The goal is to deal with an advance notice problem and give some relief to biosimilar companies, who could genuinely say that it’s hard to get an advance perspective on which patents they have to deal with 5 years from now if they keep popping out of the system.

- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BIO Attorneys Discuss the BPCIA Patent Dance

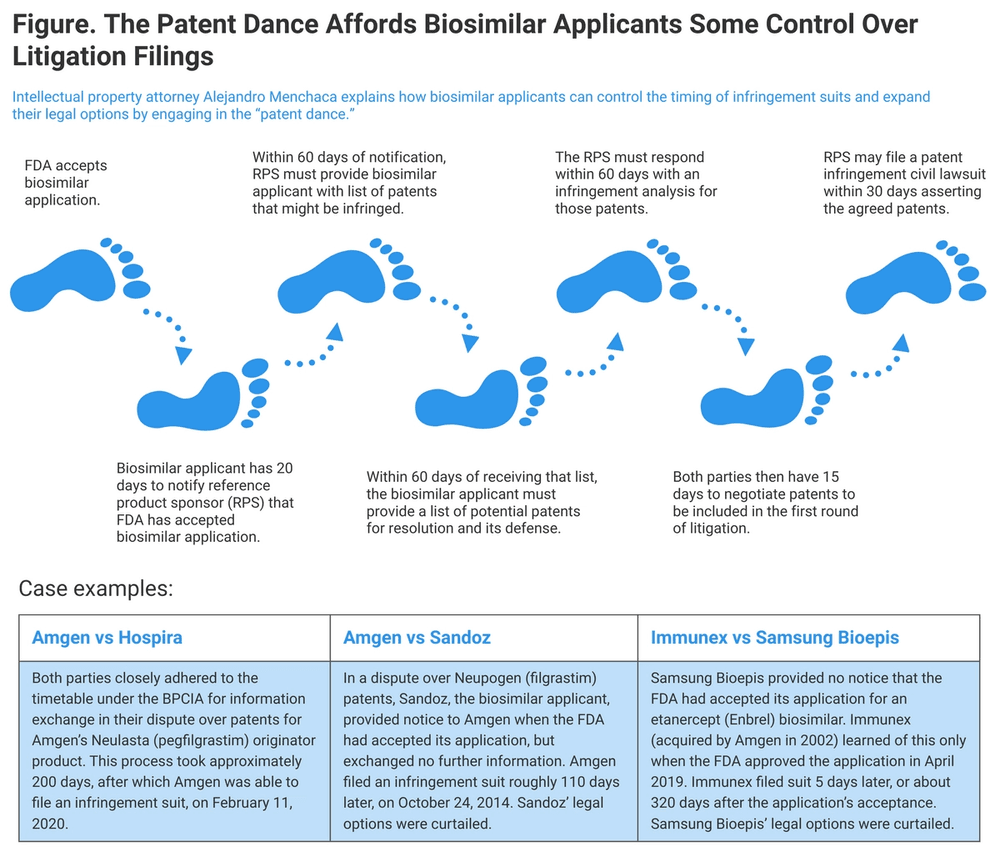

The “patent dance” under the Biologics Price Competition and Innovation Act (BPCIA) is meant to resolve litigation efficiently, and it does, although in practice biosimilar developers and originator companies may not completely adhere to the prescribed steps, according to Biotechnology Innovation Organization (BIO) experts.

How useful is the “patent dance” under the Biologics Price Competition and Innovation Act (BPCIA) for resolving patent disputes and speeding biosimilars to market? It’s more of a pointer for heading biosimilar and originator product companies in the direction of settling their disagreements over intellectual property (IP), said IP attorneys from the Biotechnology Innovation Organization (BIO), a Washington, DC–based trade association.

The patent dance is a part of the biosimilar approval pathway that allows both the originator company and the biosimilar company to exchange information relevant to the patents on the reference product that might be infringed by marketing of the proposed biosimilar.

The patent dance is intended to streamline and formalize the exchange of information and cut down on wasteful litigation that might delay the introduction of cost-saving biosimilars. The multistep process of the patent dance is carefully marked out like footprint stickers in a dance academy (Figure), but in fact, there’s a lot of improvisation.

“Almost everybody says that some part of the patent dance wasn’t complied with by the biosimilar applicant,” said Hans Sauer, deputy general counsel and vice president for intellectual property at BIO. “A fair number of them just refused to participate or started participating and then stopped.”

This isn’t necessarily a problem for getting biosimilars to market, he said. Almost half of the biosimilars currently on the market launched “at risk” of litigation over alleged patent infringements, according to BIO research. “It doesn’t actually really seem to be a problem for the system,” Sauer said.

In a 2017 decision, the US Supreme Court ruled that a biosimilar applicant doesn’t have to comply with the steps of the patent dance as laid out in the BPCIA. The decision concerned a lawsuit filed by Amgen that contended Sandoz did not provide information in accord with patent dance requirements about its proposed filgrastim biosimilar (Zarxio), referencing Amgen’s Neupogen originator product.

“The Supreme Court said the way the legislation is drafted, it’s up to the biosimilar applicant and what they want to do. They don’t have to complete the patent dance, and that’s what we’re seeing. It just depends on the applicant and their particular assessment of their business,” Sauer said.

Biosimilar companies rarely will not start the patent dance process, but they either grudgingly go through all the steps or start out and then say, “We know enough. We’ll just go straight to a plain vanilla patent litigation,” Sauer said.

Patent Dance Is a Guideline

Melissa Brand, former assistant general counsel for Intellectual Property for BIO, interpreted the Supreme Court’s decision in the Amgen vs Sandoz case as meaning that the BPCIA patent dance is essentially a guideline, but litigants are sophisticated enough to decide for themselves how to resolve patent disputes. “If a biosimilar company doesn’t want the benefits and advantages of using the patent dance, it’s up to them,” she said.

The challenge for biosimilar companies is knowing what patents could really block them from coming to market and which are relatively insubstantial. This problem can be exacerbated by originator companies that continue to file patents on products long after they have been approved. This has the potential to frustrate biosimilar developers who can’t accurately predict what aspects of product development are going to be patent protected.

Senator John Cornyn, R-Texas, has introduced legislation that would limit the number of patents a manufacturer can assert during the patent dance. “This will help deter branded manufacturers of biologics from gaming the system to increase the number of patents they assert, while preserving the incentives provided by the patent system to encourage the core innovation that produces new biologic treatments in the first place,” Cornyn said in a statement.

“One of the things that Cornyn heard was that as biosimilar companies started developing their products and going through product development decisions, patents come out of the system too late for them to change the decisions they’ve already made and spent money on. That presents problems,” Brand said.

“The goal is to deal with an advance notice problem and give some relief to biosimilar companies, who could genuinely say that it’s hard to get an advance perspective on which patents they have to deal with 5 years from now if they keep popping out of the system,” she said.

For Sauer and Brand, who have argued that the patent system is not stacked against biosimilar developers and that biosimilars are in general reaching the marketplace without undue hindrance, the Cornyn bill is “a reasonable piece of legislation.”

In the first part of this series, Sauer and Brand discussed patent thickets and whether they are the obstacles to biosimilar development and marketing that they are made out to be; and in the second part of this series, the IP attorneys noted that patent protections vary by type of patent.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.