- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

Pfizer Biosimilar Revenues Top $525 Million in Fourth Quarter 2020

Pfizer's investment in biosimilars is starting to pay off, as it now ranks these agents among its top revenue drivers.

Pfizer reported strong biosimilar revenue growth for the fourth quarter of 2020. The company said biosimilar operating income of $525 million for the quarter was up 86% compared with the fourth quarter of 2019. Operating income is what’s left after deducting employee pay, depreciation, cost of goods sold, and other standard expenses.

Pfizer launched 3 biosimilars in the United States last year: rituximab (Ruxience), bevacizumab (Zirabev), and trastuzumab (Trazimera) biosimilars. The company singled these out as major drivers of fourth-quarter revenues.

Average annual expenditures on just the reference drugs for these 3 oncology drugs were $8.6 billion from 2011 to 2016, according to Magellan Rx. A recent pharmaceutical spending survey of its membership by Vizient, a pharmaceutical network manager, ranked rituximab as the third highest drug by amount of spending among its membership.

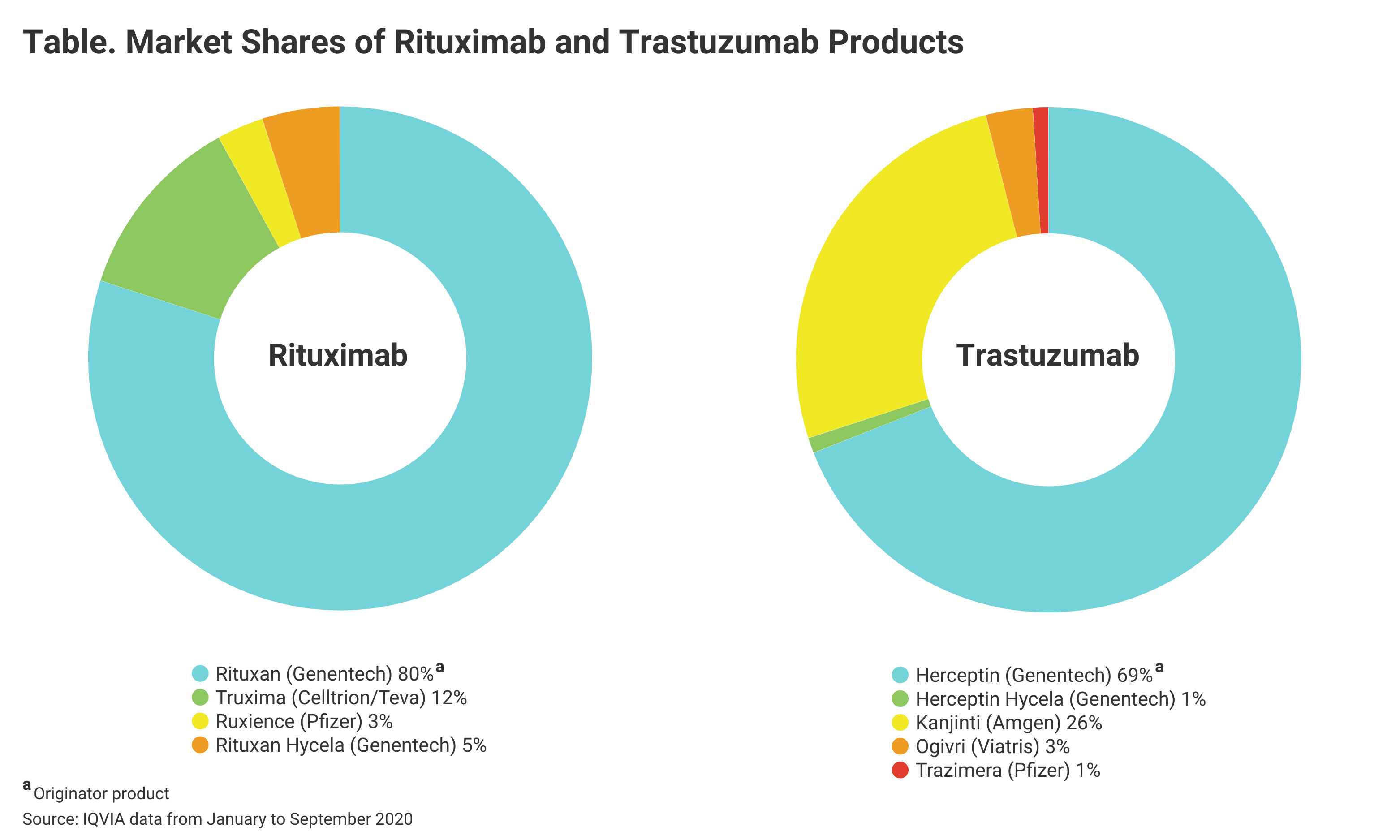

And recent IQVIA information cited by Vizient in its report suggested that Pfizer has a lot of room for profit growth, given the respective market shares of Ruxience and Trazimera, which are relatively small compared with the remaining market shares held by the originator products (Table).

Click to enlarge

Pfizer faces biosimilar competition for its etanercept originator product (Enbrel), but not in the United States, where competing biosimilars are not anticipated until 2029. However, Pfizer noted that overseas biosimilar competition is eroding Enbrel revenues, which were down 18%, “primarily reflecting continued biosimilar competition in most developed Europe markets as well as in Brazil and Japan.”

The Vizient report predicted that Pfizer would significantly increase the price of etanercept in the United States in the coming years as it nears the end of its patent protection.

For all of 2020, Pfizer reported biopharmaceutical revenues of $41.9 billion, up 8% operationally. Primary growth engines, in addition to biosimilars, were Vyndamax (tafamidis) and Vyndaqel (tafamidis meglumine), both oral formulations for the treatment of rare forms of cardiovascular disease.

Pfizer spun off its Upjohn division in November 2020 but retained its biosimilars unit. Upjohn combined with Mylan to form Viatris, which through the Mylan portfolio of products and partnerships is also a biosimilars producer.

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.