- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

IQVIA: US Spending on Biosimilars to Reach $129 Billion Over Next 5 Years

IQVIA’s Biosimilars in the United States 2023-2027 report found that while the US biologics market has grown 12.5% annually over the last 5 years, spending on biosimilars is growing and is expected to reach $129 billion by 2027.

Expected launches and uptake of biosimilars are expected to increase spending to $129 billion and savings by $180 billion over the next 5 years, according to IQVIA’s Biosimilars in the United States 2023-2027 report.

Additionally, the overall US biologics market has grown by 12.5% annually during the previous 5 years. Currently, biosimilars that have launched account for 24% of competitive molecule volume. The invoice spending for reference products facing biosimilar competition by the end of 2022 is $38 billion, and reference products representing another $96 billion in invoice spending are set to face biosimilar competition in the next 5 years.

“The report highlights the resiliency of the biosimilars market and proves once more that patient access to biosimilar medicines expands access and yields remarkable savings. To maximize savings through biosimilar adoption, policymakers should take swift action to eliminate these barriers and expand patient access to lower-priced biosimilars,” commented Craig Burton, executive director of the Biosimilars Council, in a statement on the report.

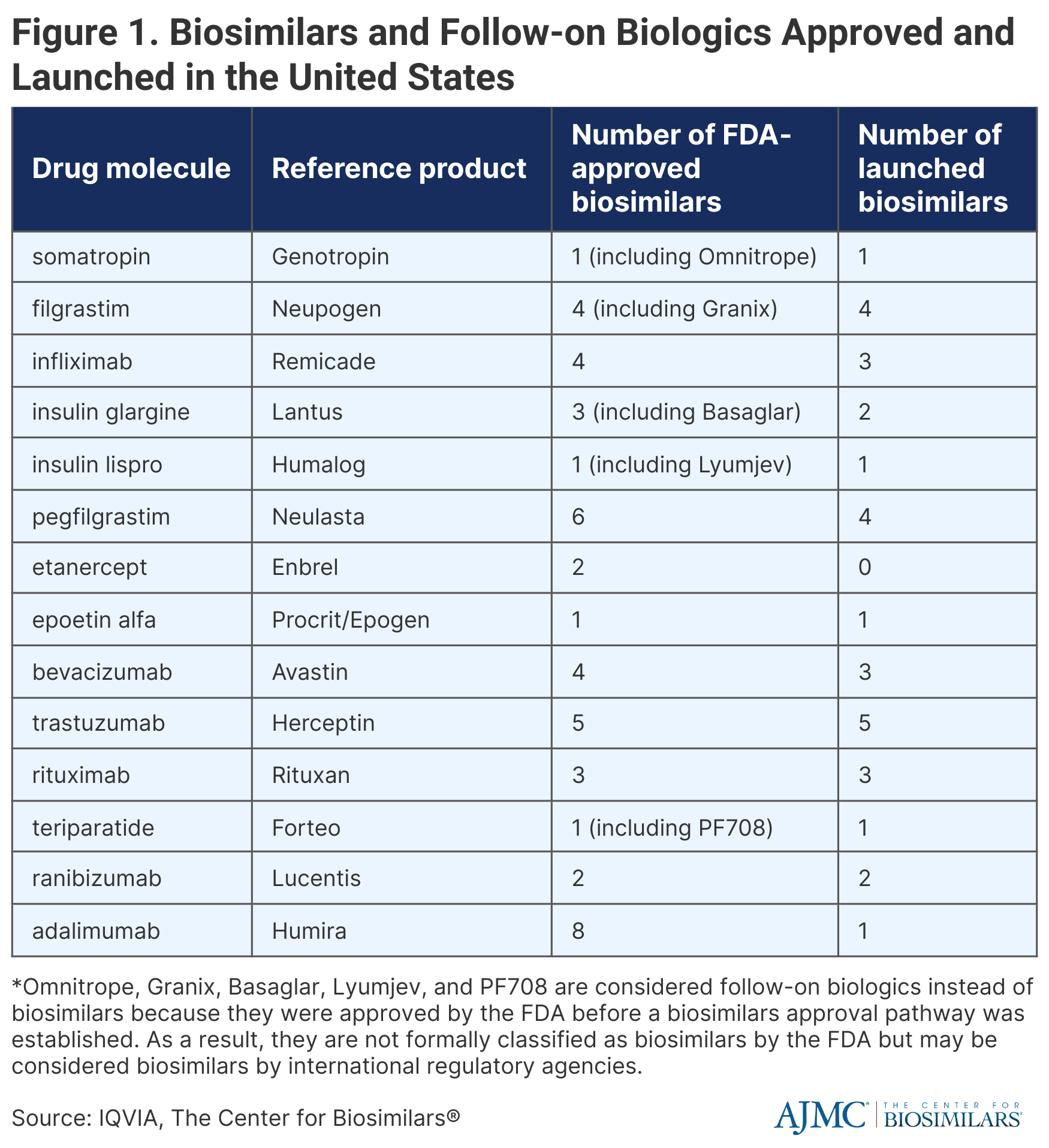

There are currently 40 official FDA-approved biosimilars as well as 5 FDA-approved follow-on biologics, which were approved before the establishment of a biosimilars approval pathway and thus, are not considered biosimilars in the United States but are classified as biosimilars in international markets. Of these 45 products, 31 have launched in the United States (Figure 1).

Biosimilars that have been approved but not launched represent 13% of total biologics sales, 10% of which is from adalimumab (Humira) and 3% is from etanercept (Enbrel). Biosimilars for Humira will launch throughout 2023, with the first launching at the end of January, and biosimilars for Enbrel will not enter the market until 2029.

Additionally, it is still unclear how interchangeability will impact biosimilar utilization because there are only 4 interchangeable biosimilars, half of which have not launched yet.

IQVIA noted that more small drug companies are breaking into the biosimilars space. Before, smaller manufacturers would partner with larger pharma companies to help with marketing. In 2020, smaller companies marketed only 9% of biosimilars. Currently, 79% of biosimilars that are under development are being developed by smaller companies with varying degrees of biologic or biosimilar development experience.

Biosimilars for Avastin (bevaizumab), Herceptin (trastuzumab), and Rituxan (rituximab) have achieved significant uptake within the first 3 years (82%, 80%, and 67%, respectively). Biosimilars for Neulasta (pegfilgrastim) and Procrit/Epogen (epoetin alfa) have had more modest uptake (37% and 27%, respectively). Infliximab biosimilars had the slowest adoption during the first 3 years, obtaining only 13% market share from the reference product (Remicade). However, biosimilars had more success by year 6, accounting for 44% of the infliximab market.

In the case of white bagging policies, where pharmacists manage pharmaceuticals distribution, vs buy-and-build policies, where providers manage distribution, biosimilars had significantly stronger uptake in buy-and-bill commercial plans (35% vs 57% 24 months post biosimilar launch, respectively).

Between institutional providers, who working hospitals or skilled nursing facilities, and professional providers, who work in physicians’ offices, biosimilars had slightly better uptake in professional settings (55% vs 60% 24 months post biosimilar launch, respectively).

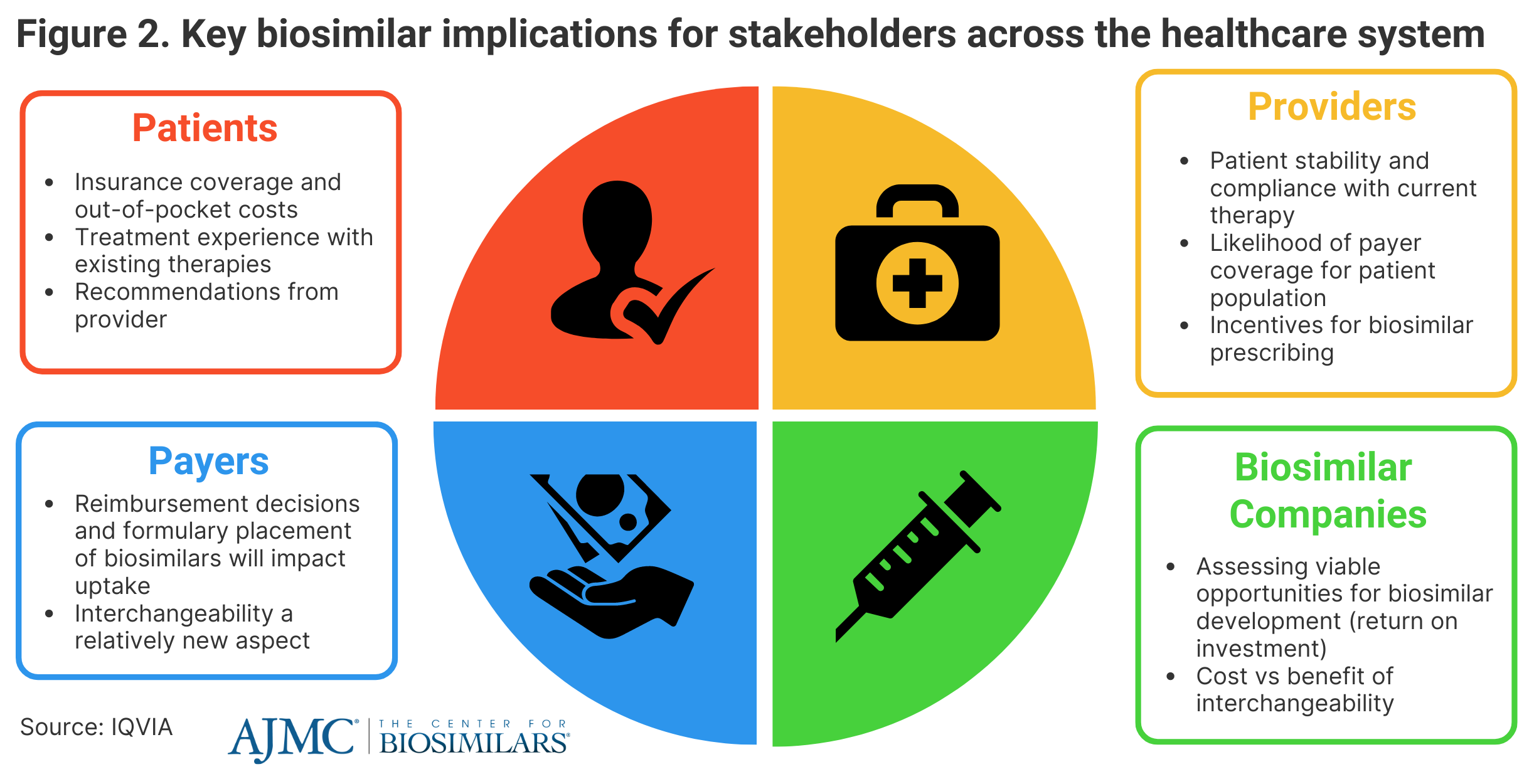

IQVIA said that biosimilars will continue to have an impact on all aspects of the health care system, saying that patients are going to be heavily influenced by coverage options for biosimilars and any out-of-pocket expenses they may face (Figure 2).

Provider recommendations could have a significant impact on uptake as well. However, providers may be discouraged to prescribe biosimilars based on patient experience with current therapies and reimbursement decisions. Payers will continue to influence the degree that patients will have access to biosimilars, as they control reimbursement decisions and formulary placements, which are impacted by rebates and coverage plan designs.

Biosimilar companies will need to evaluate biosimilar development opportunities and how future market dynamics and new legislation, such as the Inflation Reduction Act, will contribute to their potential return on investment.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.