- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Legal Experts Provide Updates on Biosimilar Patent Disputes in 2022

Patent litigators from Fish & Richardson, an intellectual property law firm, regaled audiences during a webinar covering all the big biosimilar regulatory and legal decisions throughout 2022, including updates on patent disputes and antitrust investigations.

Patent litigators from Fish & Richardson, an intellectual property law firm, regaled audiences during a webinar, entitled “Biosimilars: 2022 Year-in-Review,” covering all the big biosimilar regulatory and legal decisions throughout 2022, including updates on patent disputes and anti-trust investigations.

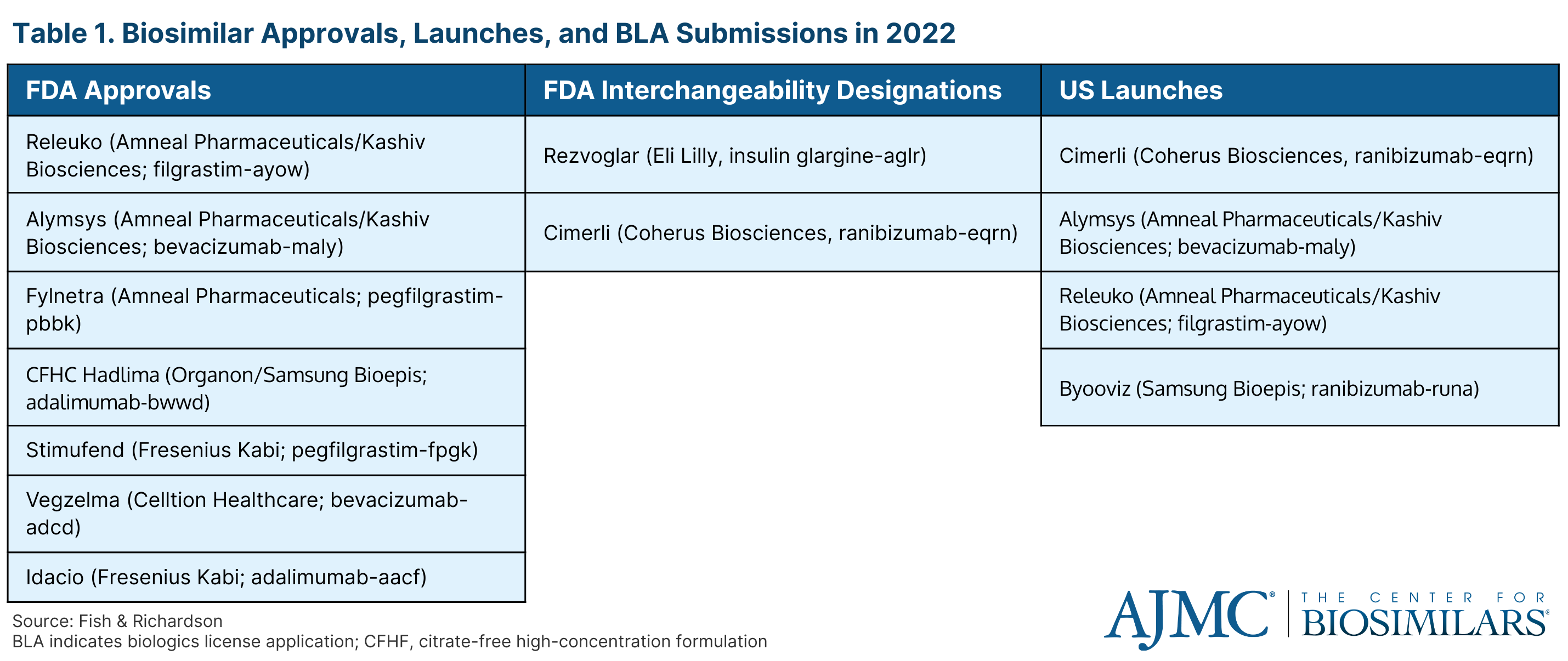

Approvals and Launches

Jenny Shmuel, JD, principal at Fish & Richardson, provided an overlook of the FDA approvals and US launches in the biosimilars space. During 2022, there were 7 approvals, including 1 for a high-concentration version of an adalimumab biosmilar (Hadlima; Organon/Samsung Bioepis), 4 launches, and 2 interchangeability designations (Table 1). Additionally, there were 11 biologics license application (BLA) submissions for biosimilars.

Click to enlarge

Since the first quarter (Q1) of 2020, uptake of biosimilars has grown substantially for some molecules. Uptake for trastuzumab and bevacizumab biosimilars has grown from about 30% in Q1 2020 to around 80% in Q2 2022. For rituximab biosimilars, that number has grown from about 5% to 64% during the same time frame. However, uptake for pegfilgrastim, infliximab, and epoetin alfa biosimilars are still trying to catch up, only obtaining 42%, 42%, and 32% of the market share, respectively.

Click to enlarge

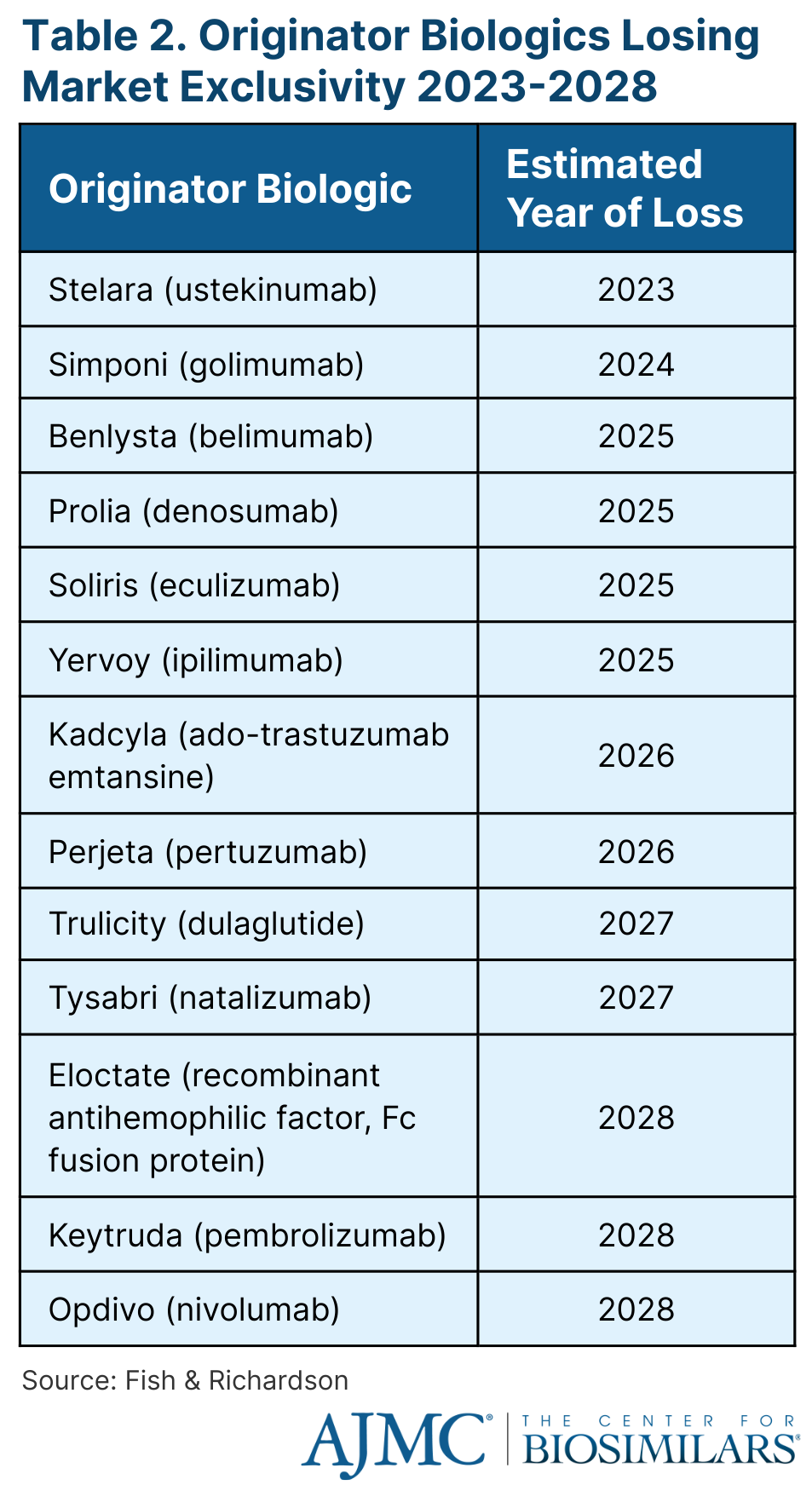

Shmuel highlighted the 13 big originator biologics that will lose exclusivity over the next 5 years (Table 2), including Stelara (ustekinumab), which is expected to face biosimilar competition starting in late 2023 or early 2024.

Pending and Resolved Patent Litigations

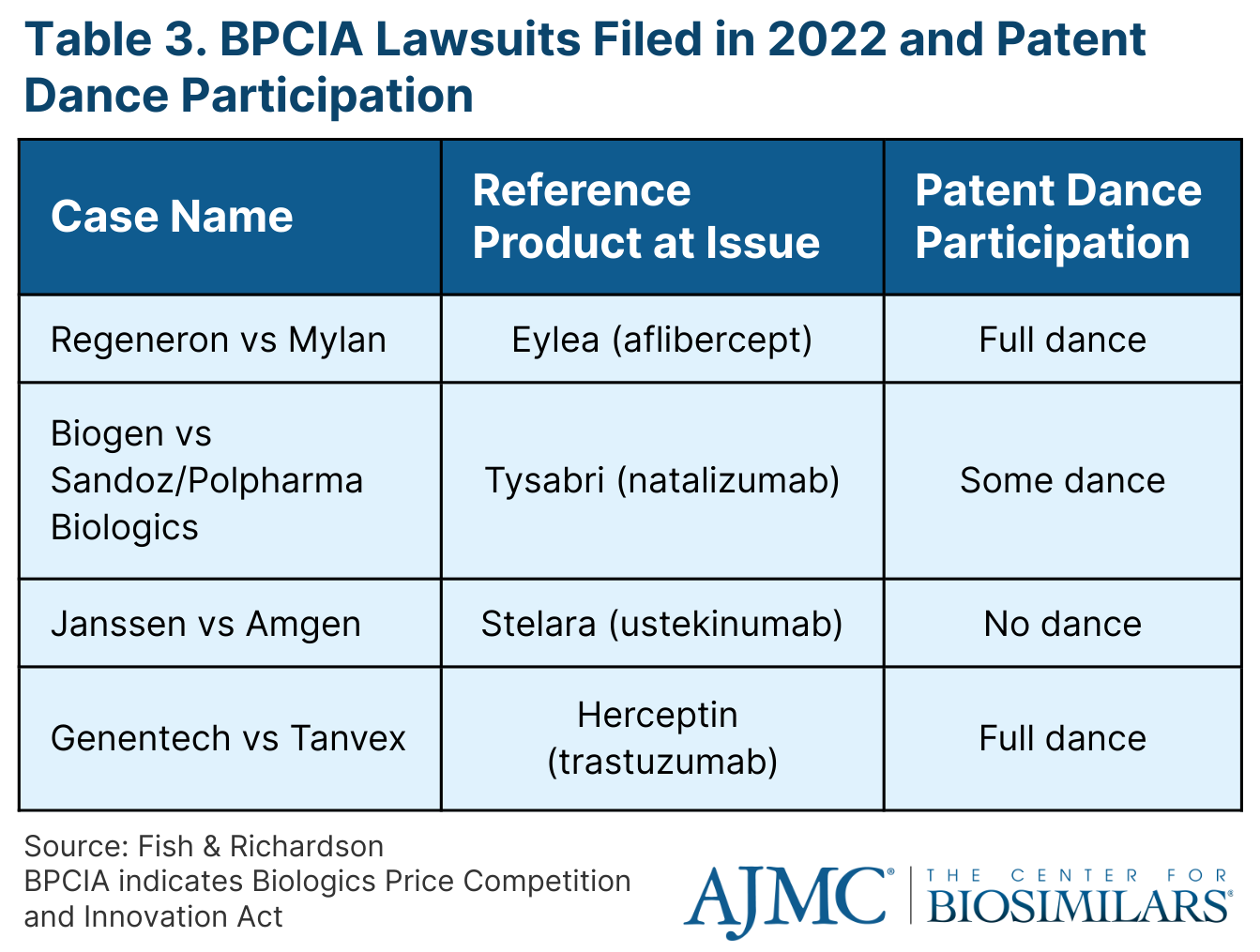

Throughout the year, there were 4 new patent lawsuits. According to Geoff Bieger, JD, principal at Fish & Richardson, this was lower than the peak of filings in 2018 (n = 12) but still up from 2021 (n = 3).

The cases ranged in how much the parties took part in the patent dance, a multistep process within the Biologics Price Competition and Innovation Act (BPCIA) that allows for both the originator company and the biosimilar company to exchange information relevant to the patents on the reference product that might be infringed by marketing of the proposed biosimilar.

Only 2 of the cases went through all steps of the patent dance process (Regeneron vs Mylan; Genentech vs Tanvex), 1 went through some of the steps (Biogen vs Sandoz/Polpharma Biologics), and the other went through none (Janssen vs Amgen) (Table 3).

The Regeneron vs Mylan case resulted in a scheduled trial for June 12 through the 23 in 2023. The current standing of the Biogen vs Sandoz/Polpharma Biologics case is that the parties have jointly requesting for an expedited preliminary injunction proceeding. The Janssen vs Amgen case was filed in November 2022 and no patent dance steps have been taken so far. In the Genentech vs Tanvex case, the parties have demanded for a jury trial, which has not been scheduled yet.

Click to enlarge

Additionally, the Supreme Court is gearing up to weigh on the Amgen vs Sanofi case regarding Sanofi’s development of a PCSK9 antibody product. In December 2022, the Court granted certiorari, agreeing to review the standard for enablement, meaning whether a party that is “reasonably skilled” in a particular field could make or use an invention protected by a patent without “undue experimentation.”

“Although not a BPCIA decision, [this case] might have significant implications in the biosimilars context…" explained Bieger. "The question the Supreme Court has taken is whether or not section 112 requires the patent to teach how to make and use the full scope of the claim embodiments. More specifically, it requires a teaching to make and use all embodiments of the invention without substantial time and effort….The results in this one will definitely generate a lot of a lot of buzz in the coming year."

Updates on Antitrust Investigations

In August 2022, a case filed in March 2019 claiming that AbbVie, the maker of Humira (adalimumab), was engaging in anti-trust behavior by creating a patent thicket and pay-for-delay schemes to prevent biosimilar competition was dismissed. The court declared that “weak patents” are valid and protected under the Noerr-Pennington doctrine, rendering the patent thicket argument null and void. It also said that AbbVie allowing companies to launch their adalimumab biosimilars in Europe while holding off in the United States did not constitute as a pay-for-delay scheme.

A settlement for a case involving Pfizer’s infliximab biosimilar and Johnson & Johnson/Janssen’s patents for Remicade (reference infliximab) is in progress, with a fairness hearing scheduled for February 27, 2023.

Finally, the Federal Trade Commission (FTC) is continuing to investigate pharmacy benefit manager rebate contracts favoring reference products and whether they count as anticompetitive practices that hinder competition from biosimilars and generics.

“The FTC issued a statement on this in June 2022, and specifically identified rebates and fees that stifle competition from generics and biosimilars and increased costs,” Schmuel noted. "The FDA concluded in [a] statement that it will continue to scrutinize rebates and fees to see if antitrust laws have been violated, and will also monitor related litigation and file amicus briefs as necessary."

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.