- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

What Types of Patents Are to Blame for Biosimilar Market Delays?

Although manufacturing patents tend to be the most common type of patent referenced in litigation regarding biosimilar development, other patents actually have a greater impact on delays for biosimilar market launches.

Contrary to popular belief, manufacturing patents are not the primary patent type impacting biosimilar market launch delays, according to a recent study published in Value in Health.

The Biologics Price Competition and Innovation Act (BPCIA) aimed to expedite the commercialization of biosimilars and enhance market access through streamlined regulatory approval and patent litigation procedures. However, more than 50% of biosimilars approved under the BPCIA have faced substantial launch delays, undermining the intended benefits and resulting in financial burdens on health care systems and delayed access to affordable biologic therapies for patients.

The study sought to investigate the reasons behind these delays, focusing on the impact of different types of patents, including those related to active pharmaceutical ingredients (API), manufacturing processes, treatment methods, composition of matter, and devices. The prevailing belief was that secondary manufacturing patents, filed after the approval of the originator drug, played a crucial role in causing these delays. The complexity of biologic manufacturing allowed originator developers to build extensive patent portfolios, leading to litigation and settlement outcomes that contributed to longer market launch delays for biosimilar developers. Notably, these settlements have led to delayed launches for biosimilars referencing Humira (adalimumab), Stelara (ustekinumab), and Enbrel (etanercept).

“Biosimilar entry is estimated to depress the price of the relevant biologic by only about 4% to 10% per biosimilar entrant. This raises an important question—what is the length of time of the current, actual originator monopolies, and are they striking the right balance between incentivizing innovation and public benefit?” wrote the authors.

To date, there had been a lack of detailed empirical understanding regarding the association between the number and types of patents asserted in litigation by biologic originator owners and the outcomes of litigation, as well as the length of biosimilar commercial market entry delays. The findings were expected to provide valuable insights into the factors contributing to biosimilar market entry delays, impacting both biosimilar and originator developers, and informing patent policy considerations related to health care accessibility.

Researchers examined biosimilars approved in the US between March 23, 2010, and December 31, 2021. The authors obtained commercial market launch dates for the products by searching Big Molecule Watch and The Center for Biosimilars® as well as the official branded websites of the originator and biosimilar developers. Information on legal complaints and outcomes were sourced from RPX Insight, Westlaw, and CourtListener. Additionally, if a company said that they would have gone through with litigations for certain patents if it had not been for BPCIA “patent dance” limitations, those patents were included in the analysis.

Patent claims were placed into 1 of 5 categories:

- An active pharmaceutical ingredient (API) claim

- A composition claim, where the protein and at least 1 other ingredient are claimed

- A manufacturing claim, where a process or part of a process involved in manufacturing are claimed

- A treatment claim, where a treatment involving the protein or composition is claimed

- A device claim, where a device is claimed to administer the protein or composition to a patient

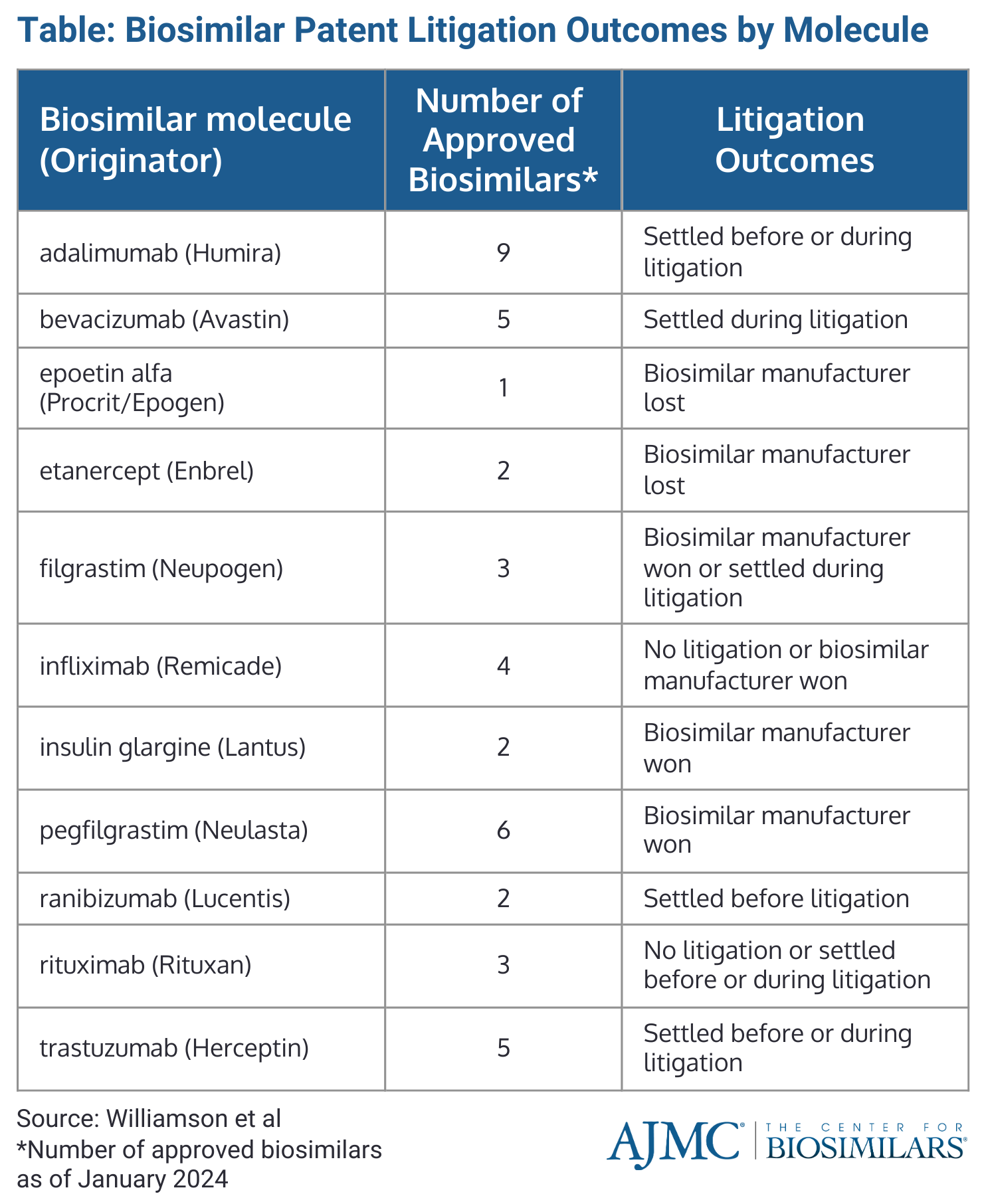

Out of 30 biosimilars commercially launched or with confirmed launch dates, 7 biosimilars won litigation (21%), 3 lost litigation (9%), 11 settled during litigation (33%), 7 settled before litigation (21%), and 2 were not subject to litigation (6%) (Table).

Market launch delays did not significantly differ between biosimilars settling before or during litigation. Among the 21 biosimilars involved in litigation, those that lost had a median market launch delay of 3571 days (approximately 9.9 years) longer than those that won or settled during litigation (P = .016). There was no clear trend in litigation outcomes when biosimilars were grouped based on their originator, as seen with biosimilars for trastuzumab and adalimumab, which saw cases be settled before or during litigation.

The median number of patents asserted and the median total claims that were asserted was 19. Biosimilars that settled during litigation had a median of 35 more patents asserted than those that lost and a median of 38 more patents than those that won (P = .003).

In cases where biosimilars settled during litigation, a greater number of manufacturing patents (P = .002), composition of matter patents (P = .042), and treatment patents were asserted compared with biosimilars that won or lost litigation (P = .002).

While there were no statistically significant differences in the proportions of manufacturing patents, composition of matter patents, or device patents asserted between biosimilars that won, lost, and settled during litigation, a greater proportion of treatment patents were asserted in litigation where biosimilars settled and lost compared with those that won (P = .047), and a greater proportion of API patents were asserted in litigation where biosimilars lost compared with those that settled or won (P = .027).

A higher proportion of composition, API, and treatment patents correlated with longer market launch delays, while a higher proportion of manufacturing patents was associated with shorter market launch delays.

Limitations of the study included a focus on the latest litigation outcomes, excluding initial decisions subject to appeal or overturn, a lack of consideration for delays unrelated to litigation or the threat thereof, acknowledgment of the small sample size of approved biosimilars, and not assessing the magnitude of patent claims.

Reference

Williamson R, Munro T, Ascher D, Robertson A, Pregelj L. Are manufacturing patents to blame for biosimilar market launch delays? Value Health. 2024;27(2):1-7. doi:10.1016/j.jval.2023.12.005

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.