- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Samsung Bioepis and Organon Seek to Enter the Market for High-Concentration Adalimumab

The companies hope to gain FDA approval for a high-concentration, citrate-free version of Hadlima, an adalimumab biosimilar that was approved in a lower concentration in July 2019.

Seeking to position themselves optimally for a share of the adalimumab (Humira) market, Samsung Bioepis and Organon are seeking FDA approval for a biosimilar high-concentration, citrate-free formulation (100 mg/mL) of adalimumab.

Adalimumab is an immunosuppressive drug for rheumatologic and gastrointestinal disorders. It is used for the treatment of rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, plaque psoriasis, ankylosing spondylitis, Crohn disease, and ulcerative colitis.

The market for high-concentration adalimumab is said to be increasing in both the United States and the European Union, as its citrate-free aspect reduces pain upon injection. Citrate is a buffer that helps to stabilize pH, but it is known to cause patients intense discomfort and affect patient adherence to adalimumab.

The high-concentration, low-volume formulation also adds convenience during administration.

In the United States, high-concentration adalimumab represents about 80% of the total market for this agent, based on recent IQVIA Midas data.

Samsung Bioepis is the biosimilar developer in the partnership with Organon, which has helped to commercialize multiple Samsung Bioepis biosimilars so far. Organon would be the US marketing partner.

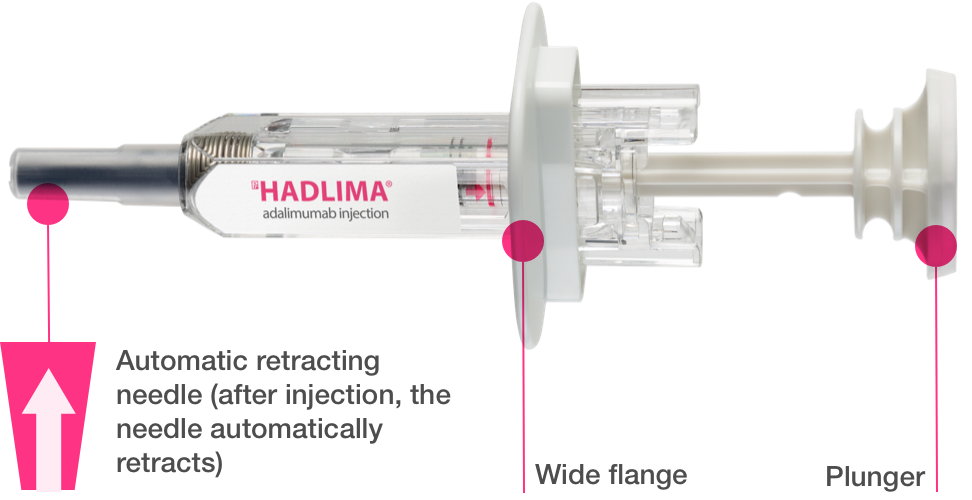

The adalimumab high-concentration biosimilar candidate is based on a lower-concentration biosimilar (SB5, Hadlima; 50 mg/mL) that was approved by the FDA in 2019.

Currently, adalimumab biosimilars are available in Canada and the European Union, but have not been able to penetrate the US market because of exclusivity protections for Humira. Hadlima’s anticipated US launch is June 2023, six months after the anticipated entry of the first adalimumab biosimilar, Amjevita (Amgen), in January 2023.

In a statement, Samsung Bioepis and Organon said the application for high-concentration Hadlima has been accepted for review by the FDA. The companies said their biologics license application was submitted to the FDA in October 2021. They are targeting a US launch on or after July 1, 2023.

The application was based on data from a randomized study comparing the pharmacokinetics, safety, tolerability, and immunogenicity of 2 formulations of SB5 (100 mg/mL vs 50 mg/mL) in healthy volunteers.

The submission of a fresh application for Hadlima reflects the competitive positioning of companies as the biosimilar entry point begins. In October, Boehringer Ingelheim obtained interchangeable status for its Cyltezo adalimumab biosimilar. Cyltezo was approved in lower-concentration, 20 mg/0.4mL and 40 mg/0.8 mL prefilled syringes, and the company has (thus far unsuccessfully) sought flexibility from the FDA on the product strength allowances, presumably so it can offer a high-concentration formulation without undergoing a repeat biologics license application.

However, the interchangeable designation is potentially of competitive value, as it allows pharmacists and health care institutions greater flexibility in dispensing lower-cost biosimilars rather than higher-cost reference drugs.

Thus far in the United States, no high-concentration adalimumab biosimilars have been approved by the FDA. Among the companies seeking approval for high-concentration adalimumab biosimilars are Teva/Alvotech (AVT-02), Celltrion (CT-P17), and Amgen (ABP-501 HC).

All of the approved adalimumab biosimilars are low concentration, some are citrate free, and some are latex free. Needle size, also a potential product differentiator, also varies among approved products.

In December, the list of adalimumab biosimilars approved for marketing numbered 7, augmented most recently by an FDA green light for Yusimry (40 mg, subcutaneous), a Coherus BioSciences product.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.