- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Opinion: The “Forgotten Molecules” May Reward Biosimilar Developers

The Center for Biosimilars® Advisory Board member Sarfaraz K. Niazi, PhD, explains an “against the grain” approach to tapping unmet need and revenue potential in biosimilars.

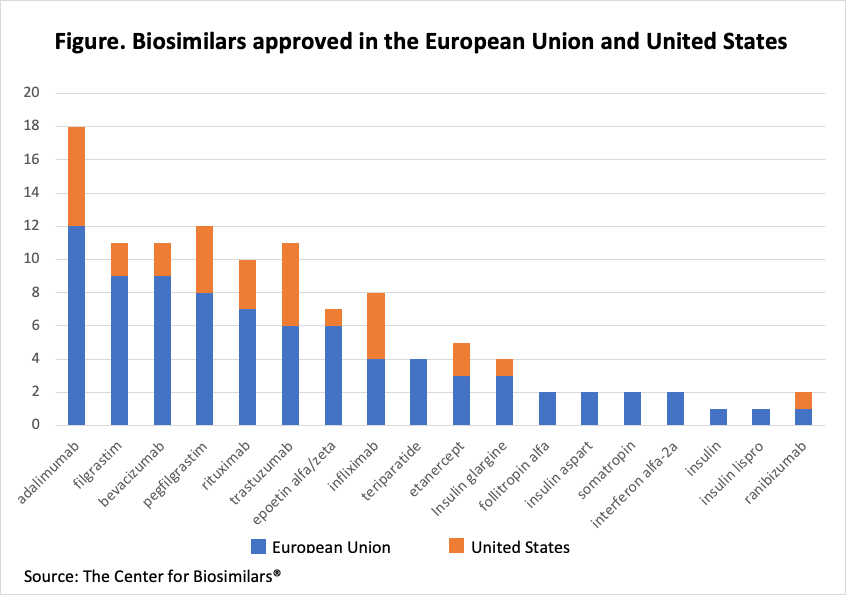

There are hundreds of potential biosimilar candidates that can be brought to the market readily to expand into the untapped market of biosimilars without significant patent challenges and producing significant revenue. Not least of the advantages is fulfilling the dire need for affordability. Yet, with over 100 biosimilars approved in the European Union and United States, we can see a trend that all companies are running after the market leaders like adalimumab. There is even a bigger market potential available in the forgotten molecules. Of the 83 biosimilars candidates, whose patents have expired, only 18 molecules are approved in the European Union and 11 in the United States (Figure). Antibodies lead the list of over 100 approved biosimilars. It is about time that we find the hidden biosimilar gems and expand the market of diseases treated with biosimilars.

Click to enlarge.

The question arises, why are we hovering over a relatively small number of molecules approved in the European Union and the United States? In this column, I will answer this question and suggest how biosimilar developers can go against the grain. With this column, I have included patent expiration dates for molecules that are available for biosimilar development or will be (Table).

A detailed analysis of the 100 approved biosimilars in the European Union and United States reveals that there is no impossible challenge in getting a new biosimilar approved. The regulatory agencies worked with extreme sensitivity as they tried to overcome the shadow of risk cast by the originator companies—“only we know how to make these products” was a slogan that has evaporated now. The science of biosimilars is now better understood, the milestones to reach biosimilarity are evident, and the technology to produce biological drugs has lowered the cost of goods.

Still, the most significant investment in the development of biosimilars remains their testing for safety and efficacy in a clinical setting. This exercise is most demanding for oncology products, where a larger population of patients than for the originator biologic is required to prove similar efficacy and safety because it is impossible to secure a treatment-naive patient population; thus there is a very high degree of variability in their responses due to prior treatments.

So, how should a developer choose a product as a biosimilar candidate?

- The development of mammalian products is more expensive and takes a much longer time.

- It is also complex to establish analytical similarity for mammalian products because of their innate variability in the fermentation process.

- Some categories like hormones and cytokines will have a perpetual market, so it would be fruitful to look for products like follicle-stimulating hormone, where biosimilarity demonstration is relatively more straightforward.

- Most cytokines will qualify because clinical efficacy testing will generally not be required because of their pharmacodynamic attributes, which are readily measured.

- Develop the products as a group; it is OK to have 2 or more biosimilars for the same indication; developers will not be cannibalizing their sales.

- Investing in regulatory planning will reduce the cost burden and time to market, making it possible to select any available products.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.