- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

BioRationality: A Dr Sarfaraz Niazi Column—The Unmined Treasure of Ignored Biosimilars

Sarfaraz K. Niazi, PhD, breaks down the current status of biosimilar development and makes suggestions for which molecules manufacturers should target next in his newest column installment.

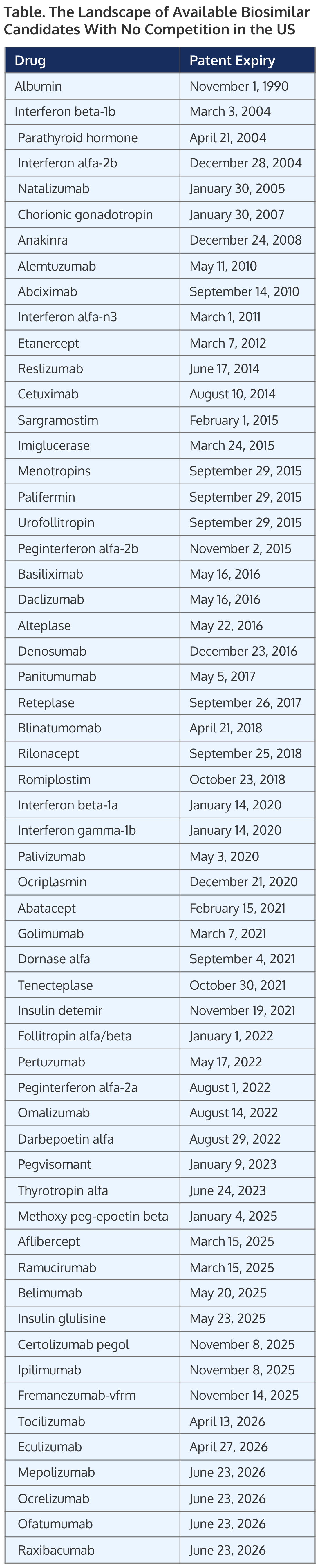

Click to enlarge.

Lurking behind the rat race of taming the 9 molecules in the United States and 14 in the European Union, there are many great opportunities to introduce biosimilars, just as lucrative. Of these, excluding protein-based vaccines and diagnostics, there are 29 monoclonal antibodies, 22 are enzymes, and the rest are of various structures and functions.[1]

The FDA has approved 41 biosimilars and the European Medicines Agency has approved 71 (shown as US/EU approval count); adalimumab (10/8); bevacizumab (4/8); epoetin alfa (1/5); etanercept (2/3); filgrastim (3/7); follitropin alfa (*2/2); infliximab (4/4); insulin aspart (0/2); insulin glargine (2/2); insulin lispro (0/1); pegfilgrastim (6/8); ranibizumab (2/1); rituximab (3/4); somatropin (x/1); trastuzumab (5/6). [*not under 351k]

There are 621 FDA-licensed biologics products,[2] including more than 250 recombinant therapeutic proteins,[3] most of which have no patent protection. A global view shows that in 2019 essential World Health Organization biological drugs include: adalimumab, certolizumab, etanercept, golimumab, infliximab, trastuzumab (as biosimilar), and rituximab. These should be excellent targets for global distribution.

The FDA has issued a list of Essential Medicines in response to a presidential order. The biological products include—filgrastim, insulin, insulin glargine, pegfilgrastim, sargramostim, obiltoxaximab, andexanet, inmazeb, octreotide, raxibacumab in this list.[4] Shouldn't there be an FDA incentive to ensure the availability of these biosimilars?

Here is my list of biosimilars that make a great choice, getting out of the herd race. (Table).

References

[1] Dimitrov DS. Therapeutic proteins. Methods Mol Biol. 2012;899:1-26. doi:10.1007/978-1-61779-921-1_1

[2] Fact sheet: FDA at a glance. FDA. Updated August 17, 2022. Accessed December 19, 2022. https://www.fda.gov/about-fda/fda-basics/fact-sheet-fda-glance

[3] Usmani SS, Bedi G, Samuel JS, et al. THPdb: database of FDA-approved peptide and protein therapeutics. PLoS One. 2017;12(7):e0181748. doi:10.1371/journal.pone.0181748

[4] Executive order 13944 list of essential medicines, medical countermeasures, and critical inputs. FDA. Updated May 23, 2022. Accessed December 19, 2022. https://www.fda.gov/about-fda/reports/executive-order-13944-list-essential-medicines-medical-countermeasures-and-critical-inputs

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.