- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Prioritizing Reference Products Over Biosimilars Led to Millions in Missed Savings for Part D

Medicare Part D plans missed out on between $84 million and $143 million in savings by not prioritizing the use of biosimilars over reference products, according to a report from the HHS Office of Inspector General.

Medicare Part D could have saved tens of millions of dollars in 2019 if biosimilars were used at a 60% utilization rate, according to a report published by the HHS Office of Inspector General (OIG).

The HHS OIG conducted its report as part of a larger strategy to address drug prices and assess biosimilar utilization, which the agency announced in February 2022. The report created a foundation for the agency to further explore the topic as Part D spending on biosimilars grows and as the market matures, especially as it prepares for the introduction of biosimilars for reference etanercept (Enbrel) and adalimumab (Humira) that are anticipated to launch in 2029 and 2023, respectively.

Biologic spending has grown substantially since 2015, when the first biosimilar (Zarxio) was approved by the FDA. This is largely driven by sales and high list prices for Humira and Enbrel, which account for nearly half of the $12 billion of spending on biologics in Part D.

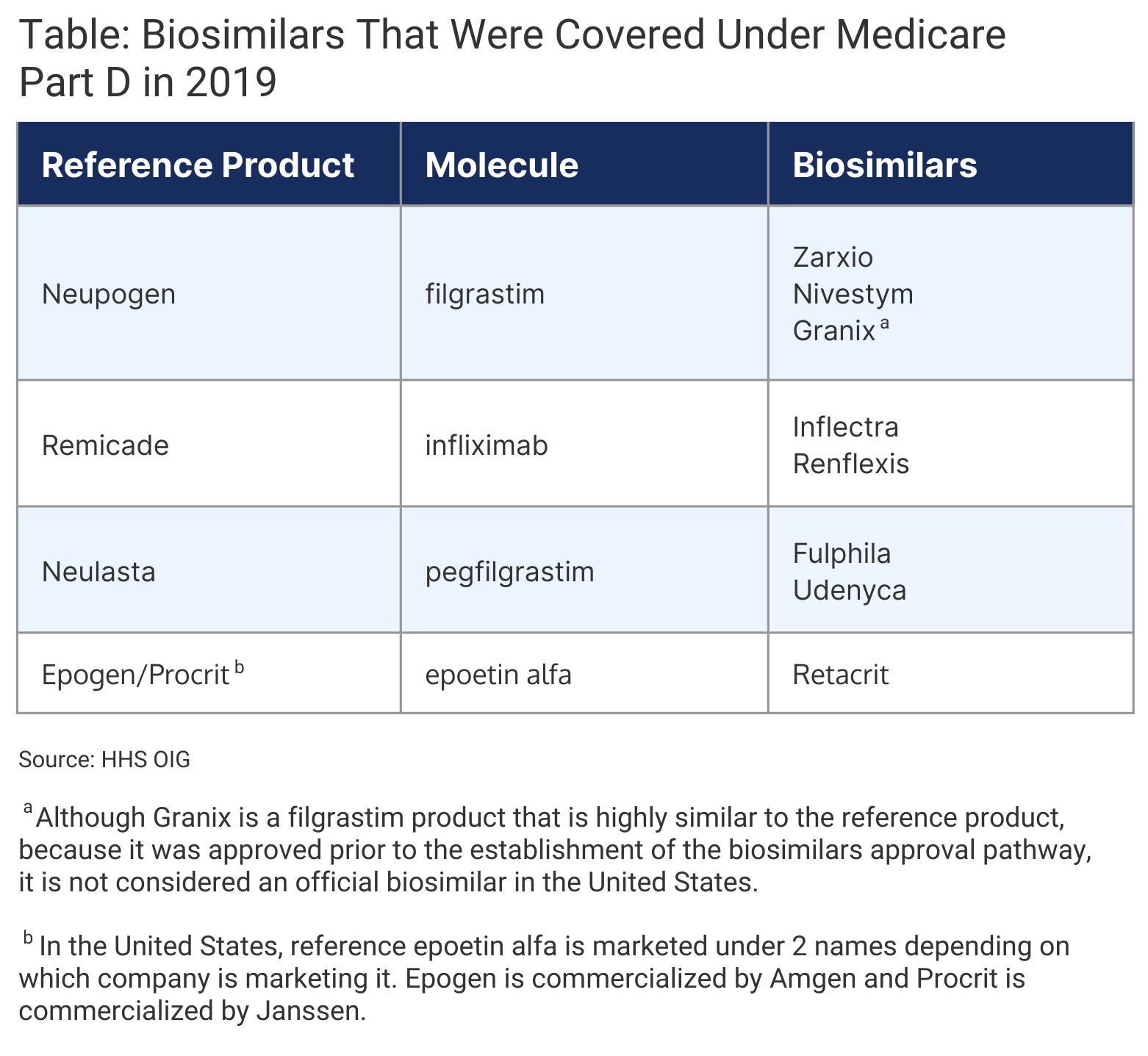

As of April 2022, 21 of the 35 FDA-approved biosimilar are available on the US market. In 2019, 8 biosimilars were approved as alternatives to 4 reference products within Part D, which cost Part D plans about $466 million annually (Table).

Click to enlarge.

The OIG analyzed biosimilar utilization in Part D from January 1, 2015, to December 31, 2019. All biosimilars for the same reference product were considered as one biosimilar group.

Over 5 years, the number of prescriptions for biosimilars increased significantly. However, they only accounted for 18% of all biologics prescriptions in 2019. From 2015 to 2019, spending on biosimilars in Part D increased from $1.7 million to $60.8 million.

Filgrastim was the only category where biosimilar prescriptions were higher than the reference product (62% vs 38%), largely driven by increased use of Zarxio. In contrast, biosimilar utilization in the infliximab, pegfilgrastim, and epoetin alfa categories was much less than the reference products (Remicade, Neulasta, Epogen/Procrit, respectively). Biosimilars accounted for 16% of epoetin alfa prescriptions, 12% of pegfilgrastim prescriptions, and 7% of infliximab prescriptions.

Part D beneficiaries out-of-pocket costs for biosimilars increased from $152,000 in 2015 to $2.8 million in 2019, which accounted for less than 20% of the $14.5 million that beneficiaries total spending on all biologics. On average, beneficiaries paid less for most biosimilars compared with their reference products. Beneficiaries enrolled in Low-Income Subsidiary (LIS) plans paid an average of $2.55 less for most biosimilars compared to their reference products.

Possible Missed Savings

If biosimilars were used at a similar utilization rate to filgrastim biosimilars (60%), Part D gross spending could have been reduced by $84 million in 2019, nearly 18% of the total Part D spending on biologic drugs.

Even greater savings could have been achieved during the same year if biosimilars were used at a 90% utilization rate compared with their reference products, amounting to $143 million of missed savings, 31% of the total biologics spending.

Overall, Part D beneficiaries could have saved nearly $1.8 million if all biosimilars were used at a 60% utilization rate, which represented 12% less than their total biologics spend in 2019. If biosimilars were used at a 90% utilization rate, the overall beneficiary spending on biologics could have achieved $3.1 million in savings, a 22% of their overall biologics spend.

Beneficiaries in LIS plans could have saved 15% (nearly $34,000) of their total spend on biologics if biosimilars were used at a 60% utilization rate or saved 25% (more than $55,000) at a 90% utilization rate.

The authors of the report said that the introduction of biosimilars for Humira and Enbrel combined with high utilization rates could produce even greater reductions in spending for Part D plans and beneficiaries.

“With numerous biosimilars available as alternatives to Humira, they may have a greater impact on the market than if a single biosimilar alternative were available. Additionally, Humira may see increased competition from the biosimilar alternative that has been designated as interchangeable,” they wrote.

Coverage Patterns

Most plan formularies placed biosimilars on lower tiers compared their reference products and thus, did not encourage biosimilar use by covering them at parity with or preferring them over reference products.

“When plan formularies place a biosimilar and its reference product on the same tier, beneficiaries have fewer financial incentives to use the biosimilar….Notably, when a biosimilar and its reference product are on the same tier, with a fixed copayment, using the biosimilar may not reduce beneficiary cost-sharing at all,” the authors explained.

Not all Part D plans covered biosimilars and reference products. In 2019, 38% of Part D vendors that included reference epoetin alfa on its plan formulary did not include an epoetin alfa biosimilar. Similarly, 32% of vendors that covered Neulasta did not cover a pegfilgrastim biosimilar. Despite most plan formularies covering at least 1 filgrastim biosimilar, 40% did not cover Zarxio. However, 18% of plans covered a filgrastim biosimilar instead of the reference product and 1 plan covered a pegfilgrastim biosimilar instead of the reference product.

The OIG is working to examine biosimilar utilization and spending in Medicare Part B in the next phase of its analysis.

Reference

Murrin S. Medicare Part D and beneficiaries could realize significant spending reductions with increased biosimilar use. HHS website. https://oig.hhs.gov/oei/reports/OEI-05-20-00480.pdf. Published March 31, 2022. Accessed April 18, 2022.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.