- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Samsung Bioepis Report Correlates Biosimilar Pricing Changes With Market Adoption

In the first edition of Samsung Bioepis’ Biosimilar Market Report, the company outlined the current state of the US biosimilars market and how increasing adoption has had an impact on pricing changes for biosimilars and their reference products.

In the first edition of Samsung Bioepis’ Biosimilar Market Report, the company outlined the current state of the US biosimilars market and changes in prices for biosimilars and their reference products.

Since 2013, biosimilars have generated $56 billion in savings for the US health care system, and over the next 5 years, savings are expected to reach $181 billion. The report, which will be updated each quarter, outlines how pricing and adoption has changed over time in different disease states, including oncology, supportive care, immunology, endocrinology, and ophthalmology.

“Biosimilars continue to play a crucial role in driving down health care costs in the US and a collaborative approach is fundamental for the sustainable growth of the US biosimilar market…. We hope to offer the resource as useful context in order to bring up-to-date information to the forefront of the biosimilar market landscape,” wrote Thomas Newcomer, vice president and head of market access at Samsung Bioepis US, in the report’s foreword.

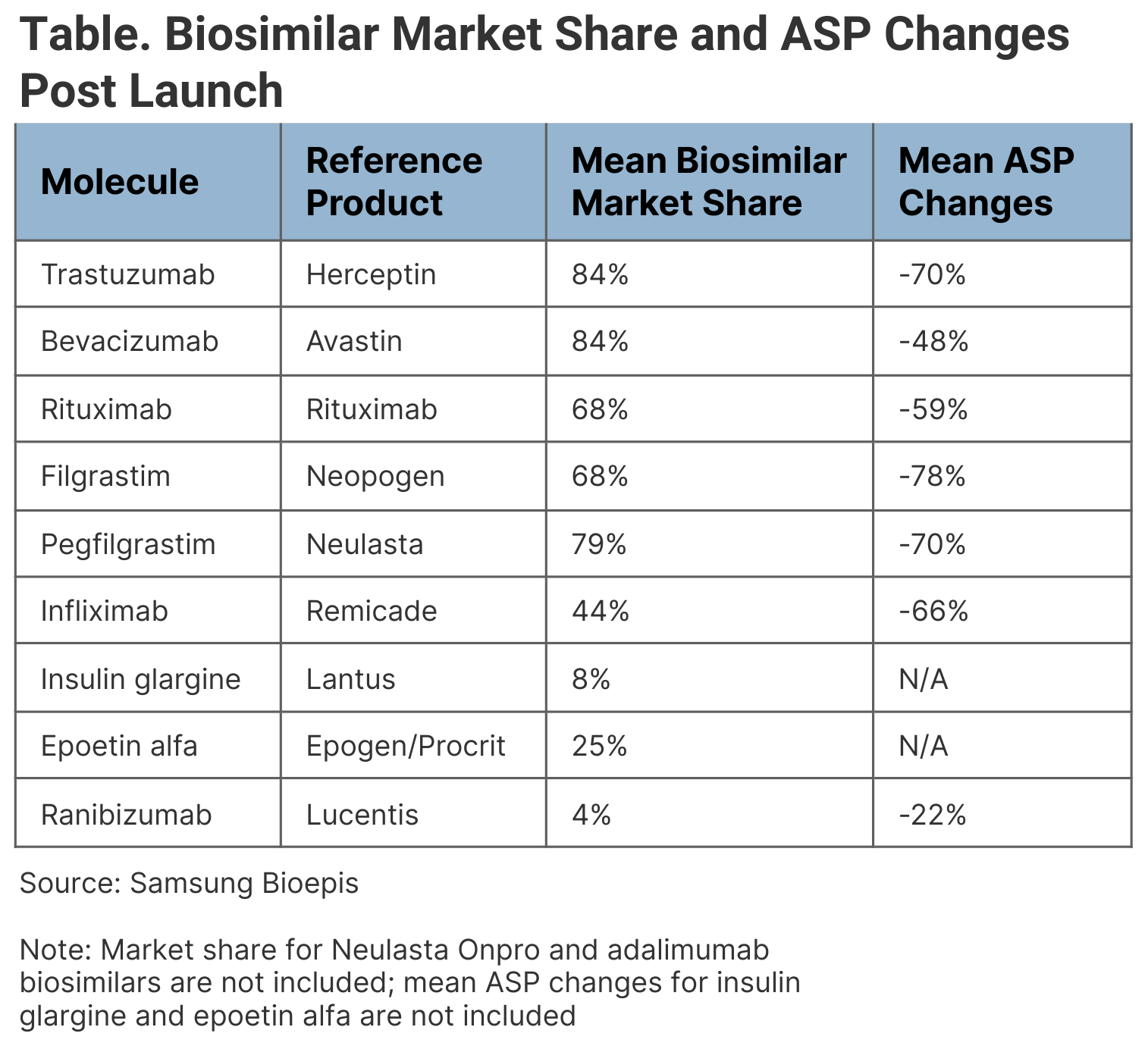

Of the 40 FDA-approved biosimilars across 11 originators, only 28 have launched on the US market, including 7 adalimumab biosimilars that are expected to launch in July 2023. Biosimilars have gained an average 53% market share in 3 years post launch of the first biosimilar in each class. (Table)

Biosimilar market share and ASP changes post launch

Additionally, the average slaes price (ASP) declined by an average of 41% over the same time frame; however, bevacizumab and filgrastim ASPs have seen increases following new biosimilar launches.

Across oncology, the stated wholesale acquisition cost (WAC) has gone down between 10% and 25% across the trastuzumab, bevacizumab, and rituximab markets. The ASP has gone down by over 60% across the oncology space.

Despite some modest biosimilar competition and lowered ASPs in the supportive care space, originators Neulasta (pegfilgrastim) and Epogen/Procrit (epoetin alfa) have been able to retain market share.

The immunology and ophthalmology spaces have experienced little uptake so far. Although infliximab biosimilars have launched with progressively lower WACs (between 19% and 59% lower than the originator), uptake has been slower than expected. Only 2 ophthalmology biosimilars, both ranibizumab products, have launched at a WAC of 30% and 42% lower than the originator. However, they launched in late 2022 and ophthalmologists are wary about using them, so uptake is low.

In 2023, at least 8 adalimumab biosimilars will launch in the United States. As of the publishing of the report, only 1 is on the market (Amjevita), and it launched with 2 WACs (5% and 55% lower than the originator). The biosimilar has not experienced much uptake so far.

In the insulin space, the 5 variations of Lantus (insulin glargine) biosimilars, including Basaglar, Toujeo, and unbranded Lantus, have WACs ranging from 4% higher to 66% lower than Lantus. Uptake of insulin biosimilars is low because manufacturers have struggled to get their products onto formularies.

Samsung Bioepis found that increased biosimilar usage resulted in ASP erosion, which indicated a strong relationship between lower biosimilar prices and higher market share. Oncology had the steepest correlation, demonstrating that the oncology space is more sensitive to pricing changes than the supportive care or immunology spaces.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.