- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Biosimilar Discounts Vary by Category

Biosimilar discounts to reference products have improved over time, but they are deeper in some categories than others.

The introduction of biosimilars brought hope for more affordable treatments and expanded access to high cost medications. The key value driver of biosimilars, well before the launch of the first biosimilar, a filgrastim product (Zarxio), has been a lower price compared with reference biologics.

As early as 2012, it was predicted that biosimilars would lead to $13 billion in savings to the US healthcare system over 10 years. Payers expected biosimilars to come in at discounts of 30% to 40%, and they anticipated larger cost savings for starting new patients on biosimilars versus switching patients from a reference product to a biosimilar (21%-30% cost savings). Over time, however, payers lowered expectations around biosimilar pricing and anticipated discounts of just 10% to 20% from reference biologics.1

Thus far, the biosimilars commercially available in the United States span 3 main therapeutic classes: oncology supportive care, immunology, and oncology. Biosimilar prices are estimated to be 10% to 37% cheaper than originator products.2,3 Discount levels between each class of biosimilars vary, likely attributable to the differing competitive landscapes and indication characteristics (eg, supportive therapy vs oncology agents).

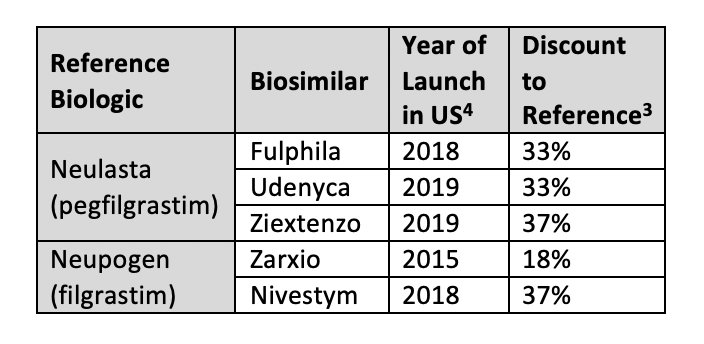

Oncology Supportive Care

Zarxio (Sandoz), which launched in the United States in 2015, is available at an 18% discount to reference filgrastim (Neupogen). Comparatively, the second US filgrastim biosimilar to launch, Nivestym, arrived at a larger discount of 37%.4 There are currently 3 pegfilgrastim biosimilars with discounts above 30%. The newest of these, Ziextenzo (Sandoz), has the largest biosimilar discount seen across all categories, at 37%.3 On average the pegfilgrastim class of biosimilars has the largest discounts seen across biosimilar agents.

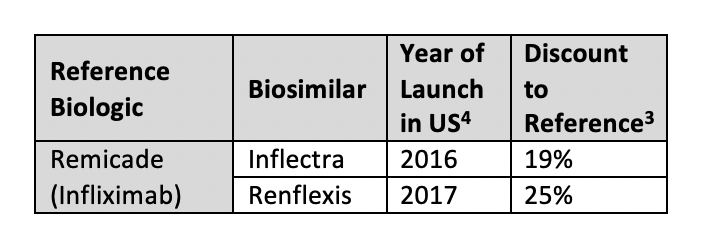

Immunology

Patent obstacles have largely prevented the entry of immunology biosimilars. The infliximab products Inflectra (Pfizer/Celltrion) and Renflexis (Merck/Samsung Bioepis) are the 2 launched biosimilars for reference product Remicade, available at 19% and 35% discounts, respectively.3 Unlike Europe, the United States has yet to see significant competition, discounts, or savings from immunology biosimilars.

Biosimilars for adalimumab (Humira) are not expected until 2023, and etanercept biosimilars to Enbrel are even further out. In the third quarter of 2019, AbbVie reported a 33.5% decline in Humira revenue as a result of biosimilar competition in the European Union.5 Some countries are seeing vast cost-savings from switching from reference adalimumab to biosimilars; Denmark, for example, has seen savings of 82.8% by making this switch. It is uncertain, however, if the United States will be able to see similar savings, or any at all. Although there are still 3 years to market entry of an adalimumab biosimilar, AbbVie has launched a citrate-free Humira and its follow-on product, risankizumab (Skyrizi). As patients transition to these, adalimumab biosimilars may not have as large a market to capture upon entry and, subsequently, may not provide deep discounts leading to greater savings.

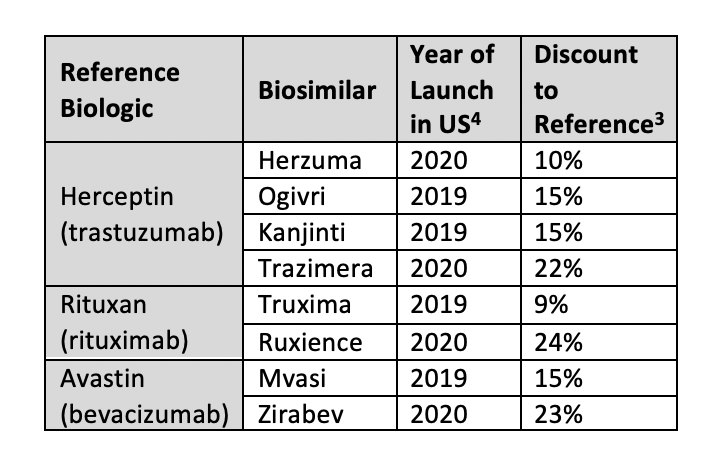

Oncology

Oncology biosimilars are the most recent market entries. There are biosimilars available for trastuzumab (Herceptin), rituximab (Rituxan), and bevacizumab (Avastin). The discount levels for oncology biosimilars range from approximately 10% to 25%.3

Trastuzumab biosimilars are about 10% to 15% cheaper than the reference product, with Kanjinti (Amgen/Allergan) and Ogivri (Mylan/Biocon) the cheapest at 15% lower. The trastuzumab biosimilar Herzuma (Celltrion/Teva) has a 10% discount to Herceptin and Trazimera (Pfizer) is available at 22% below the reference.3

For the rituximab reference product (Rituxan) there are 2 biosimilars available, Truxima (Celltrion/Teva) and Ruxience (Pfizer), with discounts of 9% and 24%, respectively. The wholesale acquisition cost (WAC) of the bevacizumab reference product (Avastin) reaches up to $12,000 per month. The bevacizumab biosimilar Zirabev (Pfizer) was launched at a 23% discount to Avastin’s WAC and Mvasi (Amgen/Allergan) at 15% less.3

Although biosimilar savings have been discussed with regard to lower discounts compared with reference product WAC prices, it is critical to note that, in practice, payers will look to the net price rather than the WAC cost. It is possible that payers may have bigger rebates, exclusive contracts, and altogether a lower net price associated with a reference product than for a biosimilar offered at a lower WAC. Such pricing strategies from developers are partly why originator products, such as Remicade, have fared well against biosimilar competition.

References

- Howell P. How much cheaper will biosimilars be? FiercePharma. March 2, 2012. fiercepharma.com/pharma/how-much-cheaper-will-biosimilars-be. Accessed May 21, 2020.

- Hernandez I, Good CB, Shrank WH, Gellad WF. Trends in Medicaid prices, market share, and spending on long-acting insulins, 2006-2018. JAMA. 2019;321(16):1627-1629. doi:10.1001/jama.2019.2990

- Chase L. A guide to biosimilar prices: how much they cost and how you can save. GoodRx. April 14, 2020. goodrx.com/blog/biosimilars-prices-how-much-they-cost-how-to-save/. Accessed May 23, 2020.

- Brennan Z. US biosimilar launches about to turn a corner. Endpoints. December 10, 2019. //endpts.com/us-biosimilar-launches-about-to-turn-a-corner/. Accessed May 23, 2020.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.