- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

COVID-19's Multifaceted Effect on Biosimilars

The coronavirus disease 2019 (COVID-19) effect on the biosimilar industry will be deep and lasting, causing not just approval and launch delays but profound structural changes in how business is done.

As the coronavirus disease 2019 (COVID-19) pandemic spreads, it will continue to affect the biopharmaceutical industry. Biosimilars are no exception, and the effect on their uptake and adoption will be multifaceted. Here are several ways that biosimilars are most likely to be influenced by COVID-19:

Inaccessibility of healthcare providers (HCPs) and other medical decision-makers: currently, COVID-19 is setting the priorities for most HCPs and hospital decision-makers: take care of affected patients, navigate the evolving COVID-19 coverage and payment landscape, and maintain an adequate supply of beds and personal protective equipment. During this time, institutions may lack the bandwidth to continue to evaluate complex biosimilar-related decisions and may stick to the status quo, the reference product, or the existing preferred biosimilar product until the dust settles. This will slow down biosimilar uptake across the board. As providers defer to their status quo therapy options to avoid unnecessary disruption, uptake of the 8 therapeutic oncology biosimilars launched in the United States so far may be particularly hard hit.

Repurposed contracting and promotional activities: although many regular account manager activities have been disrupted by social distancing measures, contracting can be conducted effectively via digital media. This is especially true for biosimilar manufacturers with existing relationships or customers interested in immediate cost-saving opportunities who are not yet preoccupied with managing COVID-19. Many financial decision-makers (pharmacy directors, medical directors) are postponing contracting discussions. Account managers can now focus on bringing accounts on board for biosimilars and leave “pull-through” sales activity for later. Also, manufacturers that are preparing to launch biosimilars during this quarter or the next may decide to postpone marketing or do a soft launch, which would entail supplying product, leveraging digital or nonpersonal channels, and contracting via tele-detailing. This could affect biosimilars such as Merck's trastuzumab and bevacizumab biosimilars, Ontruzant and SB8, respectively, which are lined up for launch over the next 2 quarters.

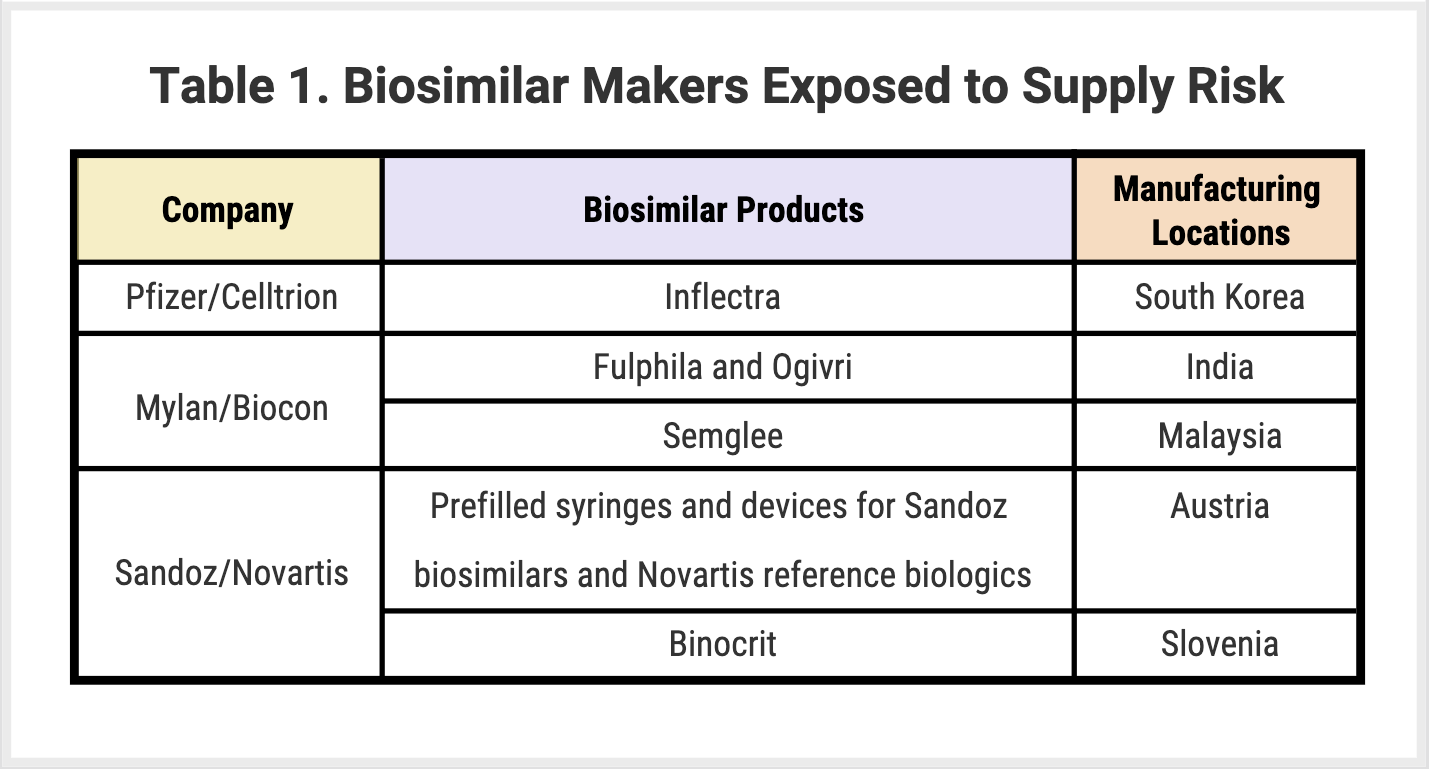

Supply shortages: COVID-19 is causing a dramatic mismatch of supply and demand that manufacturers are struggling to forecast. On the supply side, manufacturing and supply chain processes in hubs such as China, India, and the United States are being disrupted due to global lockdowns. On the demand side, conflated factors make demand difficult to predict. On one hand, patients delay seeking treatment, particularly for less convenient administration methods such as infusions, which can lead to lower patient volume and overall demand. On the other hand, stockpiling and demand for subcutaneous or oral formulations may cause a spike in demand for certain products despite decreasing patient volume. In February 2020, the FDA reported the first case of a shortage of a drug due to coronavirus. Although all manufacturers are working to mitigate the risk of supply shortages, biosimilar manufacturers that rely on facilities in Europe and Asia may be particularly at risk on the supply side (Table 1).

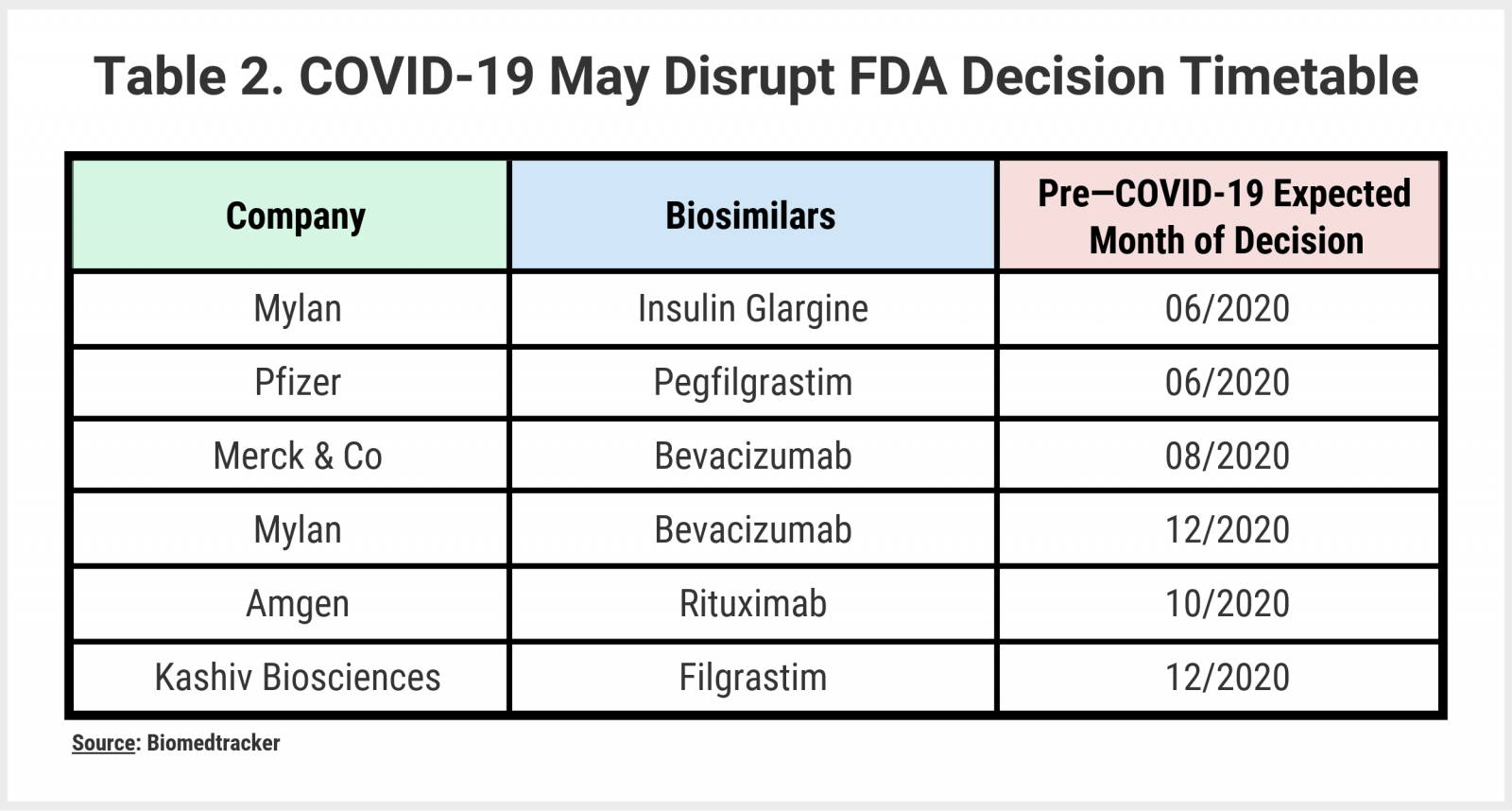

Delays in biosimilar approvals and clinical trials: most clinical trials are likely to be delayed due to challenges managing protocols, deprioritization in favor of more immediate acute care needs, and patients’ inability to travel to appointments. Beyond the logistics and prioritization challenges, manufacturers run the risk of trial participants contracting the disease, which leads to poorer outcomes. The FDA has already put out some guidance on how to manage clinical trials during the pandemic. All of the above-mentioned complicating factors are likely to undermine Prescription Drug User Fee Act/Biosimilar User Fee Amendments dates for biosimilars with approval decisions scheduled by the end of 2020 (Table 2).

Increased budget pressure can accelerate postcrisis biosimilar usage: Without a doubt, the current situation is putting significant budget pressure on the health system, with many providers waiving copays, coinsurances, and out-of-pocket costs due to COVID-19. Although the broader impact on the economy and health system is still unclear, what is certain is that after the crisis, providers will actively look for ways to compensate for the extra expense they are incurring now, and it will be more important than ever for biosimilars to deliver on their promise to bring savings to the healthcare system. In the meantime, it will be important to monitor what manufacturers of reference products and biosimilars do to help support providers as this situation evolves.

There are additional aspects of the pandemic that will affect both biosimilars and reference products alike, such as ensuring safe supplies of medicine in patients’ homes as we all observe social distancing. Patients, either on their own or in consultation with their HCPs, may start to make adjustments to treatment regimens to allow for less time in the hospital or the clinic, especially when it comes to biologics that suppress their immunity, as also recommended by American College of Rheumatology and the National Health Service in the United Kingdom.

Such recommendations, along with the already limited infrastructure, overburdened healthcare system, and social distancing policies will create a very difficult environment for biologics and biosimilars businesses in the short and medium term. However, companies can think strategically about how to create opportunities from these difficult circumstances, such as leveraging virtual technology for contracting discussions, stressing cost savings with cash-strapped customers, and improving patient-support wraparound services. These will help them set the stage for success in a post—COVID-19 world.

At the end of the day, the priority for everyone right now is protecting health and safety. Although biosimilar adoption and evolution to new treatment paradigms may stall, we firmly believe that health and safety are foremost in mind for providers everywhere.

Christina Corridon, MPH, MBA, is a principal in ZS’s Boston office and leads the firm’s biosimilar vertical. Scott Kniaz, MBA, is a strategy insights and planning manager in ZS’s Washington, DC, office. Will Gatziolis, MBA, is an associate principal in ZS’s New York office. Ross Shahinian is a strategy insights and planning manager in ZS’s New York office. Sandeep Sangwan, MPharm, is a knowledge management consultant in ZS’s New Delhi office. All are key leaders in the ZS biosimilar vertical.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.