Top 3 Key Points

- Legislative and Economic Trends: The Cardinal Health 2024 Biosimilar Report highlighted efforts to increase biosimilar adoption and addressed challenges related to patient affordability and health care spending.

- Provider Perspectives: It explored health care providers' attitudes toward biosimilars, including concerns about safety and efficacy, and how payer preferences influence prescribing practices.

- Management Strategies and Challenges: The report discussed best practices for managing biosimilar inventories and identifies challenges such as compounding issues and the need for centralized information and resources to support providers.

In its 2024 Biosimilars Report, Cardinal Health analyzed key economic and legislative developments in the biosimilar space, highlighting new treatment options, such as adalimumab biosimilars, as well as the current perspective of retina specialists on biosimilars ahead of the expected launches for multiple ophthalmology biosimilars.1

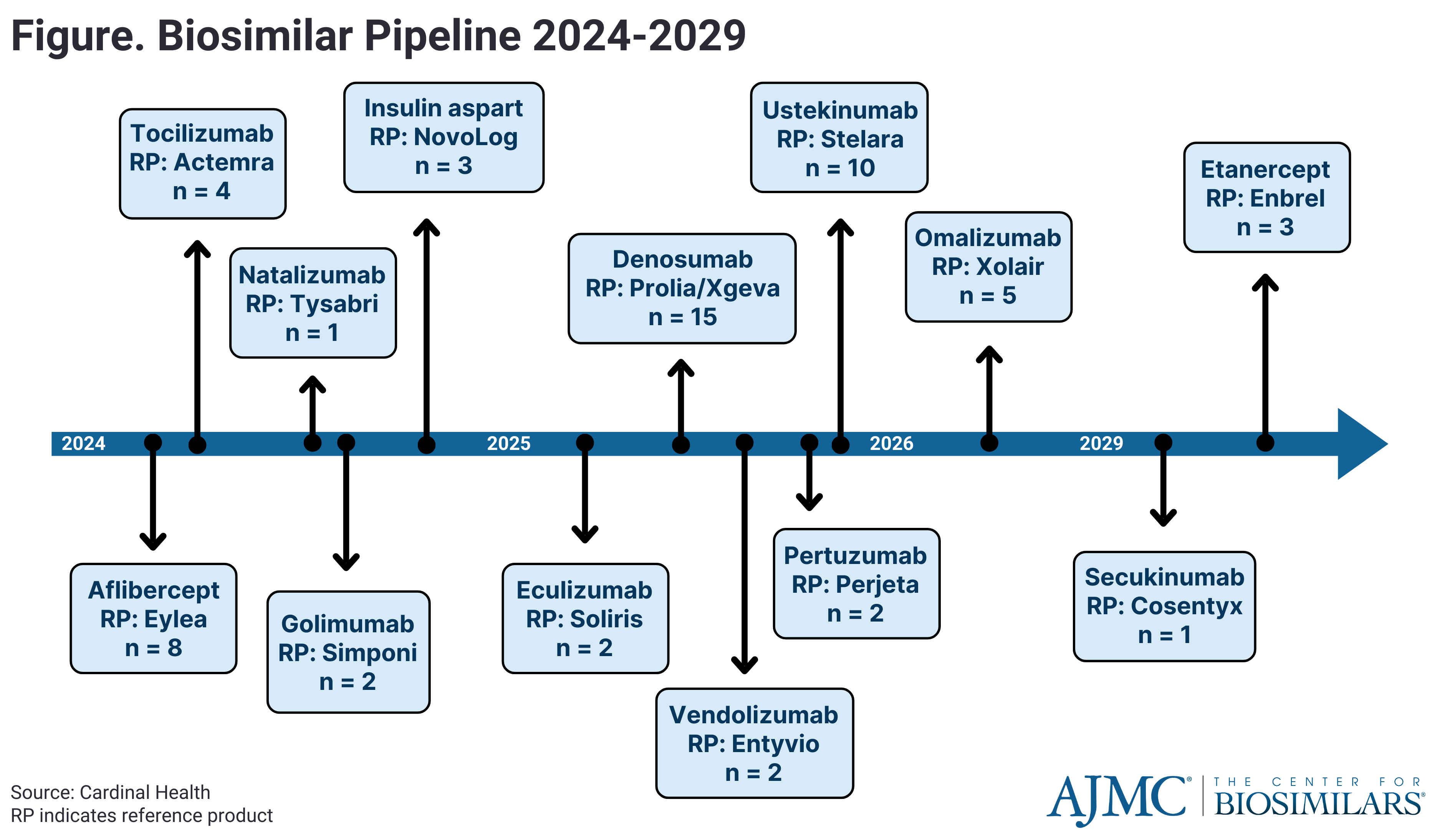

In 2023, 9 adalimumab biosimilars entered the US market, representing the highest number of biosimilars for a single product ever. Additionally, several more biosimilars—including those referencing Stelara (ustekinumab), Tyruko (natalizumab), and Eylea (aflibercept)—are anticipated to launch in the next 5 years. However, several challenges to adoption and patient affordability of biosimilars remain.

The report listed 5 best practices for managing biosimilar inventories, which has become a greater concern as more pharmacy benefit biosimilars have entered the market with similar nonproprietary names, different storage requirements, and various administration devices. Those practices are:

- Focus on profitability

- Prioritize biosimilar quarterly based on economics

- Adopt just-in-time purchasing practices

- Value flexibility over continuity

- Use technology to streamline purchasing

"It is more important than ever that all stakeholders of the health care ecosystem understand the significant benefits biosimilars offer to patients, providers, practices, and payers alike," said Fran Gregory, PharmD, MBA, vice president of emerging therapies at Cardinal Health, in a a statement.2 "The savings generated by biosimilars will play an increasingly important part in creating a balance between funding innovative new treatments and reducing the overall financial burden on the health care system. This report offers critical context on this rapidly changing clinical and market landscape, and the role biosimilars will play in increasing the accessibility and affordability of care."

Government Relations Update

With the increasing availability of biosimilars, there's been growing interest in interchangeable biosimilars, which can be substituted for the reference product at pharmacies without the need for a health care provider's intervention. Although only 9 biosimilars have received interchangeability status in the US as of February 2024, efforts are underway in Congress to streamline the designation process.

The report highlighted the Biosimilar Red Tape Elimination Act introduced by Senator Mike Lee (R-Utah), which aims to automatically qualify biosimilars for interchangeability designation, potentially reducing costs and increasing access to therapies. Additionally, Representative Mariannette Miller-Meeks (R-Iowa) introduced the Biologics Competition Act, which would require the FDA to assess the interchangeability approval process. Both parties support efforts to address biosimilars and related health care issues, suggesting possible legislative action before the current Congress adjourns.

Provider Perspectives and Prescribing Trends

Biosimilars offer substantial cost savings in health care, estimated at $38.4 billion to $124.5 billion from 2021 to 2025, with an average cost reduction of 30% compared with reference biologics. These savings, if passed on to the patient, can help expand access to affordable health care while reducing the risk of financial toxicity for patients. Additionally, biosimilars contribute to reducing health care disparities and sustaining the health care system by creating room for innovative treatments.

However, retina specialists continue to be skeptical of ophthalmology biosimilars. Although 75% of retina specialists surveyed said they believe biosimilars can improve the sustainability of the health care system and nearly 80% reported being “extremely” or “very” familiar with biosimilars, only 60% have prescribed one.

The main reasons for prescribing hesitancy were lack of long-term data on biosimilars (48%), limited clinical experience with biosimilars (41%), lack of confidence in the safety and efficacy of biosimilars (40%), and concerns about differences or variances in manufacturing between biosimilars and their reference products (39%).

Regarding bevacizumab products, which are used off label to treat ophthalmic conditions, 75% of providers said they rely on 503B outsourcing facilities for compounding. Although 35% reported that they don’t have compounding difficulties regarding biosimilars, over 10% reported having compounding issues for at least 1 bevacizumab biosimilar. Additionally, 75% of retina specialists reported compounding safety to be a barrier to compounding bevacizumab biosimilars and the reference agent (Avastin).

Most insurers tended to prefer the reference product over biosimilars, preventing many retina specialists who are open to them from prescribing them to patients. When asked what they would do if biosimilars became a payer’s preferred product for financial reimbursement, 82% said they would be “very likely” or “somewhat likely” to prescribe biosimilars.

Regarding prior authorization requests, 94% and 50% of specialists said that obtaining prior authorization is “easy” or “very easy” for Avastin and Lucentis (reference ranibizumab), respecitvely, which were much higher percentages compared with their respective biosimilars.

Survey participants identified several needs, including a centralized source of information on relevant biosimilars, access to more comprehensive and accurate data, educational materials for patient sharing, and resources to aid small practices in assessing efficacy, safety, and reimbursements for new biosimilars.

Historically, national preferred formularies (NPFs) have taken several years to designate a specific biosimilar as a preferred option. For instance, although infliximab biosimilars debuted in the US in 2016, it wasn't until 2022 that Express Scripts included a biosimilar on its NPF list. However, there has been a positive shift in this trend with the introduction of adalimumab biosimilars, with the 3 largest pharmacy benefit managers—Express Scripts, Optum, and CVS Caremark—incorporating adalimumab biosimilars into their NPF lists in 2023.

A Look Ahead

The future of biosimilars promises significant developments, with a growing pipeline of approvals and launches (Figure). As biosimilar utilization rises and average sales prices decrease, competition is driving down costs. Major biosimilars referencing Stelara (ustekinumab) and Eylea (aflibercept) face impending biosimilar competition, potentially reshaping their respective markets. Manufacturers are exploring switch studies and alternative dosing strategies to maintain market share.

The report concluded, “Over the last decade, biosimilars have demonstrated their promise at generating competition and necessary savings for the health care system. At least 10 additional molecules will face biosimilar competition in the next 4 years, with projected savings of $180 billion. Hopefully, these savings can be reinvested into innovative new therapies with the potential to help many more patients."

References

1. 2024 Biosimilars Report. Cardinal Health. February 29, 2024. Accessed February 29, 2024. https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-2024-Biosimilars-Report.pdf

2. Cardinal Health annual research report examines milestone year in biosimilars. News release. Cardinal Health. February 29, 2024. Accessed February 29, 2024. https://www.prnewswire.com/news-releases/cardinal-health-annual-research-report-examines-milestone-year-in-biosimilars-302075391.html?tc=eml_cleartime