- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Part 1: Biosimilars to Bring a Bumper Crop of Adalimumab Options

In the first article of a 4-part series, The Center for Biosimilars® offers specifics for each of the adalimumab biosimilar products coming in 2023 and explains why the experience in Europe may differ from what’s coming in the United States.

Readers can also check out part 2, part 3, part 4, podcast 1, and podcast 2 now.

For most of the decade, AbbVie’s Humira (adalimumab) has been the most profitable drug in the world. It took a global pandemic to knock the injectable biologic for inflammatory diseases into second place in 2021, but it still reached $20.7 billion in sales, topped only by Pfizer’s vaccine for COVID-19. In 2018, Humira ranked second on a list of the 25 top-selling drugs of all time, second only to the cholesterol drug Lipitor (atorvastatin), which also launched in 1992.

But Humira’s reign is finally coming to an end in the United States, as biosimilars that reference the blockbuster originator will usher in a new era for the adalimumab market—and, possibly, big changes for providers, patients, and payers.

Despite much of the global biosimilar industry having experience with adalimumab biosimilars, 2023 will signal the official start of the adalimumab biosimilar market in the United States, where AbbVie has been able to use patent legislation and pay-for-delay deals to get biosimilar companies to postpone launch dates.

Now, the wait for adalimumab biosimilar savings is almost over.

This month, The Center for Biosimilars® will look at all aspects of what the launch of adalimumab biosimilars in the US market will mean for stakeholders, from lessons learned in other markets to the need to hear from providers who must decide whether to prescribe new products.

Today, the series, entitled "WHEN CHOICE ARRIVES: Competition & Consequences," examines new products that are coming in 2023, how products differ from each other, and what lessons can be gained from the European experience with adalimumab biosimilars.

FDA-Approved Biosimilars

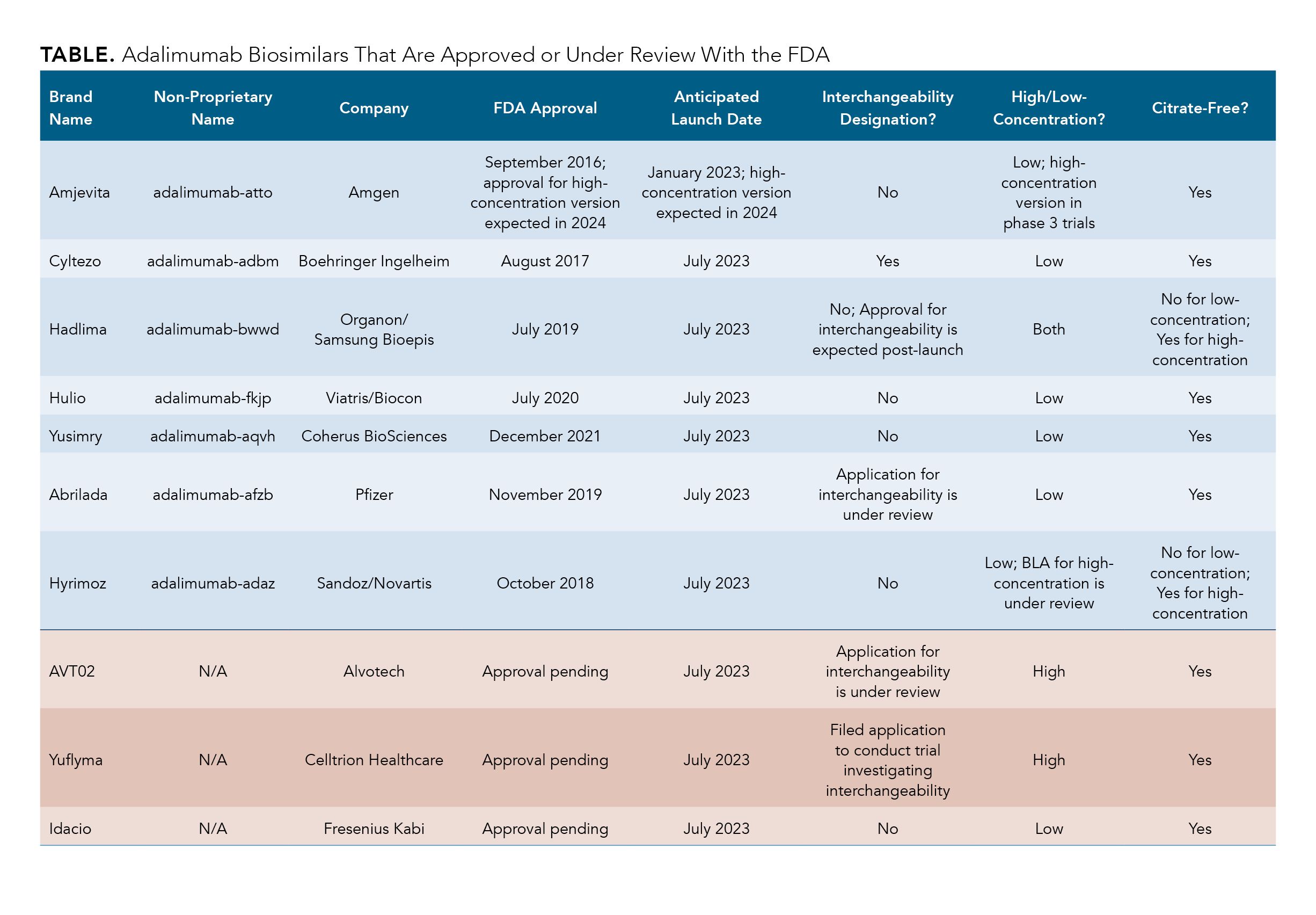

Currently, there are 7 FDA-approved adalimumab biosimilars waiting to enter the US market, all of which are currently available in the European Union; most are also accessible in Canada and the United Kingdom (Table).

Updated as of September 6, 2022. Click to enlarge

The first adalimumab biosimilar expected to enter the market is Amjevita (adalimumab-atto), which will launch in January 2023. Amjevita, developed by Amgen, was also the first adalimumab biosimilar to receive FDA approval in September 2016.

Following Amjevita, 5 other adalimumab biosimilars are set to launch in early July 2023, including Cyltezo (adalimumab-adbm), Hadlima (adalimumab-bwwd), Hulio (adalimumab-fkjp), Hyrimoz (adalimumab-adaz), and Yusimry (adalimumab-aqvh). Cyltezo is a Boehringer Ingelheim biosimilar, and Yusimry was created by Coherus Biosciences. Cyltezo received FDA approval August 2017, and Yusimry was approved in December 2021.

Hadlima and Hulio are part of commercialization agreements, wherein the company that developed the biosimilar has made an agreement with another company to market the drug in the United States. Hadlima was developed by Samsung Bioepis and will be marketed by Organon, a Merck spinoff, and Hulio was developed by Fujifilm Kyowa Kirin and will be marketed by Mylan, a company under the Viatris brand. Hulio was approved in July 2020. The low-concentration formulation of Hadlima was approved in July 2019 and the high-concentration formulation (Hadlima HCF) was approved in August 2022. Hyrimoz is a product of Sandoz, a subsidiary of Novartis, and was approved in October 2018.

But Wait, There’s More!

Currently, biologics license applications (BLAs) for FDA approval are under review for 3 biosimilars. Additionally, the FDA is reviewing BLAs for high-concentration versions of 1 biosimilars that have already been approved in a low-concentration formulation. (See below for a discussion of the differences between high- and low-concentration formulations.)

AVT02, Alvotech’s biosimilar candidate for adalimumab, is expected to be approved by the end of 2022 and is anticipated to launch in July 2023. AVT02 is unique in that the FDA is considering applications for approval and interchangeability at the same time. Celltrion Healthcare’s adalimumab biosimilar, Yuflyma, is also expected to launch in July 2023. A decision on FDA approval is expected by the end of 2022.

Lastly, the BLA for Idacio, Fresenius Kabi’s candidate, is projected to be approved during the fourth quarter of 2022, in time for its planned July 2023 market introduction.

A BLA for the high-concentration formulations (100 mg/ml) of Hyrimoz is under review, and a high-concentration formulation of Amjevita is currently being tested in phase 3 trials.

High-Concentration vs Low-Concentration and Citrate-Free

One of the key features among adalimumab biosimilars is the concentration of the product. High-concentration formulations allow for patients to receive fewer doses of adalimumab compared with low-concentration formulations.

Currently, Humira and Hadlima are the only adalimumab products that have a high-concentration formulation approved by the FDA. Although high-concentration and low-concentration versions of Humira are available on the US market, over 80% of prescriptions are for the high-concentration solution.

Of the biosimilars that have BLAs under review, the ones for AVT02 and Yuflyma are for both high- and low-concentration formulations. For Idacio, approval is only being considered for a low-concentration formulation.

Another important factor to consider is whether a product is free of citrate. Citrate-free formulations allow for patients to experience less injection site pain and the use of a smaller needle during adalimumab administration. Out of all the adalimumab products approved or being considered by the FDA, only Hyrimoz and the low-concentration version of Hadlima will not have a citrate-free option when they enter the market. When Hadlima HCF launches, it will be citrate-free.

What’s Interchangeability and Which Products Have It?

Interchangeability is a regulatory designation unique to the United States. A biosimilar that is deemed interchangeable, such as medications for rheumatic conditions or diabetes, can be distributed at the pharmacy level instead of the reference product without requiring the pharmacist to first receive permission from a physician. Interchangeability allows for patients to have easier access to biosimilars by shortening the time that it takes for pharmacists to get approval to supply biosimilars to patients.

To receive an interchangeable designation, biosimilar manufacturers must spend extra time and money to fund additional clinical trials, during which patients will be switched back and forth from the reference product to the biosimilar at least 3 times to establish that switching is safe and does not impact clinical outcomes.

Although the concept of interchangeability has been around for a while, only 3 biosimilars have been given the designation: Semglee (insulin glargine), Cimerli (ranibizumab), and Cyltezo (adalimumab). Semglee is the only one currently on the US market. Cimerli is expected to launch in October 2022.

The companies behind Hadlima, Abrilada, and AVT02 have expressed that they will seek interchangeability for their adalimumab biosimilars; the latter 2 of the 3 currently have BLAs for interchangeability being considered by the FDA.

A big concern surrounding the designation is that interchangeable biosimilars may be viewed as superior to biosimilars that do not have interchangeability designation. Interchangeable biosimilar are not better or safer than any other biosimilars for the same originator. The designation only means that switching studies have been conducted and that it can be supplied more easily to patients.

Can the US Look to Europe to Help Prepare?

The European Union and the United Kingdom have used biosimilars a decade longer than the United States and, as a result, have become major subjects of study on how to manage growing biosimilar markets, generate health care savings, instill competition and innovation, and collect real-world data. However, there are differences to consider when looking at adalimumab biosimilar experiences in Europe.

The European Union has 10 adalimumab biosimilars authorized for marketing, all of which have been made available to patients shortly after approval. The first to hit the market was in 2017 (Amgevita). Although analyzing strategies in Europe can be helpful for American stakeholders, unlike the United States, Europe had adalimumab products launch over several years, making it more difficult to discern how the US adalimumab market will be impacted by the introduction of many biosimilars over a short period of time.

Additionally, the European Union does not have interchangeability designations. Biosimilars offered at the pharmacy level can be substituted for a reference product without having to get permission from a physician, and clinical outcomes have not suffered as a result.1

Another consideration is that most European countries have nationalized health care, meaning that savings related to competitive pricing for biosimilars do not affect patients in Europe the same way they do patients in the United States. US health systems have to deal with payers and pharmacy benefit managers making decisions for formulary lists, opportunities for rebates and reimbursements, and efforts to combat misinformation on biosimilars—all of which are topics that will be discussed in future installments of this series.

Even though Europe can aid in predictions on how the US biosimilar industry will evolve over time and could offer some insights on the US market in the future, Europe doesn’t have, nor should it be expected to have, all the answers. The world of biosimilars has changed significantly since they arrived in Europe. Although there is much the United States can glean from the experience abroad, there’s only so much it can learn to prepare for the adalimumab boom.

Reference

La Noce A, Ernst M. Switching from reference to biosimilar products: an overview of the European approach and real-world experience so far. EMJ. 2018;3(3):74-81.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.