- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Preferred Status for Semglee Will Test Value Proposition of Insulin Biosimilars

Hopes that insulin biosimilars can improve access and affordability will be tested by Express Scripts’ plan to give preferred formulary status to Semglee, a long-acting insulin that is interchangeable with Lantus.

Biosimilars are poised to take another bite out of originator brand revenues. Express Scripts, a pharmacy benefit manager, said it will put a biosimilar insulin glargine (Semglee) on its largest formulary as a preferred agent. The company anticipates savings of $20 million in 2022 by switching patients to this drug.

Semglee was approved by the FDA as a biosimilar in July 2021, meaning it is considered highly similar to the reference product (Lantus, Sanofi) and its use results in no clinically meaningful differences in safety or efficacy. The drug also has interchangeable status, which enables pharmacists to dispense Semglee instead of the brand product without express authorization from the prescribing physician.

However, Semglee, a Biocon/Viatris product, was originally approved in June 2020 under the 505(b)(2) new drug regulatory pathway, meaning it has been on the market for a few years but at first did not have biosimilar status.

Express Scripts' Timing

It is unclear why Express Scripts waited until now to give this drug preferred status, although the interchangeable status, which may make it easier to generate savings, without physician pushback, appears to have been a factor.

"We have advocated for more than a decade for a safe and effective pathway to bring biosimilars to market because they hold tremendous promise for cost savings for patients, plans, and our entire health care system," said Amy Bricker, president, Express Scripts. "The FDA approval of the first interchangeable biosimilar signals a historic opportunity to realize these cost savings for our clients and members.

The company’s National Preferred Formulary includes more than 28 million covered individuals. Express Scripts said it anticipated that the savings effect for patients would be mixed. Some will see reduced out-of-pocket costs and some will see no change in their share of expense for insulin glargine.

Semglee is the only insulin biosimilar in the US marketplace. In March 2020, a provision in the Biologics Price Competition and Innovation Act (BPCIA) made it possible for insulins to be considered for biosimilar status, which triggered the insulin approval application for Semglee filed by Biocon/Viatris.

The BPCIA was enlarged to allow insulins and certain classes of other biologics, and the reasoning was partly that biosimilar status for insulins would help break the near monopoly conditions for insulin supply held by a few dominant producers. The relative absence of competition has enabled producers to enjoy steady price hikes at consumers' expense, although that has reversed in recent years in the insulin glargine market, where competition is making inroads.

Previously, a new drug application under 505(b)(2) was Semglee's only route to approval for Biocon/Viatris, and although the product was highly similar to Lantus, it did not carry the biosimilar status that might have given physicians and patients the confidence to use it interchangeably.

Basaglar vs Lantus

Another insulin glargine in the same boat is Basaglar, which was launched to market in 2016. Basaglar is considered a biosimilar because of its highly similar composition to Lantus; however, it does not have that status.

Even without biosimilar status, it is still possible for a nonbiosimilar copy biologic to carve away at the market share of a dominant brand and achieve savings for payers and patients, according to investigators who published findings on the cost reductions for Basaglar (insulin glargine) this month in JAMA Internal Medicine.

Basaglar, which is highly similar to Lantus but is not officially a biosimilar, has had a “substantial” impact on the cost of insulin glargine, according to the study authors.

Prior to the arrival of insulin glargine competitor products to Lantus, the list prices of this product were climbing at a 4.9% quarterly rate of increase. That meant that from 2010 to 2014, the list price of 100 IU of Lantus rose to $22.21 from $9.23.

From 2015 to 2020, when competition was present in the marketplace, the net price of Lantus began to decline by 5.2% per quarter, and by the end of the first half of 2020, Lantus had lost substantial market share. Investigators said that the product went from having a 100% market share in 2010 to having a 46.2% market share by June 2020.

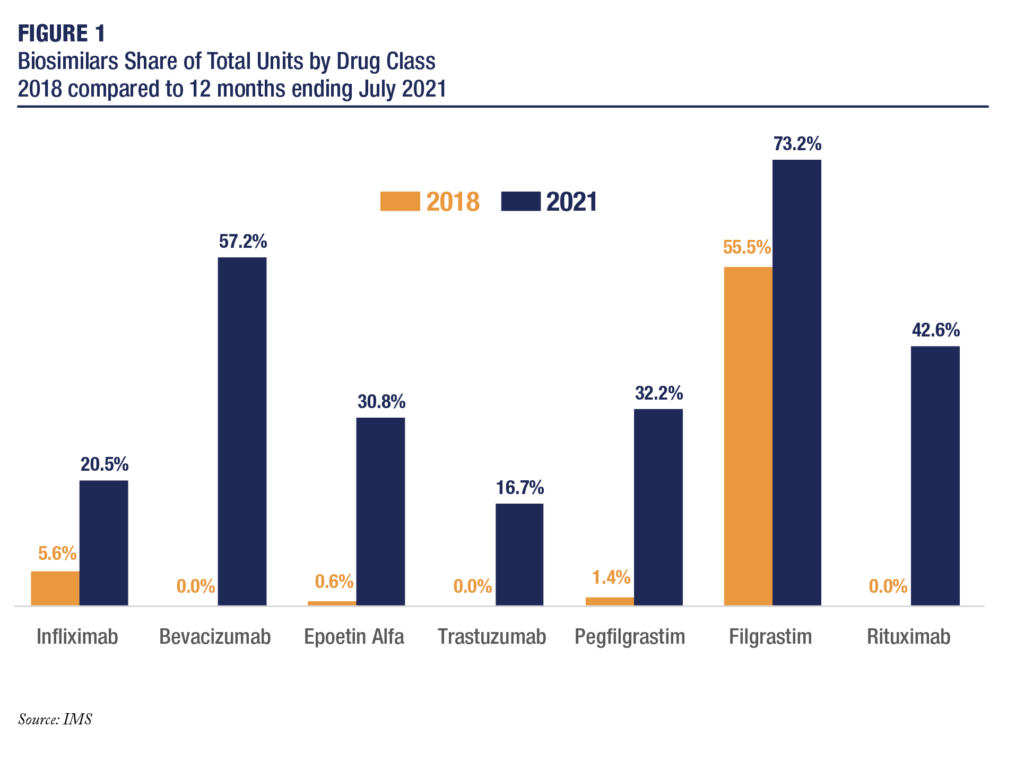

Whereas the savings and market share captured by an insulin glargine biosimilar have yet to be documented, given the novelty of this class of biosimilars, a recent study from Pacific Research Institute indicated that, across the board, better established biosimilars have gained tremendous market share in the United States since 2018 (Figure).

The study showed, for example, that rituximab biosimilars, of which 3 have been approved and launched since 2018, have grown from a 0% share of the rituximab market to a 42.6% share. Similarly, pegfilgrastim biosimilars, 4 of which have entered the US marketplace since 2018, have captured a 32.2% share, vs 1.4% in 2018.

The FDA has approved 31 biosimilars, of which 21 have been launched and 2 are approved as interchangeable biosimilars. Both of the interchangeable designations were granted since July 2021. One was for Semglee and the other was for Cyltezo, an adalimumab biosimilar.

Interchangeability and Physician Resistance

Many stakeholders in the health care industry continue to state that education about and promotion of biosimilars is needed on a broad scale to overcome hesitation in using these drugs. A recent study by investigators at NORC at the University of Chicago indicated high levels of physician comfort and familiarity with biosimilars, and 71% of patients surveyed said they would be “fully confident and accept a biosimilar if their physician prescribed it.”

However, just 20% of physicians agreed that pharmacists should be authorized to substitute biosimilars for brand biologics without a physicians’ approval. “When asked about this in an interview, one physician explained they were hesitant because they want to be aware of decisions made around their patient’s course of treatment,” authors of the study wrote.

More competition in the insulin market is expected to arrive, according to a recently updated biosimilar pipeline report from AmerisourceBergen. A phase 3 study is underway for Basalin SubQ, an insulin glargine biosimilar candidate from Gan & Lee and Sandoz. In the rapid-acting insulin category, there are 5 product candidates in various stages of development.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.