- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Part 2: Unlocking the Potential of Biosimilars to Improve Health Equity

Part 2 of this series dives into the health care system, revealing financial hurdles that limit biosimilar access and ultimately hinder health equity.

Health Equity Chart | Image Credit: leowolfert - stock.adobe.com

In the second and final part of this series installment by The Center for Biosimilars®, the role of payers, pharmacy benefit managers (PBMs), and the financial incentives that influence prescription choices are addressed as obstacles towards affordable biosimilar treatments, specifically among underserved communities.

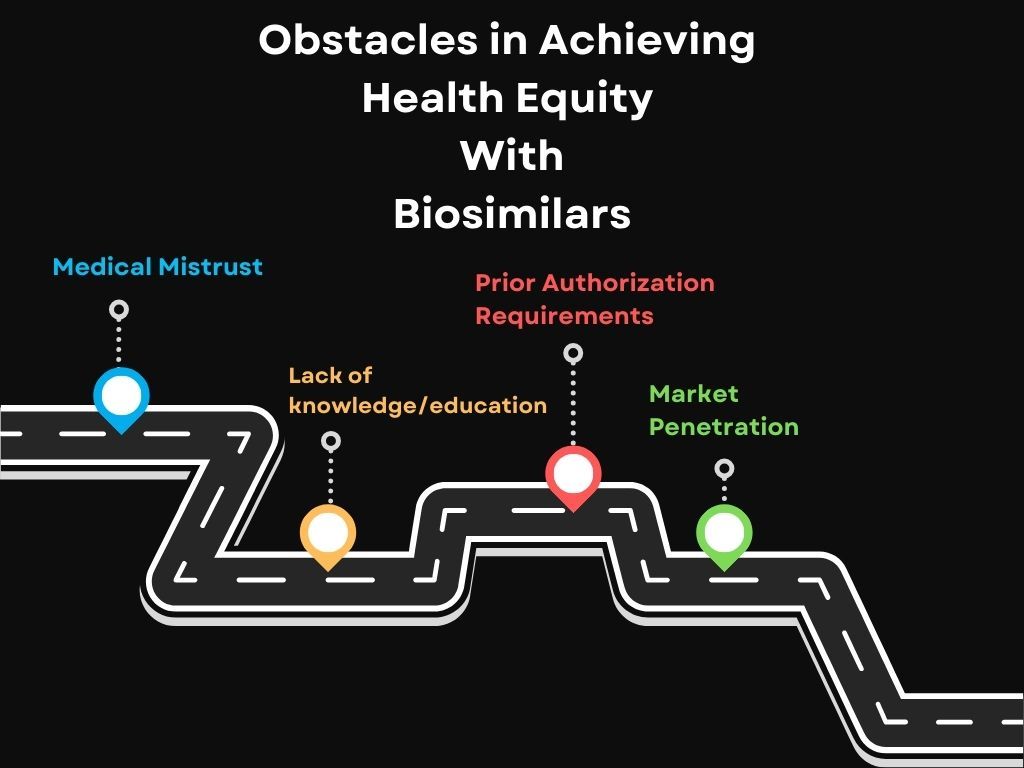

The first part of the series, titled "Part 1: Unlocking the Potential of Biosimilars to Improve Health Equity”, highlighted the medical mistrust that underserved communities have towards health care systems and professionals. Solutions to this issue included further education among patients and physicians to attempt to close knowledge gaps while gaining trust from patients.

Part 2 shifts focus onto the professional health care systems that may be imposing boundaries towards biosimilar access through a financial lens. We will continue to investigate why biosimilars are not achieving the market adoption they deserve.

Biosimilars have the potential to increase patient access to life-saving medications at lower costs but barriers from pharmacy, physician, and insurance groups limit patient access to health equity, especially for underserved communities.

Pharmacies, Physicians, and Insurance Groups

Biosimilar barriers, often perpetrated by insurance companies, affect pharmacies and physicians as well pharmacy benefit managers, health care providers, and policymakers. Prescription drug insurance benefits are usually negotiated by managed care organizations (MCOs), integrated delivery networks, and PBMs. Research found both medical and pharmacy benefits were usually managed by MCOs or PBMs (91.7%). These high-level roles offer physician practices and institutions financial incentives, awarded to them when more expensive originator biologics are prescribed over biosimilars.1

In order to understand the limited uptake of biosimilars, the 340B Drug Pricing Program must be addressed. In 1992, Congress introduced the 340B Drug Pricing Program, allowing pharmaceutical manufacturers participating in Medicare and Medicaid Part B programs to begin a contract relationship with the Secretary of Health and Human Services.2 The program requires participants to apply discounts on covered outpatient drugs when purchased by specific covered entities. Covered entities include some disproportionate share hospitals, children’s hospitals, rural hospitals, critical access hospitals, rural referral centers, sole community hospitals, and free-standing cancer hospitals. However, the 340B program has quickly turned into disadvantages for patients and manufacturers, leaving insurance companies reaping all the benefits.

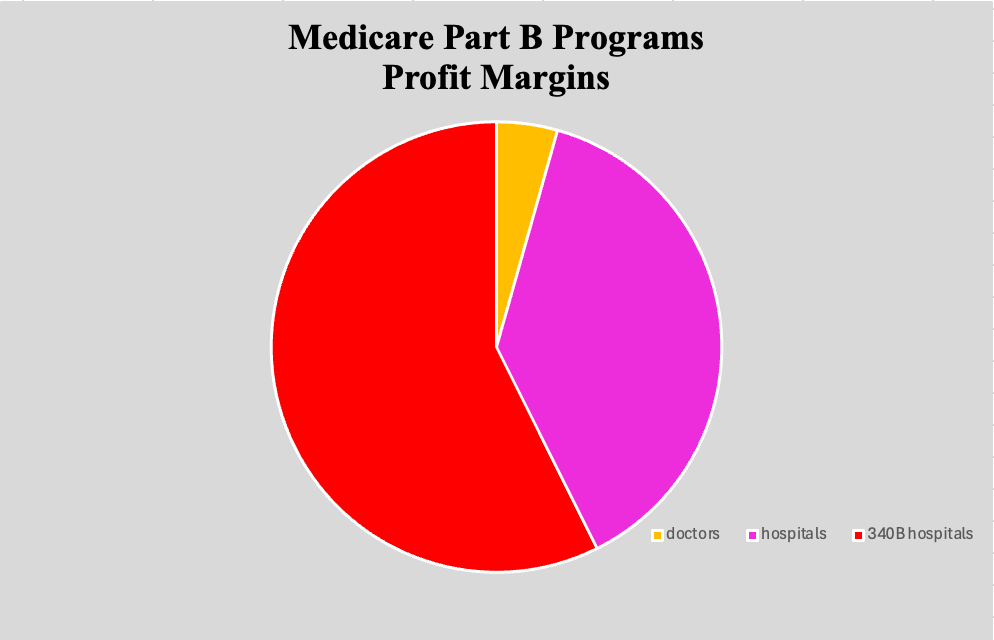

Under Medicare Part B programs, drug costs are unevenly allocated among doctors and 340B participating hospitals. Where doctors typically see a 16% profit margin and hospitals make an average of 140% profit, 340B hospitals make around 210% of a profit.3 This furthers the notion that profit margins seem to be a greater focus than people in these health care systems. Commercial insurance contracts and steep discounts are likely to blame for these significant differences in profit. These policies are standing in the way of patient cost savings, allowing providers to profit from contract rebates that favor more expensive products while preventing savings from being directly passed down to patients.

Pie graph representing profit margins of doctors, hospitals, and 340B hospitals. Source: American Hospital Association

Payer-created prior authorization requirements also affect the timely treatment that could be offered to patients. As a result, patients may not feel biosimilars are worth it if they must depend on slow moving prior authorizations. As patients wait days or weeks for approval, their condition could exacerbate.

The lack of biosimilar knowledge or education among physicians does not help with uptake among patients either. Countless survey studies found evidence that physician and patient knowledge of biosimilars is insufficient, likely because they are not entirely familiar with the biosimilar regulatory approval process.4 While innovator biologics rely on clinical data to establish safety and efficacy of the innovator product, the development of biosimilars has limited reliance when compared with the biosimilar and innovator. The oncology space is likely being impacted by these concerns since recently approved cancer treatment biosimilars are not receiving adoption as fast as supportive care biosimilars have.

Additionally, biosimilar development includes the idea of extrapolation of indications, where studies utilize a patient population more sensitive to attempt to find clinically meaningful differences between the originator and biosimilar products. This allows comparative clinical studies to be waived for each indication approved for the innovator product. Many oncologists and gastroenterologists have expressed concerns over the extrapolation of indications, as well as clinicians across medical specialties.

Overall, strict mandates remove patient choice and can leave them focused on negative assumptions about biosimilars that could amplify or misattribute symptoms. These restrictions must be further researched to identify PBM price negotiations that result in patient access to expensive biologic treatment therapies.

Common obstacles patients and physicians face when attempting to achieve health equity through biosimilar access.

Closing the Gaps

Payers and PBM policies that favor more expensive reference products affect the accessibility and affordability of biosimilars, blocking biosimilars from being able to help achieve health equity. To address these systemic issues, all stakeholders will need to take action to help ensure access to biosimilar treatments.

Robert Popovian, PharmD, MS, a health economist and founder of Conquest Advisors, said in an interview with The Center for Biosimilars regarding current solutions, “We have done some policy work to shape the [biosimilar] environment but it's not enough. As you see, there's a significant struggle that the Humira biosimilars are having with regards to market penetration.”

When adalimumab (Humira) biosimilars hit the market in 2023, the assumption was competition among various similar biologic drugs would drive down prices.6 For some companies, this has been the case after choosing a dual-pricing strategy that launched the adalimumab biosimilars at 2 wholesale acquisition costs (WACs) or those that launched both branded and unbranded biosimilars at different price points.7 The idea was to ensure companies could convince PBMs to add their products on formularies (high WAC) while allowing patients without insurance to access the product at an affordable price (low WAC).

However, adalimumab biosimilars and the reference product do not guarantee cheaper costs. While some adalimumab biosimilars have steep discounts from the current price of the reference product, they are often more expensive than the originator. When the drug cost is more expensive for patients, PBMs receive a larger profit because they are awarded a portion of the drug’s list price.6

A lot of adalimumab biosimilars are priced significantly lower than Humira, and some companies have launched their biosimilars with 2 wholesale acquisition costs. However, if payers and PBMs aren't willing to add these medications to formularies, the savings won't get passed to the patients.

Pharmacy benefit managers need to be more transparent about their role, negotiation processes, and disclosure of rebate retentions to build trust from stakeholders, health care providers, and policymakers.

The “big 3” PBMs (Express Scripts, OptumRx, and CVS Caremark) all have adalimumab biosimilars listed on the high-list price formularies.5 Market penetration can take years to show effective results so the issue surrounding adalimumab biosimilars should be addressed as soon as possible to ensure cost effectiveness later down the line and promote health equity. Samsung Bioepis reported a 53% market share after the first 3 years of the initial launch of an adalimumab biosimilar but found uptake speed differed overall among treatment spaces.8

Across other companies, the uptake of biosimilars over the past 3 years ranged from 8% for drugs like insulin lispro to 82% for bevacizumab.9 Near the end of 2023, adalimumab biosimilars reached only 2% of market volume. It is possible the reason for low adoption rates is based on the contracts the originators have with insurers, as well as the formulary differences of the citrate-free high potency form of the originator.

Step therapy, also known as health plan-imposed coverage exclusions, play a role in restricting access to biosimilars for patients in need. Ironically, biologics generate an average of $120 billion in drug net spending and 93% of the overall growth in total drug spending for 10 years. However, biologics account for only 2% of all patient prescriptions.

In a database analysis, 19.4% of biosimilars were restrictedly covered compared with their reference products.5 The study focused on a total of 17 health plans and found 6 plans had step therapy restrictions on biosimilars for less than 10% of all coverage decisions and 5 plans restricted biosimilars for more than 30% of all coverage decisions offered. Results found more restrictions on biosimilars if they were for diseases that had prevalence greater than 1,000,000 patients in the US. However, less restrictions were placed on biosimilars that could generate savings greater than $15,000.

The idea of penetrating health care providers with policy changes may seem impossible. However, in some instances, it has already been done and shown success. Kaiser Permanente, a large-scale insurer, has removed what most experts find to be a major issue in biosimilar uptake, known as rebate contracting.5

Popovian commented, “Kaiser Permanente has made it possible to negotiate with pharmaceutical companies without using rebate contracting, proving it is possible. The insurer can gain all the savings upfront and pass it on to patients from an out-of-pocket cost perspective without using a PBM to negotiate contracts.”

The only downside to this solution is the decision to remove contract rebates lies in the hands of PBMs, which are unlikely to go along with these changes.

To combat this issue, Popovian suggested to, “delink the fees from the price of the medicine, that means to create a flat fee for any kind of services that the PBM may provide.” Another possible solution surrounds addressing benefit design for biopharmaceuticals, leaving patients unaware of the drug costs in generics and brands because it is a flat rate.

Fortunately, legislature is arising as a possible solution, suggesting portions of rebate savings to be passed through payers or patients in favor of underserved communities.

Ha Kung Wong, JD, an intellectual property attorney and partner at Venable LLP, spoke to The Center for Biosimilars on government policy, stating “[Congress] could eliminate the separate categories of biosimilar and interchangeable [products] to eliminate confusion for patients and prescribers and to allow for automatic substitution at the pharmacy level.”

Wong goes on to explain how effective this process was in Europe and how it could potentially “provide better awareness and better avenues for biosimilars to be listed higher up in insurance formularies such that patients will have access to better coverage for biosimilars.”

These examples provide evidence that policies surrounding biosimilars in the health care space can and should be changed to unlock their full potential.

In an interview, Chiara Gasteiger, PhD, of Stanford University’s Mind and Body Lab researching as a postdoctoral scholar, suggested that to combat trust issues among patients, providers, and physicians “there needs to be more transparency on the role of PBMs, their negotiation processes and disclosure of rebate retentions to build trust and understanding from stakeholders, health care providers and policymakers. Existing regulations should also ensure that PBMs comply with laws that protect patients and encourage fair pricing.”

Aside from financial and political challenges, biosimilar education remains a barrier to uptake. With some health care providers still not confident in their knowledge about biosimilars, patients are less likely to have access to these medications. Without access, biosimilars can’t aid in the fight to achieve health equity.

“More education, such as on testing and manufacturing, needs to be integrated into medical training curriculums and all providers should have access to comprehensive training programs that are regularly updated with new designations, guidelines, and policies,” Gasteiger suggested.

In addition, the introduction of electronic health records allows real time data to be exchanged among health care teams, payers, and providers because prior authorization requirements often influence timely treatment among patients. Gasteiger stressed the importance of these groups attempting to collaborate to share resources, improve ongoing communication about prior authorization, and streamline processes. The reduction of administrative complexities to be less frequent and expedited can assist with further uptake and adoption.

Profit exceeds the amount of biosimilars prescribed.

Insurers pose threats towards biosimilar accessibility, often for their own financial benefit, while physicians and pharmacies struggle with the limited power they hold. It is up to all health care stakeholders to work together to create a more accessible health care system and participate in frequent discussions where concerns can be addressed in a supportive environment with evidence-based policies.

Gasteiger commented, “Encouraging more research and providing research grants that enable providers to share experiences with interchangeability may also provide reassurance for some prescribers and help build trust. Research may also help professional medical organizations and other relevant organizations develop consensus statements.”

Low patient awareness and unfavorable perceptions of biosimilars stem from their physicians’ and pharmacies’ lack of awareness. Aside from overall unfamiliarity of biosimilars, providers have the power to transfer their negative expectations to patients. A study found less than 50% of the survey polled patients had heard of biosimilars and among them, 50% worried about the biosimilar being less effective than the innovator and 46% expressed concerns about the biosimilar safety profile.4

A multi-pronged approach that tackles financial incentives, education, and communication is necessary to dismantle these barriers and unlock the full potential of biosimilars for improved patient access and affordability.

Despite offering substantial cost savings and improved access to treatment, particularly for underserved communities, biosimilars face hurdles within the healthcare system. Addressing these challenges through policy changes, increased education for both patients and providers, and improved communication among all stakeholders is essential to unlocking the full potential of biosimilars and expanding access to affordable treatment.

References:

1. Yang J, Blinzler K, Lankin J, et al. Evolving perceptions, utilization, and real-world implementation experiences of oncology monoclonal antibody biosimilars in the USA: Perspectives from both payers and physicians. BioDrugs. 2022;36:71-83. doi:10.1007/s40259-021-00509-3

2. Krishnamurthy B, Kuhlman A. New error-ridden 340B study misses the mark. American Hospital Association. www.aha.org. February 7, 2024. Accessed June 3, 2024. https://www.aha.org/news/blog/2024-02-07-new-error-ridden-340b-study-misses-mark#:~:text=They%20examine%20the%20difference%20between

3. Boccia R, Jacobs I, Popovian R, de Lima Lopes G Jr. Can biosimilars help achieve the goals of US health care reform?. Cancer Manag Res. 2017;9:197-205. doi:10.2147/CMAR.S133442

4. Shubow S, Sun Q, Nguyen Phan AL, et al. Prescriber perspectives on biosimilar adoption and potential role of clinical pharmacology: a workshop summary. Clin Pharmacol Ther. 2023;113(1):37-49. doi:10.1002/cpt.2765

5. Yu T, Jin S, Li C, Chambers JD, Hlavka JP. Factors associated with biosimilar exclusions and step therapy restrictions among US commercial health plans. BioDrugs. 2023;37:531-540. doi:10.1007/s40259-023-00593-7

6. Dashevsky J. The rise of Humira biosimilars and the battle for market share. Healthcare Huddle. January 28, 2024. Accessed June 3, 2024. https://www.healthcarehuddle.com/p/rise-humira-biosimilars-battle-market-share

7. Jeremias S. Happy birthday adalimumab biosimilars: reflecting on the first year of US competition. The Center for Biosimilars. January 31, 2024. Accessed June 17, 2024. https://www.centerforbiosimilars.com/view/happy-birthday-adalimumab-biosimilars-reflecting-on-the-first-year-of-us-competition

8. Jeremias S. Report: varied biosimilar uptake speeds pose missed opportunities for cost savings. The Center for Biosimilars. January 23, 2024. Accessed June 17, 2024. https://www.centerforbiosimilars.com/view/report-varied-biosimilar-uptake-speeds-pose-missed-opportunities-for-cost-savings

9. Jeremias S. Biosimilars account for 23% market share, with wide uptake disparities across molecules. The Center for Biosimilars. May 22, 2024. Accessed June 17, 2024. https://www.centerforbiosimilars.com/view/biosimilars-account-for-23-market-share-with-wide-uptake-disparities-across-molecules

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.