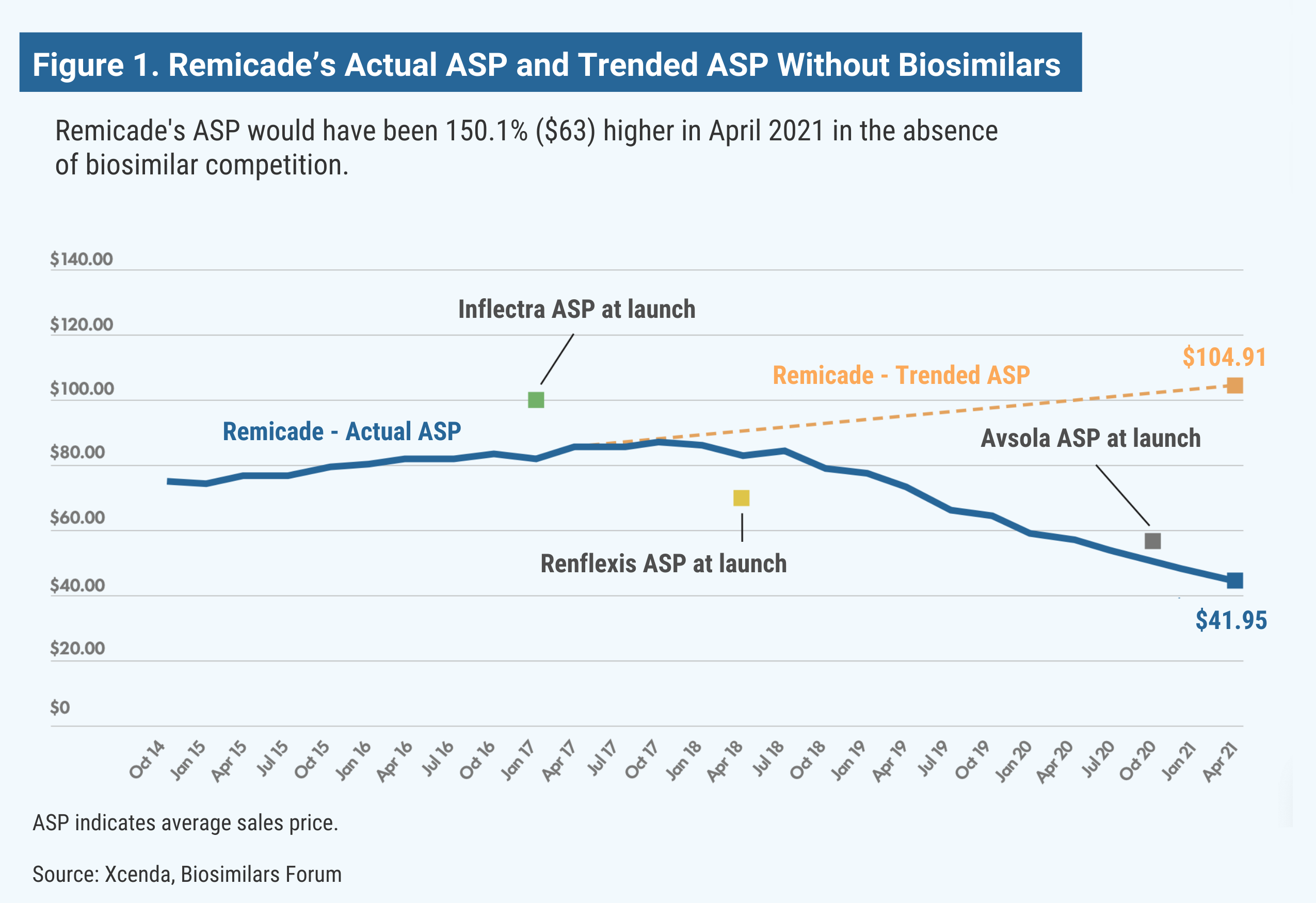

Remicade (infliximab) is used as an autoimmune treatment for arthritis (rheumatoid arthritis, arthritis of the spine, psoriatic arthritis), certain bowel diseases (Crohn disease, ulcerative colitis), and a specific severe skin disease (chronic plaque psoriasis). The medicine reduces symptoms and can induce and maintain remission of these chronic diseases, improving quality of life. Without the launch of the infliximab biosimilars Inflectra, Renflexis, and Avsola, Remicade’s estimated ASP would be 150% higher, research shows (Figure 1).

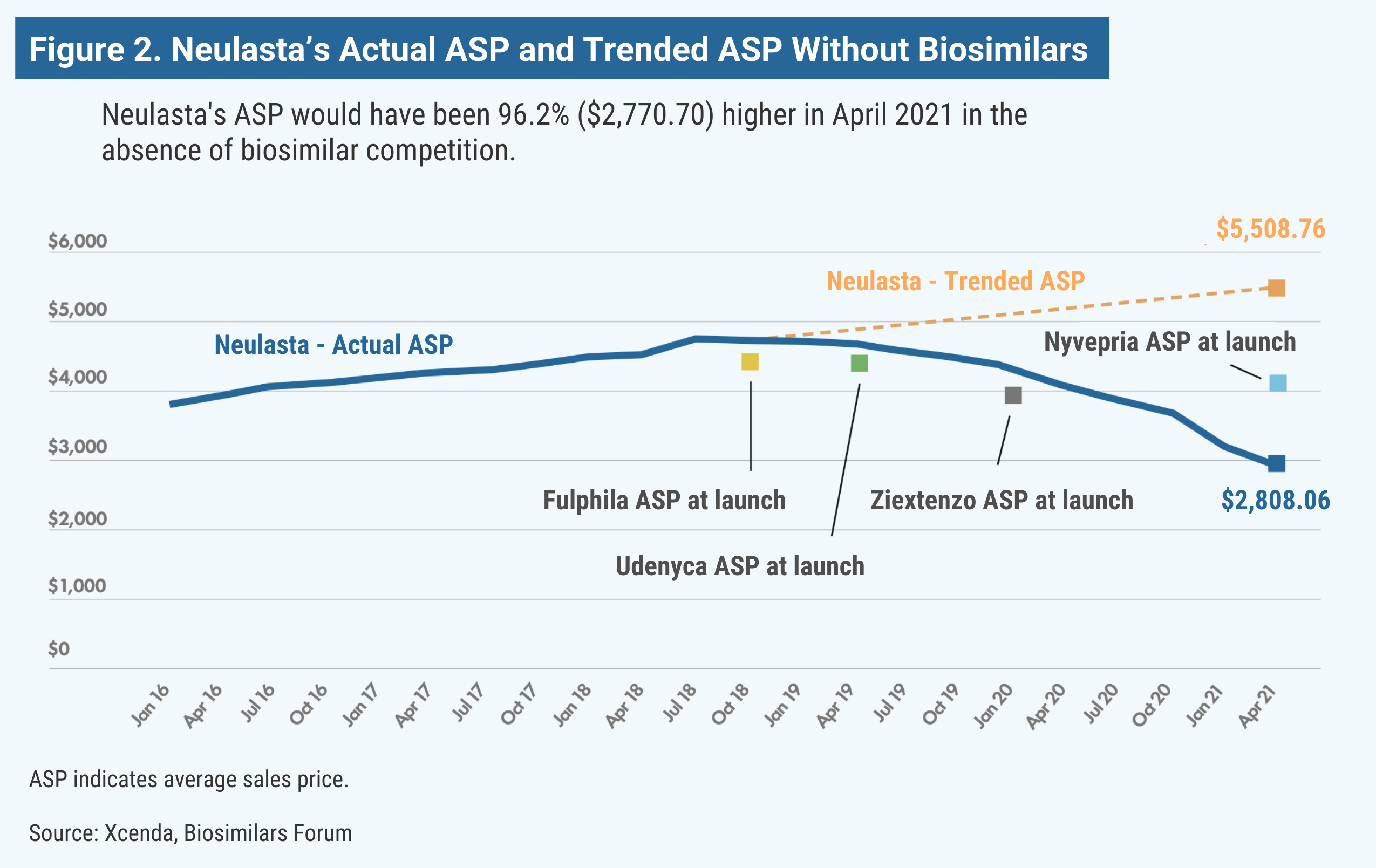

Neulasta (pegfilgrastim) is used in oncology support to help the body replenish white blood cells after receiving chemotherapy. Although chemotherapy works by killing cancer cells, it can decrease the number of white blood cells in the body and lower the immune system, potentially causing febrile neutropenia (FN). Based on a study of patient data from 2007 to 2010, more than 80% of US patients with FN require hospitalization. Pegfilgrastim can boost white blood cells and, in turn, change the lives of many patients. Without the launch of pegfilgrastim biosimilars Fulphila, Udenyca, Ziextenzo, and Nyvepria, Neulasta’s price would be almost double (Figure 2).

All in all, these data underscore the value biosimilars provide to patients and our health care system. Biosimilar introduction facilitates lower prices of brand name biologics (reference products) and biosimilars in every class, so even patients who decide to stay on brand-name biologics benefit. In fact, biosimilar competition could help 1.2 million patients gain access to biosimilars or biologics by 2025. These innovative therapies have the potential to reduce overall spending on medicines by a staggering $100 billion in just 5 years.

2021 marks 6 years since the first biosimilar, Sandoz’s Zarxio, was made available to patients in the United States. The last 2 years have represented tremendous growth, as more than half of the biosimilars on the market in the United States have launched in the last 18 months. Despite the savings that biosimilars have created, much work is needed to enable more widespread use. Lower-cost biosimilars are available to just 20% of patients who need biologic therapy.

The US market needs bipartisan policy solutions to break down barriers to continued access, including structural disincentives, market and regulatory dynamics, and deliberate disparagement and misinformation. Without policy solutions, the health care system will continue to miss out on savings from biosimilar competition, which compromises the viability of the biosimilars market in the long term. Worse still, patients won’t benefit from expanded access to more-affordable therapies.

As Congress looks to identify savings for patients, let’s look at what’s working and can be improved. For lower drug prices, the answer is more competition from biosimilars.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.