- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

House Committee Issues Blistering Report on AbbVie's Humira Tactics

The House Committee on Oversight and Reform contends AbbVie's "biosimilar defense strategy" has succeeded beyond the company's wildest imagination.

An investigative report from the House Committee on Oversight and Reform describes a “cold and heartless” methodology allegedly employed by AbbVie to keep biosimilar competition away from its increasingly lucrative adalimumab (Humira) franchise. There aren’t any adalimumab biosimilars on the US market currently, although 6 have been approved by the FDA.

AbbVie’s CEO Richard Gonzalez is on the hot plate this week as the House committee questions him and hears testimony from various opponents to adalimumab patent exclusivities that have helped AbbVie receive $170 billion in worldwide net revenue from Humira since 2003, “including $107 billion from the US health care system,” according to the report.

The Center for Biosimilars® requested comment from AbbVie prior to publication but there was no response.

Click to enlarge.

AbbVie has at least 136 US patents protecting adalimumab and most recently has asserted 62 of them in a battle with Icelandic company Alvotech, which seeks to bring a high-concentration formulation of adalimumab to market.

The Humira company has at times even surprised itself with the cleverness of its biosimilar competition defense strategy, the House report alleges, citing internal documents it obtained from AbbVie.

“In 2014, AbbVie’s executives estimated that 3 to 5 biosimilar competitors would enter the market by the first quarter of 2017, [but] AbbVie ultimately entered into settlement agreements with 4 of these competitors, delaying their entry into the market until 2023,” the report said, citing AbbVie documents. In fact, the company has delayed entry until 2023 for all 6 adalimumab biosimilars currently approved for the US market.

Part of this strategy was to “raise barriers to competitor ability to replicate” adalimumab, the report said, citing language used by AbbVie employees in documents. The House report contends these barriers included filing hundreds of patent applications for Humira, in the hopes that many would stick, and launching follow-on products that kept the core adalimumab franchise out of reach of competitors. For example, high-concentration Humira was introduced in 2018 and has captured a large share of the adalimumab market. The product’s advantage was a reduction in pain upon injection.

“If AbbVie had truly developed the concentration formulation to reduce pain for patients, it would have launched the drug immediately. Instead, AbbVie held the formulation off the market until July 2018, possibly waiting until biosimilar manufacturers had invested significant resources in developing biosimilar versions of the original formulation of Humira,” the report alleged.

Regular and Frequent Price Increases

Through regular and frequent price increases, along with an expanding market for adalimumab, AbbVie has succeeded in increasing its annual US Humira revenues from $200,000 in 2003 to $16.1 billion in 2020. The report contends this was partly accomplished by tying executive compensation at the company directly to Humira net revenue.

“The first year this net revenue incentive was added to the calculation coincided with the highest period of price increases in Humira’s history—over 30% in a 10-month period,” the report said.

AbbVie has raised the price of Humira 27 times, so that a 40-mg/mL syringe of adalimumab in the United States is now priced at $2984 ($77,586 annually), which represents a 470% increase from when the drug launched in 2003. Meanwhile, Humira prices in the European Union, where adalimumab biosimilars have been marketed, are often less than half or one-third the cost of adalimumab in the United States.

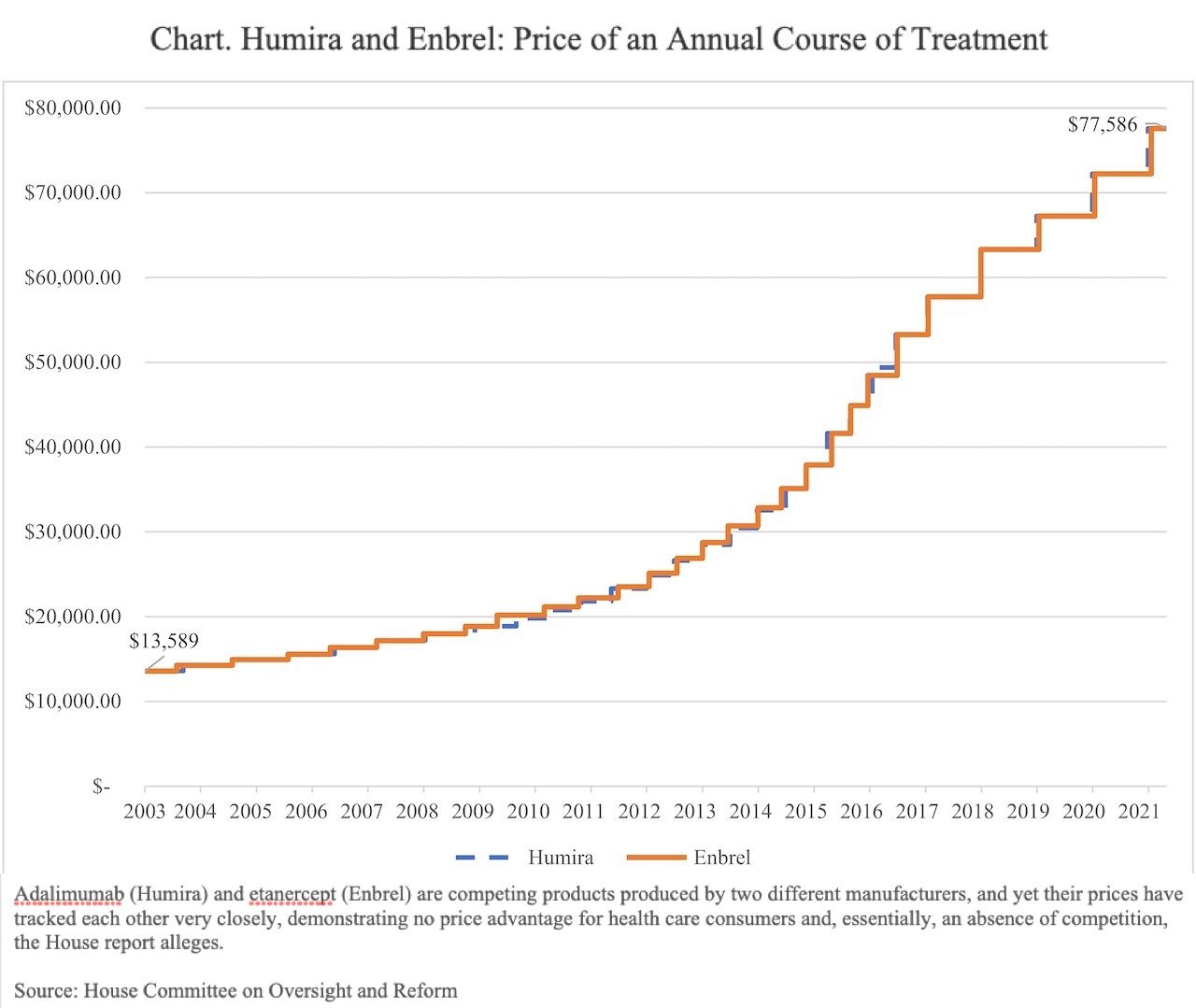

Another allegation in the report suggests, if not price fixing, an unspoken collaboration with a competitor to avoid allowing either company’s product to undersell the other. The report states that Humira’s closest competing drug is Amgen’s etanercept (Enbrel), which also has full exclusivity in the United States, owing to patent protections.

“Instead of pricing Humira and Enbrel below one another to gain market share—as expected in a competitive market—AbbVie and Amgen engaged in a practice known as 'shadow pricing,' consistently following the other company’s price increases.”

From 2003 to 2021, the prices of Humira and Enbrel mirrored each other almost exactly throughout dozens of price increases, according to the report (Chart).

The House report also describes similar practices for another AbbVie blockbuster drug, ibrutinib (Imbruvica), a small molecule product used for the treatment of hematologic cancers.

“These price hikes contributed to billions of dollars in corporate profits and enriched company executives while harming American patients and taxpayers,” the report said.

For related reading, click here.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.