- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Part 1: Panelists Suggest More Groundwork Is Needed for Indian Biologics to Achieve Global Market Access

In part 1 of this panel discussion, 3 experts on India’s biologics industry explain what’s missing from current biosimilar regulation and what the country needs to do for its products to compete internationally.

In part 1 of this panel discussion with The Center for Biosimilars®, 3 experts assess the state of the biosimilars industry in India and some of the biggest issues facing its success.

Gaps in the Guidelines

Sarfaraz K. Niazi, PhD, an adjunct professor of biopharmaceutical sciences at the University of Illinois, Chicago, contends that India’s guidelines involve requirements for unnecessary nonclinical data, such as from animal trials, and do not contain acceptable requirements for the number of patients needed to conduct a clinical study.

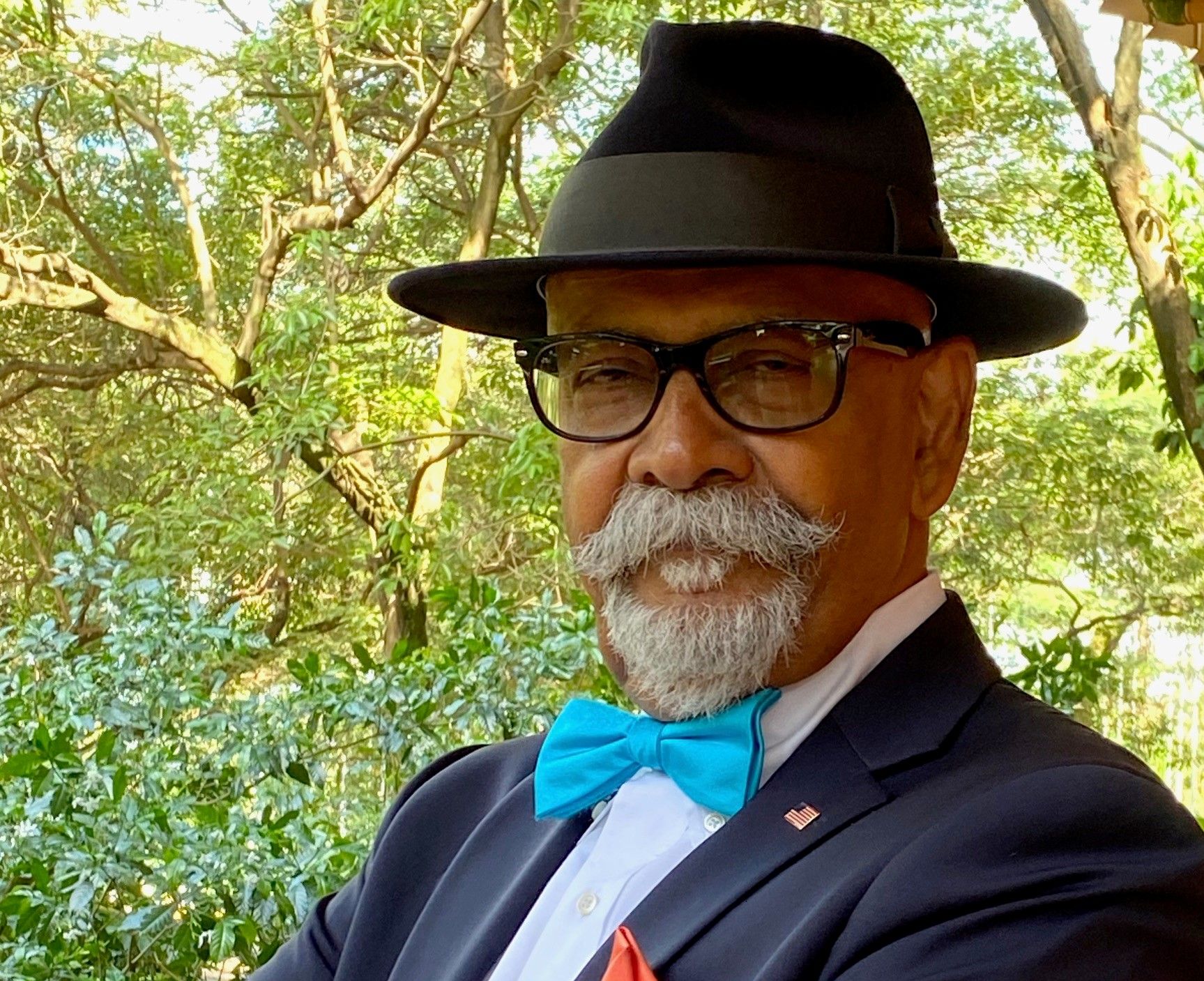

Sarfaraz K. Niazi, PhD

Anurag Rathore, PhD, a professor in the Department of Chemical Engineering at the Indian Institute of Technology in Delhi, India, states that a lot of India’s biologics issues aren’t necessarily with the guidelines, but are with guideline adherence, in that most regulators have specialized in small molecule drugs and have limited experience working with biologics.

Economics of Affordability

Anurag Rathore, PhD

Paul Cornes, BM, BCH, MA, MRCP, FRCR, a consultant oncologist and biosimilars expert who was part of the team that developed and presented evidence to the FDA for the first successfully approved US biosimilar, explains why reducing biosimilar development costs without sacrificing clinically relevant data is important, including that most patients with cancer are from low- and middle-income countries, where affordable drugs are needed.

Paul Cornes, BM, BCH, MA, MRCP, FRCR

Rathore notes that India has tremendous skill already with producing safe and effective drugs because roughly half of the products on the US market are manufactured in India despite challenges. He agrees that it’s critical for India to manufacture biologics economically to improve affordability, but that it’s also important to improve the reliability of data coming from clinical trials.

Cornes states that India does have the resources to produce world class biosimilars but that he has concerns over whether there are too many small players and too much competition in the Indian marketplace, such that the large companies with the quality and resources to compete globally may find it hard to get the recognition they deserve.

Niazi states that the standards put forth by the Central Drugs Standard Control Organization (CDSCO) are not optimal to allow for trial data to be accepted worldwide, which results in a lot of Indian companies doing only what is needed to receive approval in India. This means that none of the locally produced biosimilars sold exclusively in India could qualify for use in Western countries without companies having to redo their trials from scratch.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.