- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Report: Varied Biosimilar Uptake Speeds Pose Missed Opportunities for Cost Savings

Samsung Bioepis’ Biosimilar Market Report for the first quarter of 2024 chronicles some major market trends, including which treatment spaces have quicker uptake than others, highlighting missed opportunities for savings as well as the 1-year experience of adalimumab biosimilar competition in the US.

On average, biosimilars obtain 53% market share in the first 3 years after initial launch; however, uptake speed continues to differ between treatment spaces, according to Samsung Bioepis’ Biosimilar Market Report for first quarter 2024 (Q1 2024).

“Slow adoption is a missed opportunity for cost savings, not only for health care systems but also for patients. Some of the biosimilars have pricing models that are designed to provide direct cost savings, but patients cannot benefit from these lower-cost options if the biosimilars are not made available to them,” said Thomas Newcomer, vice president, head of market access, US, at Samsung Bioepis.

“These realities delay biosimilars from playing a pivotal role in alleviating the financial burden the US health care system and patients currently face. We need every stakeholder to pay attention to where the market is going and discuss ways to ensure that access is guaranteed to these important biologic medicines.”

Treatment spaces were classified as either having “fast uptake speed” or “slow uptake speed,” Oncology biosimilars as well as pegfilgrastim and ophthalmology biosimilars were considered to have fast uptake speed, whereas the immunology, filgrastim, epoetin alfa, and insulin glargine markets were labeled with slow uptake speed. Biosimilars in fast uptake speed markets have an average of 75% market share at the 3-year post first biosimilar launch, and biosimilar in slow uptake speed markets have an average of 23% market share.

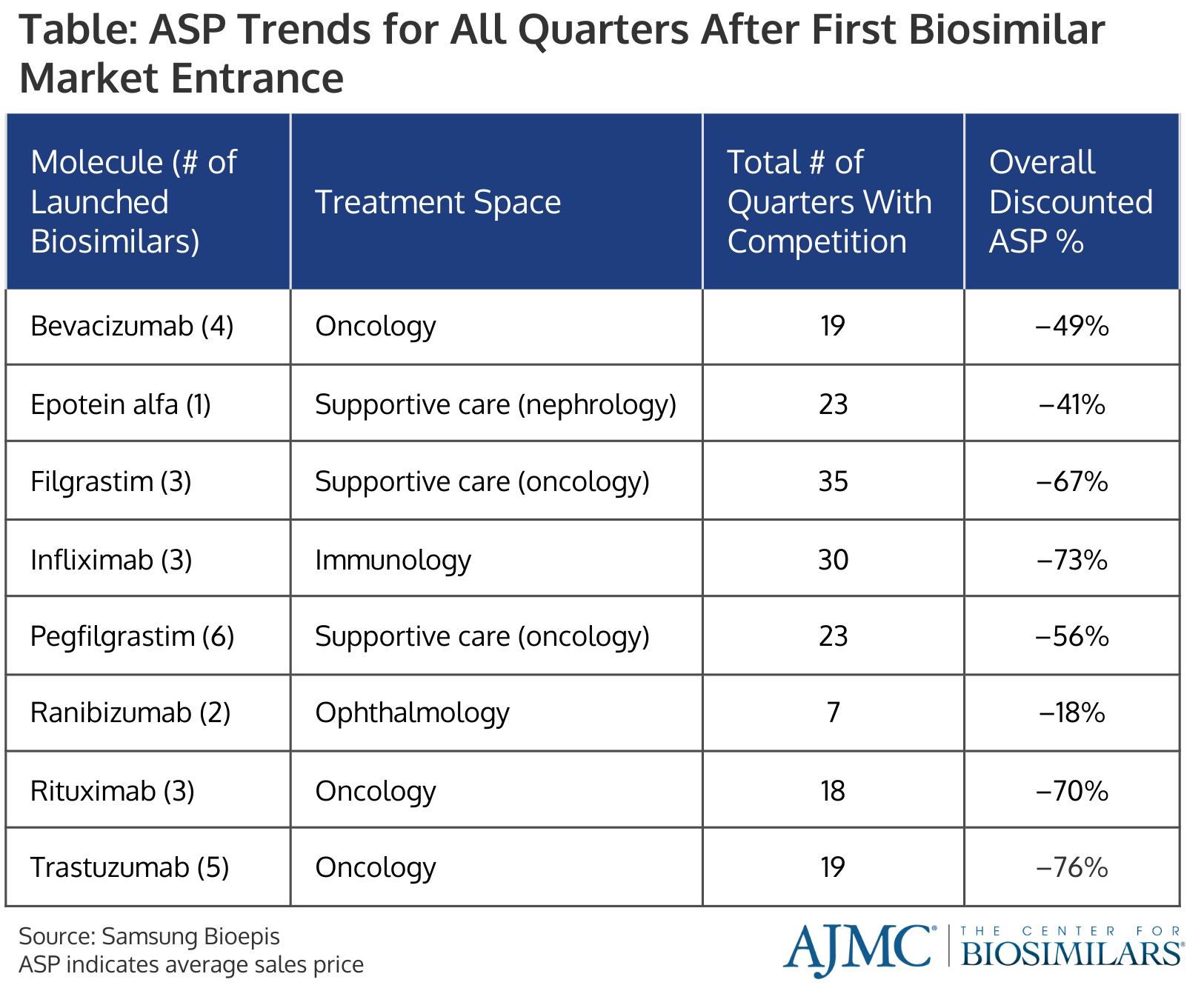

Additionally, average selling prices (ASPs) have declined by 41% over the same time frame. However, more mature markets—such as the filgrastim and infliximab markets, which have had biosimilar competitors on the market the longest—have even greater price cuts (Table).

Click to enlarge.

Oncology and Supportive Care Trends

Across all oncology biosimilars, the stated wholesale acquisition cost (WAC) experienced a 10% to 25% discount compared to the reference product, and savings are mainly seen in ASP where biosimilars can save health systems up to 90% compared with reference products.

For the trastuzumab space, the average ASP has dropped to $1393 (–67%) for all products and $1034 (–76%) for all biosimilars from the start of biosimilar competition (Q3 2019 to Q1 2024).

Similarly, the average ASP in the rituximab space has gone down to $1932 (–57%) for all products and $1330 (–70%) for all biosimilars over the course of 18 quarters (Q4 2019 to Q1 2024). Smaller changes in average ASP were found in the bevacizumab space, where they’ve dropped 41% for all products and 49% for biosimilars.

In the supportive care space, particularly the pegfilgrastim and epoetin alfa spaces, the companies behind the originators have continued to lower their ASPs to those of the biosimilars to retain market share. However, reference filgrastim still has an ASP considerably higher than its biosimilars ($446 vs between $104 and $223).

Immunology and 1 Year of Adalimumab

Despite a slow start for infliximab products—which experienced low uptake and savings for the first 3 years after the first biosimilar competitor entered the market—infliximab biosimilars have seized 54% market share after 7 years. Additionally, the average ASP has declined 70% for all products and 73% for biosimilars. This was largely due to Janssen launching an unbranded version of its infliximab biosimilar in Q4 2022, which reignited price erosion that slowed in 2020 and 2021.

The adalimumab (Humira) space has been the biggest development over 2023, when 8 FDA-approved biosimilars launched throughout the year. As of December 2023, adalimumab biosimilars have obtained 2% of the market. However, there is opportunity for significant discounts as 2 companies have chosen to launch with at least an 85% discount and 5 others have chosen to launch their products with either 2 WACs or a branded and an unbranded version, intending to entice pharmacy benefit managers to add their product to formulary while still offering patients a significant discount.

Although the market reaching its first anniversary, most products have only been on the market for 6 months, leaving questions about provider and patient acceptance of adalimumab biosimilars and the impact of interchangeability on adoption rates up in the air.

“Slow adoption to date may suggest that prescribers and specialty pharmacies have not yet determined the best practices to navigate payer biosimilar preferences and may favor the originator to avoid treatment delays. Strategies requiring biosimilar use over the originator product may be needed for acceleration of biosimilar adoption,” the authors noted.

Endocrinology and Ophthalmology

Similar to the adalimumab space, 1 company has launched unbranded (66% lower than originator) and branded version (8% lower than originator) of its insulin glargine biosimilar. The reference manufacturer has also launched an unbranded version at a 61% discount from the branded version. ASPs for other biosimilars range from 4% higher to 26% lower than the branded version of the reference drug. However, overall uptake for all insulin glargine biosimilars is low, ranging from 0% to 18% market share.

Lastly, ophthalmology biosimilars are beginning to see some uptake, with Cimerli, the first ophthalmology biosimilar to obtain an interchangeability designation jumping from about 5% to 29% market share between Q1 2023 and Q3 2023. Additionally, growing reductions in average ASP (–23% for all products; –18% for biosimilars) will likely continue into 2024.

Reference

Biosimilar market report 4th edition, Q1 2024. Samsung Bioepis. January 17, 2024. Accessed January 22, 2024.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.