- Bone Health

- Immunology

- Hematology

- Respiratory

- Dermatology

- Diabetes

- Gastroenterology

- Neurology

- Oncology

- Ophthalmology

- Rare Disease

- Rheumatology

The Age of Adalimumab Is Upon Us: How Stakeholders Can Prepare

The Center for Biosimilars® provides an updated look on the adalimumab biosimilars that are coming down the US pipeline as well as what stakeholders need to know and how they can prepare ahead of the US launch of 8 adalimumab biosimilars in July 2023.

For most of the decade, AbbVie’s Humira (adalimumab) has been the most profitable drug in the world. It took a global pandemic to knock the injectable biologic for inflammatory diseases into second place in 2021, but it still reached $20.7 billion in sales, topped only by Pfizer’s vaccine for COVID-19.

In 2018, Humira ranked second on a list of the 25 top-selling drugs of all time, second only to the cholesterol drug Lipitor (atorvastatin), which also launched in 1992. But Humira’s reign is finally coming to an end in the United States, as biosimilars that reference the blockbuster originator will usher in a new era for the adalimumab market—and, possibly, big changes for providers, patients, and payers.

Despite much of the global biosimilar industry having experience with adalimumab biosimilars, 2023 will signal the official start of the adalimumab biosimilar market in the United States, where AbbVie has been able to use patent legislation and pay-for-delay deals to get biosimilar companies to postpone launch dates.

Now, the wait for adalimumab biosimilar savings is almost over.

Part 1: Biosimilars to Bring a Bumper Crop of Adalimumab Options

FDA-Approved Biosimilars

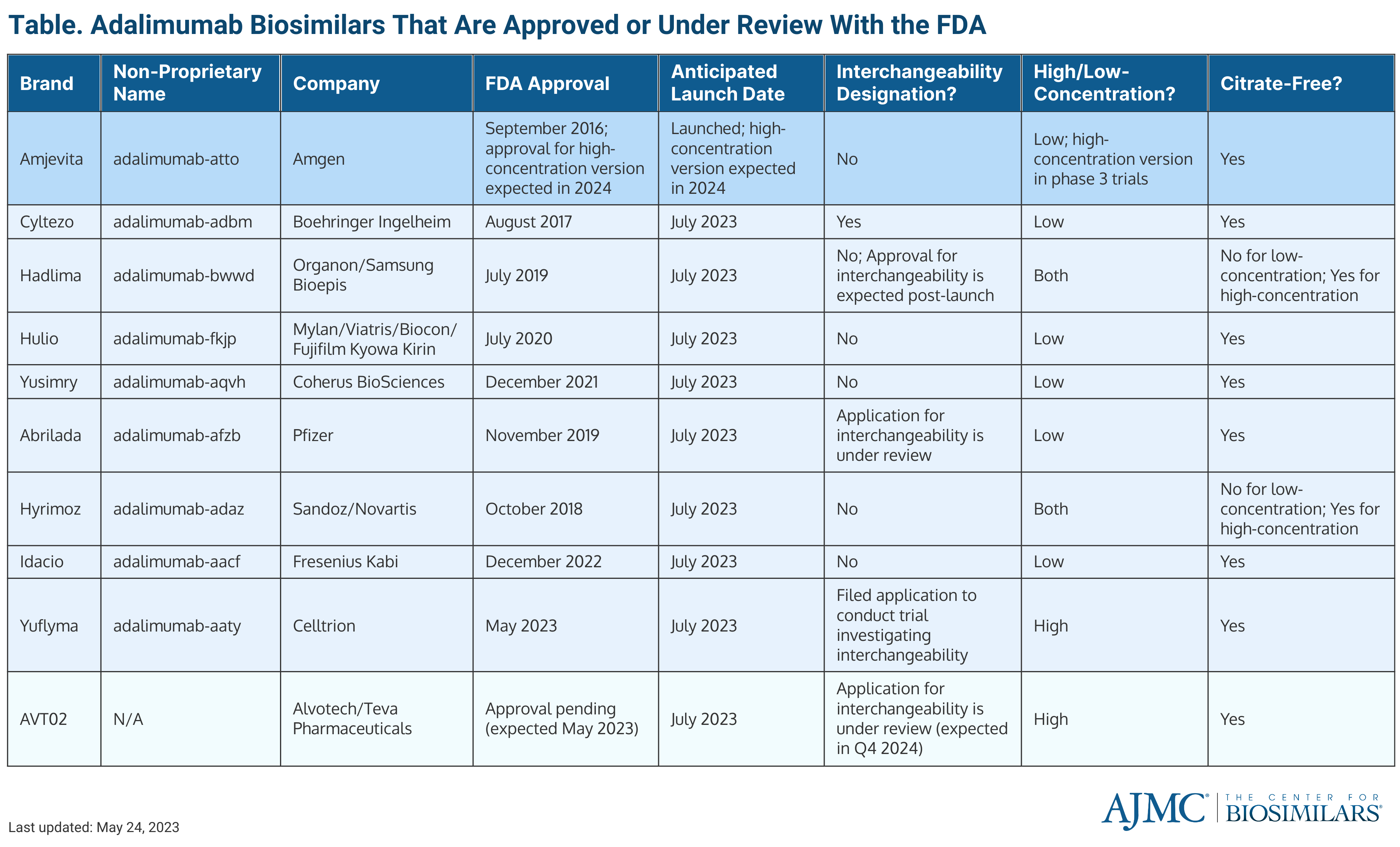

Currently, there are 9 FDA-approved adalimumab biosimilars waiting to enter the US market, all of which are currently available in the European Union; most are also accessible in Canada and the United Kingdom (Table).

Click to enlarge.

As of June 2023, there is 1 adalimumab biosimilar on the US market. The first adalimumab biosimilar to enter the market was Amjevita (adalimumab-atto), which launched in January 2023. Amjevita, developed by Amgen, was also the first adalimumab biosimilar to receive FDA approval in September 2016.

Following Amjevita, 8 other adalimumab biosimilars are set to launch in early July 2023, including Abrilada (adalimumab-afzb), Cyltezo (adalimumab-adbm), Hadlima (adalimumab-bwwd), Hulio (adalimumab-fkjp), Hyrimoz (adalimumab-adaz), Idacio (adalimumab-aacf), Yusimry (adalimumab-aqvh), and Yuflyma (adalimumab-aaty).

Cyltezo is a Boehringer Ingelheim biosimilar, and Yusimry was created by Coherus Biosciences. Cyltezo received FDA approval August 2017, and Yusimry was approved in December 2021.

Hadlima and Hulio are part of commercialization agreements, wherein the company that developed the biosimilar has made an agreement with another company to market the drug in the United States. Hadlima was developed by Samsung Bioepis and will be marketed by Organon, a Merck spinoff, and Hulio was developed by Fujifilm Kyowa Kirin and will be marketed by Mylan, a company under the Viatris brand. Hulio was approved in July 2020. The low-concentration formulation of Hadlima was approved in July 2019 and the high-concentration formulation (Hadlima HCF) was approved in August 2022.

Hyrimoz is a product of Sandoz, a subsidiary of Novartis, and was approved in October 2018. In March 2023, the FDA approved a high-concentration (100 mg/ml) version of Hyrimoz (Hyromoz HCF. Additionally, a high-concentration formulation of Amjevita is currently being tested in phase 3 trials. (See below for a discussion of the differences between high- and low-concentration formulations.)

Idacio, a Fresenius Kabi product, gained approval in December 2022; Yuflyma, developed by Celltrion Healthcare, was approved in May 2023; and Abrilada, developed by Pfizer, was approved in November 2019.

Currently, there is 1 biologics license application (BLA) for an adalimumab biosimilar that is still under review: AVT02, which was developed by Alvotech and will be marketed by Teva Pharmaceuticals. AVT02 is unique in that the FDA is considering applications for approval and interchangeability at the same time.

Alvotech’s original approval decision date was in March 2023. However, FDA has sent the company 2 complete response letters, citing deficiencies in the company’s Iceland-based manufacturing facility during the FDA’s inspections. The agency did not cite any issues in the clinical safety and efficacy data that was submitted in the BLA, and Alvotech has expressed that it will comply with the FDA and continue to pursue US approval for AVT02.

High-Concentration vs Low-Concentration and Citrate-Free

One of the key features among adalimumab biosimilars is the concentration of the product. High-concentration formulations allow patients to inject the drug faster because there is less liquid compared with low-concentration formulations.

Currently, Humira, Hadlima, and Hyrimoz are the only adalimumab products that have a high-concentration formulation approved by the FDA. All 3 products will have a high-concentration and low-concentration version on the market. Although high-concentration and low-concentration versions of Humira are available on the US market, over 80% of prescriptions are for the high-concentration solution.

Both AVT02 and Yuflyma will only be offered in high-concentrations formulations, pending AVT02’s approval.

Another important factor to consider is whether a product is free of citrate. Citrate-free formulations allow for patients to experience less injection site pain and the use of a smaller needle during adalimumab administration. Out of all the adalimumab products approved or being considered by the FDA, only the low-concentration versions of Hyrimoz and Hadlima will not have a citrate-free option when they enter the market. However, the high-concentration versions of the drugs will be citrate-free.

What’s Interchangeability and Which Products Have It?

Interchangeability is a regulatory designation unique to the United States. A biosimilar that is deemed interchangeable, such as medications for rheumatic conditions or diabetes, can be distributed at the pharmacy level instead of the reference product without requiring the pharmacist to first receive permission from a physician. Interchangeability allows for patients to have easier access to biosimilars by shortening the time that it takes for pharmacists to get approval to supply biosimilars to patients.

Additionally, interchangeability designations can help pharmacies by alleviating prior authorization (PA) requirements; the designation prevents patients from waiting long periods for their biosimilar prescription to be approved.

To receive an interchangeable designation—for a biosimilar that is not an insulin product or administered into the retina—biosimilar manufacturers must spend extra time and money to fund additional clinical trials, during which patients will be switched back and forth from the reference product to the biosimilar at least 3 times to establish that switching is safe and does not impact clinical outcomes.

Although the concept of interchangeability has been around for a while, only 4 biosimilars have been given the designation: Semglee (insulin glargine), Cimerli (ranibizumab), Basaglar (insulin glargine), and Cyltezo (adalimumab). All of which have launched in the United States, except Cyltezo.

The companies behind Hadlima, Abrilada, and AVT02 have expressed that they will seek interchangeability for their adalimumab biosimilars; the latter 2 of the 3 currently have BLAs for interchangeability being considered by the FDA. Celltrion has also filed an application to conduct a switching study to obtain interchangeability for Yuflyma.

A big concern surrounding the designation is that interchangeable biosimilars may be viewed as superior to biosimilars that do not have an interchangeability designation. Interchangeable biosimilars are not better or safer than any other biosimilars for the same originator. The designation only means that switching studies have been conducted and that it can be supplied more easily to patients.

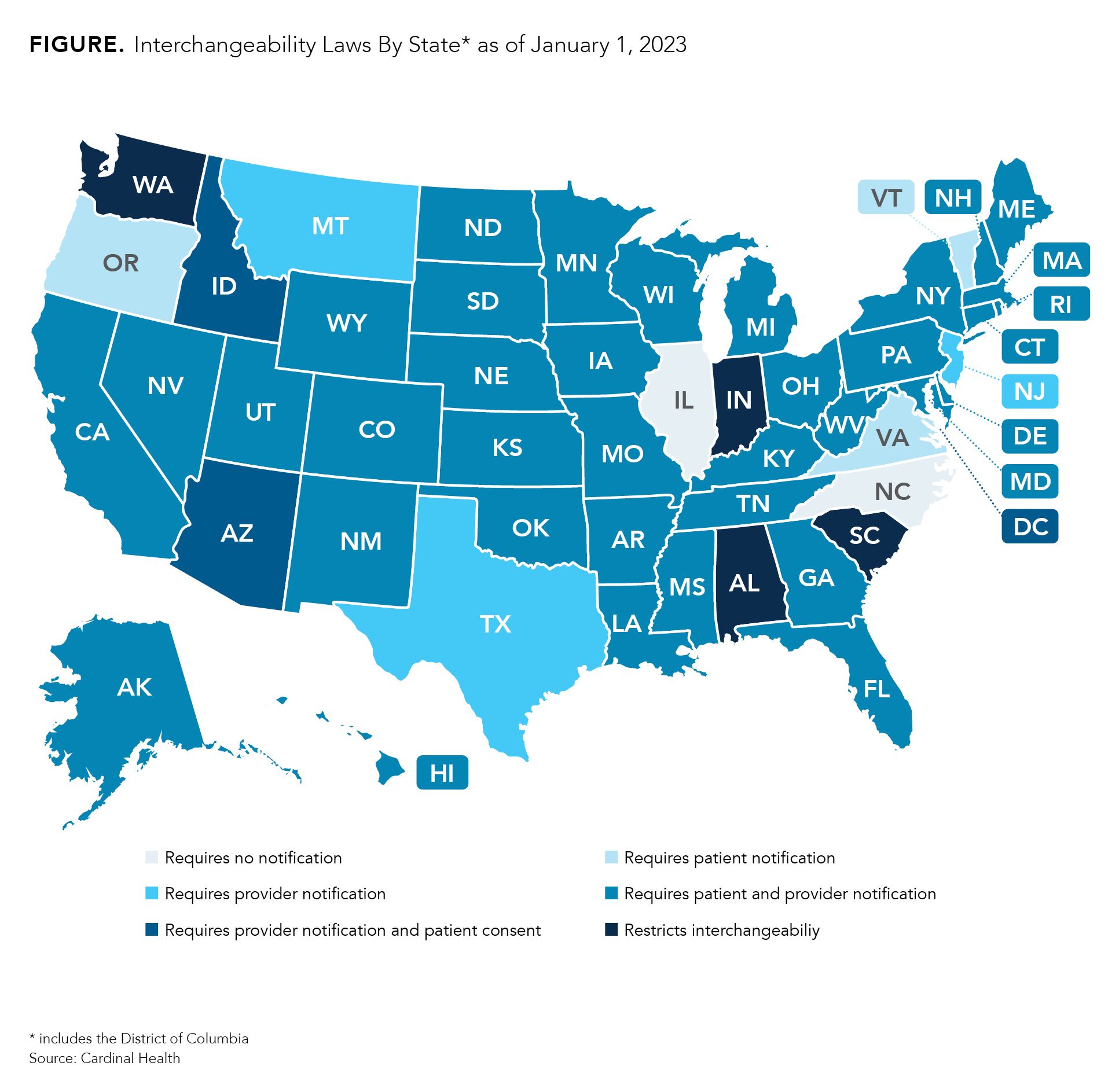

Although the United States doesn’t have much experience with interchangeable biosimilars, every state and the District of Columbia has implemented laws on interchangeability. Most states have passed legislation that requires pharmacists to notify providers and/or patients that an interchangeable biosimilar is substituting for the reference product listed on the prescription (Figure). Every state gives physicians the power to deny substitutions. Many allow for providers to write “dispense as written” or “brand medically necessary” on the prescription.

Click to enlarge.

However, 4 states (South Carolina, Indiana, Alabama, and Washington) have laws that restrict interchangeability, meaning that every prescription must be approved by a physician prior to dispensing regardless of whether the FDA has deemed the product to be interchangeable. Providers may indicate on prescriptions that substitutions are permitted.

Additionally, the laws in Mississippi and Idaho for alerting patients and providers are expected to expire July 1, 2026, and July 1, 2025, respectively. So far, there is no sign that a law will be passed as a replacement.

Those who wish to know more about the specific language in the laws from their state can visit Cardinal Health’s Interchangeability Laws By State report.1

Can the US Look to Europe to Help Prepare?

The European Union and the United Kingdom have used biosimilars a decade longer than the United States and, as a result, have become major subjects of study on how to manage growing biosimilar markets, generate health care savings, instill competition and innovation, and collect real-world data. However, there are differences to consider when looking at adalimumab biosimilar experiences in Europe.

The European Union has 10 adalimumab biosimilars authorized for marketing, all of which have been made available to patients shortly after approval. The first to hit the market was in 2017 (Amgevita). Although analyzing strategies in Europe can be helpful for American stakeholders, unlike the United States, Europe had adalimumab products launch over several years, making it more difficult to discern how the US adalimumab market will be impacted by the introduction of many biosimilars over a short period of time.

Additionally, the European Union does not have interchangeability designations. Biosimilars offered at the pharmacy level can be substituted for a reference product without having to get permission from a physician, and clinical outcomes have not suffered as a result.2

Another consideration is that most European countries have nationalized health care, meaning that savings related to competitive pricing for biosimilars do not affect patients in Europe the same way they do patients in the United States. US health systems have to deal with payers and pharmacy benefit managers making decisions for formulary lists, opportunities for rebates and reimbursements, and efforts to combat misinformation on biosimilars—all of which are topics that are discussed in latter sections of this article.

Even though Europe can aid in predictions on how the US biosimilar industry will evolve over time and could offer some insights on the US market in the future, Europe doesn’t have, nor should it be expected to have, all the answers. The world of biosimilars has changed significantly since they arrived in Europe. Although there is much the United States can glean from the experience abroad, there’s only so much it can learn to prepare for the adalimumab boom.

Part 2: For Patients and Employers, 2023 Means a Changed Landscape

Will Patients See Savings, and How Much Is Expected?

Projections show that adalimumab biosimilars could generate $19.3 billion in savings by 2025, a 50% share of the total amount of savings expected from biosimilars between 2021 and 2025. However, whether those savings will impact patients directly depends on a few things:

- Price discounts of biosimilars and reference products

- Co-payments and co-insurance

- Insurance coverage

As biosimilars enter the market, companies developing these competitors will have to set launch prices, which will likely be considerably lower than Humira. Additionally, AbbVie, the maker of Humira, will also have to determine whether to lower its price for Humira to compete against the biosimilars.

Overall, list price discounts for biosimilars average about 30% to 40% lower than the reference products. However, biosimilars in the US immunology space, such as those referencing Remicade (infliximab) tend to launch at a 19% to 25% discount from the reference product.

In Europe, where 10 adalimumab biosimilars compete against Humira, there’s more hope for biosimilar discounts. One analysis published by The Journal of Pharmaceutical Sciences showed that after the first quarter of 2020, when compared with the Humira’s list price 1 year before biosimilar market entry, adalimumab biosimilars averaged net price reductions from the reference product ranging from 15% to 29% in France to over 50% in Denmark, Germany, Hungary, Italy, Poland, and Sweden.3

Even more impressive, the threat of biosimilar competition has been enough to get AbbVie to lower its price for Humira up to 80% in some international markets.

However, for the first 6 months of biosimilar competition, Humira will only face 1 competitor, making it difficult to tell exactly how much of a price reduction biosimilars will cause in the long run. In July 2023, between 5 and 9 biosimilars are expected to launch. Many biosimilar companies will have less time to gauge the market to determine a launch price.

Additionally, AbbVie has been gradually raising the US price of Humira over the past few years, increasing its wholesale acquisition cost by 7.3% and its net price by 9.6% between 2019 and 2020.

Halfway through 2023, we do have some idea of how companies are approaching the pricing dilemma. When Amgen launched Amgevita, it used a dual-pricing structure, where the drug had 2 list prices (5% and 55% lower than Humira). This strategy was used so that pharmacy benefit managers (PBMs) and payers would be encouraged to put the drug on their formularies but patients without insurance could still obtain the drug for a significant discount from the originator.

Additionally, Coherus Biosciences said that it is partnering with Shark Tank’s Mark Cuban’s online pharmacy (Mark Cuban Cost Plus Drug Company) to offer Yusimry at a list price of $569.27 plus dispensing and shipping fees.

Co-payments and coinsurance can be a tricky field to navigate because they are determined by health insurers, also known as payers. Co-payments, or co-pays, are fixed dollar amounts that patients pay for many prescription drugs and health services such as office visits, and often do not count toward a deductible. Coinsurance costs, which act as a cost sharing measure between patients and payers, are calculated as a percentage of the cost of some medicines and health services that patients must pay after they meet their deductible.

For Medicare beneficiaries, cost sharing gets even more complicated. For most, adalimumab would be covered under Part D, but some beneficiaries may be covered under Part C if they are enrolled in Medicare Advantage or even Part B if they receive treatment in a doctor’s office. Historically, cost sharing varies over the year as out-of-pocket spending hits certain benchmarks.

Assuming prices of adalimumab biosimilars and Humira continue to be lower than the current prices of Humira, patients with plans using coinsurance will likely see lower out-of-pocket costs. Additionally, a report from the ERISA Industry Committee (ERIC), found that US patients who took a covered biosimilar over the reference product paid an average of 12% to 45% ($300 to $600) less out-of-pocket annually than those who took the reference product.

Although efforts have been made to cap co-pay costs for insulin, so far, they only apply to patients enrolled in Medicare Part D plans. The Inflation Reduction Act, signed August 16, 2022, creates a $2000 annual cap on out-of-pocket spending in Part D starting in 2025. Again, this cap does not extend to commercial plans.

Some pharmaceutical companies may offer co-pay assistance programs that can help patients afford medicines and encourage them to maintain loyalty to their drug. However, patients should check with their insurance providers, as some may exclude co-pays paid through patient assistance programs or drug company-issued coupons from counting towards their deductible.4

Additionally, some insurance companies, such as Cigna, have implemented shared savings programs. Cigna, for example, offered patients a $500 debit card to switch to biosimilars. The program was designed to encourage patients to ask for biosimilar versions of expensive originators, saving both the patients and the plans money.

How Will Coverage Work? And Will There Be Changes?

Patients should be aware that their pharmaceutical coverage may change, meaning that patients currently on a therapeutic regimen with Humira may suddenly be given a biosimilar.

Coverage options are dictated by a PBMs, third-party entities that makes decisions on which drugs will be included on formulary lists and which preference tiers they fall on, which correspond with their level of coverage. As a result, every insurance plan may have a different list of adalimumab products that may be covered.

According to Vizient’s Pharmacy Market Outlook Report, plans will cover adalimumab products in 1 of 3 ways: preference for biosimilars, preference for the reference product, or coverage for the reference product and biosimilars at parity (no preference). Patients will not have much of a say in which strategies their plans will implement. Additionally, different plans may have different policies on whether to alert patients or their providers on coverage changes.

So far, 4 PBMs (Optum Rx, Prime Therapeutics, Express Scripts, Smith Rx) have come forward announcing that they will list at least 1 adalimumab biosimilar on their preferred drug lists, with more PBMs expected to follow. Smith Rx has also partnered with the Mark Cuban Cost Plus Drug Company for Yusimry.

However, if patients see that their Humira prescription has changed to another adalimumab product, they should try not to worry. The FDA has some of the strictest guidelines in the world for approving a biosimilar, and every FDA-approved biosimilar has met the agency’s standards.

Multiple studies and reviews have demonstrated the safety of switching from a reference product to a biosimilar. Early studies have also shown that switching from a biosimilar to another biosimilar does not impact clinical outcomes. In many cases, if a patient does experience negative clinical outcomes from the result of a switch, they can talk to their doctor about switching back to the original product.

Employers and patients can also look at international experiences to see how switching from reference products to biosimilars has not disrupted clinical outcomes. Many European countries and Canadian provinces have experience with biosimilar switching, and clinical outcomes have not been compromised as a result.

If a patient wants to save money by using a biosimilar, they should talk with their physician to understand their options.

How Much Can Employers Save and What Can They Do?

Self-insured companies could have saved $407 million in 2018 had they completely ceased use of Remicade (reference infliximab) and Neupogen (reference filgrastim) in favor of biosimilars. Ford Motor has already saved $5 million by switching patients to 5 biosimilars.

Despite how much power PBMs and other health care entities have over coverage options, employers have more power than they realize.

“If we look at the way the health insurance markets are today, they're driven by the employers…. As large employers switch, you have that double effect of one; they're moving a large population toward more-affordable drugs—that is a beneficial impact—but [you also have] the secondary impacts of news stories that come from it and the awareness that those drive other large, as well as smaller, payers towards embracing biosimilars,” said Wayne Winegarden, PhD, senior fellow in business and economics at the Pacific Research Institute (PRI), director of PRI’s Center for Medical Economics and Innovation, and a member of The Center for Biosimilars® Advisory Board, in an interview.

Already, large employers and benefit funds, such as CalPERS, Costco, and Disney, have analyzed how much they were paying for biologic drugs, negotiated with their payers, and have worked hard to drive more patient use of biosimilars and generate savings.

Employers can advocate for policy changes that promote biosimilar use by contacting federal and state legislators to encourage them to support biosimilars legislation, such as the Biosimilars User Fee Amendments of 2022 among others.

In February 2022, the National Alliance of Healthcare Purchaser Coalitions outlined several steps that employers can take to get biosimilars on formulary and improve employee satisfaction. They include:

- Creating an additional tier or preferred reimbursement for biosimilars and reference products or adding biosimilars to the branded tier without having to change cost-sharing or co-pay models

- Ending relationships with PBMs and payers that have spread misconceptions about biosimilars being more expensive and less safe than reference products and search for those that are more transparent

- Include all biosimilars on formulary and offer incentives for their use over reference products

- Explore a precision-medicine model to help patients receive the right treatment on the first try

- Employers may need to be persistent during negotiations, as many biosimilars may be on the medical benefit; this may require more preparatory work to ensure that cost share is lower or nonexistent.

Overall, employers spend around 40% to 50% of their health care costs on specialty medications, including adalimumab. Employers can also work with employer support organizations, such as Employers Health, which helps employers oversee pharmacy plan performance and secure health benefits that can help patients and save them money.

Part 3: How Adalimumab Biosimilars Will Impact Clinicians

Providers

Providers may face challenges to prescribing biosimilars on several fronts. Payers and PBMs will have a big influence on which biosimilars, if any, are accessible to patients. They will act as levers on whether adalimumab biosimilars will be covered and whether they will be preferred over Humira. As has been seen in oncology, payer, and PBM interference in prescribing decisions has long been an issue preventing biosimilar adoption.

PBMs also make decisions on which biosimilars are eligible for rebates and reimbursements, which have been known to shape payer policies and formulary decisions. Rebates, which are determined during negotiations between PBMs and drug companies, help payers save money on drugs. However, they are often greater for reference products and do not result in lower out-of-pocket costs for patients.

Reimbursements, or compensation given to a pharmacy or clinic for using a certain product, are agreed on by PBMs and payers and can impact providers. Again, however, this compensation does not result in lower drug prices for patients but can impact prescribing habits.

The biggest change that providers may see is that their patients’ prescriptions may change, and in some cases, they may not be made aware that a change has occurred.

Payers may not have policies in place to alert physicians that they are no longer covering the reference product or a particular biosimilar. A survey of medical oncologists published in 2022 found that providers were often unaware that their patients had been switched from a reference product to a biosimilar, which the investigators cited as a major ethical issue. Patients who experience a coverage switch may become emotionally distressed, and having a physician that understands why the switch occurred could mitigate patient concerns.

Interchangeability is another consideration. With several adalimumab biosimilars expected to enter the market with an interchangeable designation, pharmacists may switch out a prescribed product for an interchangeable biosimilar without being required to ask a physician for permission.

However, in preparation, most states have passed laws that require pharmacists to inform patients and physicians that a substitution has occurred, and all states give physicians the ability to restrict interchangeability by writing “dispense as written” or “brand medically necessary” on a prescription.

Increased PA requests could place added burdens on providers as well. PA requests have long been a barrier to biosimilar adoption, forcing patients to wait longer periods to receive their medications. According to a survey from the American Medical Association, most providers wait between 1 to 5 days to receive a decision on PA requests from payers.

Providers may also be tasked with supplying information on biosimilars to patients to prepare them for a changed prescription. Providers should make themselves familiar with the adalimumab products coming down the pipeline, the properties that differentiate them from each other, and the clinical evidence establishing the safety of biosimilars and the safety of switching to one. Rheumatologists should also keep up-to-date on any guidances on switching patients safely.

Practice Administrators

Along with keeping up with the launch dates for different adalimumab biosimilars, administrators will need to ensure that clinics are well prepared for the introduction of adalimumab biosimilars, meaning that clinics may have to undergo several policy changes regarding:

- Mitigating stocking and administration complications

- Educating staff and patients on biosimilars and incoming adalimumab products

- Managing medication switches and/or implementing automatic substitution policies

Prior to adalimumab, clinics have had to juggle up to 5 biosimilars for the same reference product (trastuzumab), all of which launched at different times, giving health care facilities more time to add biosimilars without causing much disruption to patient care. However, up to 10 adalimumab biosimilars are expected to launch within the same year, meaning that different strategies may be needed to ensure that biosimilars are managed properly.

Stocking multiple biosimilars for the same reference product is another major concern for practices and pharmacies. Carrying a reference product along with several biosimilars could increase carrying costs. Additionally, biosimilars and reference products may have different storage properties, such as storage temperature requirements, shelf lives, light sensitivity, administration routes, and packaging.5

Labels may also look alike because biosimilars will be listed with the same nonproprietary name as the reference product with different, but sometimes very similar, 4-letter suffixes added on to the end (ex. adalimumab-aqvh, adalimumab-adaz, adalimumab-adbm), which could create confusion and potentially lead to accidental administration of the wrong product or a product not covered by a patient’s insurance, creating additional costs and billing issues for the practice.

Clinic administrators may be tasked with curating biosimilar education materials for patients and other clinicians if they do not have them already. Administration teams could develop their own materials or collect existing materials. Notably, FDA has already warned 1 company about its education materials.

Administrators will also need to consider how to handle switches to biosimilars. In addition to formulary changes causing patients to receive different medications than they have received previously, clinics will have an opportunity to make biosimilars—and the savings that come with them—more accessible to patients by implementing automatic substitution policies.

Automatic substitutions, also known as therapeutic interchange, have been shown to increase biosimilar adoption and cut costs within oncology practices. These policies would enable pharmacists to substitute biosimilars for the reference product automatically without having to wait for a physician to approve it. Automatic substitution can act as a practice-level policy for interchangeability.

Three adalimumab biosimilars are expected to launch with an interchangeability designation (Approved: Cyltezo; Under review: Abrilada, AVT02, and 2 others are expected to have this designation sometime after launching (Hadlima, Yuflyma). However, relying on interchangeability designations could restrict patient access to 5 other options, or in the states with laws completely restricting interchangeability. Administrators can stay up to date with their state’s interchangeability laws by visiting, Cardinal Health’s Interchangeability Laws By State report.

Nurses

Nurses can play a key role in helping patients gain comfort with adalimumab biosimilars. Patients may be wary about their prescriptions suddenly changing and nervous about what changing prescriptions could mean for their out-of-pocket costs and management of their conditions.

Whereas physicians will be responsible for managing prescription changes, nurses will be tasked with directly managing switches. Nurses are already highly familiar with administering medicines and managing and reporting adverse events, but they can also counsel and monitor patients, aid in maintaining patient adherence, and help develop guidances.

Studies have shown that nurses can also have a direct impact on helping to mitigate the nocebo effect from occurring by educating patients and increasing their confidence in the safety and efficacy of adalimumab biosimilars.

However, education for nurses is often ad hoc and incomplete, leaving many unaware of the differences between biosimilars and their references products. Nurses may not be fully briefed on certain aspects, such as interchangeability or pharmacovigilance.

Nurses should make themselves aware of what biosimilars are, how they differ from reference biologics, the safety of biosimilars, the safety of switching, and the rigorous approval process that each biosimilar has gone through to be FDA-approved to ensure that patients do not experience emotional distress from having their prescriptions change.

Additionally, there are some nurse-targeted guidances that address how to ensure that patients are switched from a reference product to a biosimilar safety, including the guidance developed by the European Specialist Nurses Organisation.

Overall, nurses will be the clinicians administering these biosimilars, and nurses, in addition to the patient, need to have confidence in what they are giving their patients.

Pharmacists

A paper published in Exploratory Research in Clinical and Social Pharmacy outlined several steps that clinical pharmacists can take to promote biosimilar utilization:6

- Weighing in on formulary decisions and encouraging the addition of biosimilars

- Assessing the credibility and reliability of biosimilar suppliers

- Conducting literature searches on the use of biosimilars in other health care facilities

- Conducting clinical trials to demonstrate comparable effects of biosimilars compared to reference products as part of a multidisciplinary team

- Directly managing the storage and dispensing of biosimilars

- Providing education to all health care stakeholders and policymakers

Additionally, clinical pharmacists can aid in the mission to improve patient confidence and acceptance of adalimumab biosimilars. A study published in Joint Bone Spine found that patients who had a consultation with a clinical pharmacist about biosimilars prior to meeting with a rheumatologist were significantly more likely to opt for a biosimilar over a reference product.

Pharmacists benefit from having a comprehensive understanding of the managed care landscape, making them well positioned to serve as champions for biosimilar use and driving adoption. Clinical pharmacists can also partner with physicians to develop efforts that can encourage adoption.

Pharmacists can advocate to administrators and other colleagues to support automatic substitution policies and advocate for health care reform. One pharmacist wrote to the editor of the Journal of Managed Care & Specialty Pharmacy, calling for pharmacists to speak out about the effect that health care reform proposals have on patient access to pharmaceuticals.

Finally, as medication experts, pharmacists can help lead education efforts and monitor the biosimilar pipeline for providers and other members of the health care team. Pharmacists can act as a source of truth and education to help develop confidence in biosimilars across the health care landscape.

The Monumental Task of Stakeholder Education

When it comes to the potential clinical and economic success of adalimumab biosimilars, education amongst all clinicians may become the first line of defense as all clinicians can ensure that patients are adequately educated on biosimilars. Patient education that is not sponsored by a drug company can be critical to ensuring that patients are accepting of biosimilars, clinical outcomes are maintained, and out-of-pocket costs decrease.

As mentioned above, patient education can help prevent the nocebo effect, which has been known to be the most common reason for patients with inflammatory bowel disease switching back to the reference product after being switched to a biosimilar, accounting for 75% of reverse switching cases.

To ensure that patient education is effective, education materials should be objective and clearly not developed by a pharmaceutical partner that is promoting their own product. Clinicians and patients need to have discussions surrounding all the patients’ treatment options to ensure that patients are receiving the best possible care.

Additionally, clinicians themselves may need to have more biosimilar education, and education materials may need to be targeted differently between physicians, nurses, pharmacists, and administrators. One paper on the current state of provider education on biosimilars concluded that, “Education initiatives aimed at improving understanding of biosimilars should be viewed as the responsibility of all stakeholders in healthcare…While coordination across all these diverse groups is hardly feasible, cooperation and collaboration are encouraged whenever possible.”7

Increasing biosimilar education materials aimed at clinicians is a common strategy to improving provider confidence in the safety and efficacy of biosimilars. Some experts have said that provider education is the first step towards instilling patient confidence in biosimilars. However, a 2020 survey found that existing educational resources may not be adequately reaching clinicians.

Clinicians may have to search out biosimilar material if it is not already made available to them. A great introduction to the world of adalimumab biosimilars is to know what’s already approved and what’s coming.

Another place to go is the FDA website, which has an entire page with videos, infographics, fact sheets, and stakeholder toolkits for health care providers to learn about biosimilars. The International Generic and Biosimilar Medicines Association (IGBA) also has an education website promoting awareness of biosimilar products.

Another resource is the provider guidance created by Canadian rheumatology experts in 2020, which includes helpful tips for getting patients on board and comfortable with the idea of switching from a reference product to a biosimilar.

Additionally, clinicians can keep up to date with the latest clinical and real-world data that is constantly emerging about biosimilars, as well as the international data on the safety and efficacy of switching from Humira to adalimumab biosimilars. Administrators can also develop and curate biosimilar educational materials, such as pamphlets or packets, that can easily be distributed to other clinicians and patients.

Pharmacists should learn the nuances of adalimumab biosimilars, such as brand names, labels, concentrations, administration devices, interchangeability statuses, and which versions contain citrate, so as to ensure that patients are being distributed the correct product.

When it comes to the influx of adalimumab biosimilars coming, everyone in the clinic setting will have to do their part to make sure that savings are achieved and that patients are prepared.

Part 4: How Payers Can Prepare for Adalimumab Biosimilars

Formulary Placement and Tiers

According to Vizient’s 2022 Pharmacy Market Outlook report, when adalimumab biosimilars arrive in the US market, payers will structure formulary lists using 1 of 3 strategies: preferring Humira, preferring at least 1 biosimilar, or covering the biosimilar(s) and reference product at parity.

Some industry experts have called for a parity approach, which could allow for providers to pick the right product for their patients based on price, availability, and patient preference. Others have argued that preferring biosimilars is the best way to ensure biosimilar utilization and savings for all stakeholders.

Regardless of which strategy would be best for instilling market competition and generating savings, either may be more economically beneficial than prioritizing the reference product. According to a 2020 survey from the Center for the Evaluation of Value and Risk in Health at Tufts Medical Center, US health plans granted preferred status to biosimilars in only 14% of coverage decisions. Additionally, in rheumatology, 65% and 59% preferred reference infliximab (Remicade) over biosimilars Renflexis and Inflectra, respectively.

However, a report from the HHS Office of Inspector General found that Medicare Part D plans alone missed out on between $84 million and $143 million in savings during 2019 by prioritizing reference products over biosimilars. Additionally, Health New England, a nonprofit payer in Massachusetts, saved $1.7 million in a single year by reaching 93% utilization of infliximab biosimilars.

To achieve full benefits, payers are encouraged to evaluate which strategy is best for their organization, taking into account the needs of their practices and beneficiaries. Payers should also work with their PBMs to advocate for biosimilars. In some cases, payers may need to end relationships with current PBMs and form relationships with new ones to ensure that biosimilars can save payers money—and that employers don’t switch to another payer.

Payers may wish to re-examine formulary tiers and other savings programs to promote biosimilars. In 2021, the Association for Accessible Medicines recommended that payers such as Medicare Part D plans should include a dedicated specialty tier for generics and biosimilars, increase add-on payments to providers who use biosimilars (average sales price plus 8% vs 6%), and create a shared savings program to encourage biosimilar adoption.

Additionally, payers should keep in mind that if they restrict access to biosimilars and biosimilar savings, policymakers, such as the state legislators in Minnesota, may introduce legislation to override payer preferences by requiring coverage for all biosimilars.

Another consideration for formulary placement will be interchangeability status. Up to 5 adalimumab biosimilars are expected to have an interchangeability designation. Until these biosimilars launch with interchangeability, the list prices for interchangeable biosimilars as well as their discounts compared to Humira and other biosimilars will remain unknown.

Payers may want to consider not restricting formulary placement to adalimumab biosimilars with interchangeability as it may limit competition in the market, which will impact adoption rates, potentially giving rise to misunderstandings about what interchangeability designations mean. Prioritizing interchangeable adalimumab biosimilars over other adalimumab biosimilars could limit savings for payers as well as the rest of the health care system.

In addition, payers should remember that most adalimumab biosimilars, including new versions with interchangeability or high-concentration formulations, will launch throughout the second half of 2023 and beyond. Payers who wish to add adalimumab biosimilars to formulary and want to generate the most savings possible should ensure that their formulary modification policies are updated so that biosimilars can be added as soon as they enter the market.

Rebate, Reimbursement Structures

Rebates and reimbursements are known to influence prescription habits, formulary placement, and prevent biosimilar dissemination to patients. Both structures tend to incentivize the use of reference products. However, payers may want to look into ensuring that rebates and reimbursements encourage biosimilar use to ensure that better savings and clinical outcomes can be achieved.

Over the past few years, more payers have been adjusting their reimbursement strategies to incentivize biosimilar prescriptions, according to a report from Magellan Rx Management. The report found that most payers indicated that biosimilar pricing was the biggest influence on their reimbursement decisions, and provider willingness to switch patients from a reference product to a biosimilar was cited as the next most impactful factor.

Payers may want to negotiate rebates and reimbursement agreements with their PBMs and practices, respectively, to ensure that lower-cost biosimilars are accessible to beneficiaries and result in cost savings for everyone.

Payers should also keep in mind that short-term benefits from rebates could prevent long-term savings from biosimilars, thus diminishing incentives for businesses to invest in future biosimilars, limiting market competition that could drive down prices and lead to further lost savings for payers.8

Obviously, payers will do what is best for business, and it may be tough to convince many to take a chance on adalimumab biosimilars, especially if rebates for Humira prevent payers from adding adalimumab biosimilars on formulary lists. However, several health systems have been able to generate significant savings from adopting policies that enable biosimilars to be added to formulary:

- Providence St. Joseph Health saved $26.9 million in 2 years by adding biosimilars

- Texas Oncology generated $4 million a month converting patients to 3 biosimilars

- Pharmacare, a public payer in a Canadian province, anticipates savings will reach about $80 million (about $61 million USD) by 2024 after it added 5 adalimumab biosimilars to formulary in 2021

Additionally, the Biosimilars Forum has a state-by-state savings calculator that quantifies the amount that states could save if biosimilars accounted for 75% market share.

Reframing Prior Authorization and Step Therapy

Prior authorization and step therapy policies can aid payers by giving them and PBMs more of a say in which medications are prescribed to patients, especially if those medications have higher rebates. Both presenting challenges to biosimilars and preventing providers from being able to give them to patients.

In addition to presenting another barrier to biosimilar utilization, prior authorization policies create undue administrative burden on payers and practices. In a survey from the American Medical Association, providers reported that they have to wait between 1 to 5 days to receive a decision on prior authorization requests from payers, forcing patients to wait longer periods of time to receive their medications.

A big concern providers have is that prior authorization, in a way, negates formulary coverage by requiring practices to ask permission to prescribe their patients a medication, according to a panel discussion on prior authorization at the Association of Community Cancer Centers’ 2022 Annual Meeting & Cancer Center Business Summit. One panelist argued that using prior authorization for formulary management is inappropriate because it puts extra burden on practices to stock more biologics than could be easily managed and requires nurses to keep track of more formularies, making it more difficult for practices to manage costs related to biosimilars.

Payers should evaluate whether prior authorization requirements for adalimumab biosimilars will reduce efficiency within health systems and the amount of biosimilar savings payers could receive.

Step therapy policies in which patients will be required to try the reference product before a biosimilar can exacerbate costs for payers in ways they may not anticipate. An analysis from Avalere found that patients who were forced to start therapy with a reference product and experienced negative outcomes were likely to max out their deductible and copay requirements as soon as 5 months into a plan year, leaving payers to pay for the patients’ new medication for the next 7 months. However, patients with no step therapy requirements likely would not hit the maximum out-of-pocket costs until the end of the 12-month period.

Additionally, payer costs were 37% higher in cases where patients underwent step therapy with a negative outcome, costing them an average $50,000 more monthly. The impact that step therapy could have on adalimumab biosimilar use, and subsequently payer costs, is likely to be even more dramatic considering that Humira is one of the most expensive and top-selling drugs in the world.

However, step therapy policies that require patients to start therapy on a biosimilar before switching to a more expensive product could help foster savings for payers. An analysis from Magellan Rx Management found that giving payers the option to use step therapy that promotes biosimilars or parity reimbursement helped the PBM achieve a 90% utilization rate of oncology biosimilars over a 1-year period, showing that these policies on their own can boost adoption rates and cut costs.

Payers should consider whether step therapy requirements benefit them and their beneficiaries. Payers with requirements favoring reference products may want to change them to favor biosimilars instead or they may want to do away with them altogether. They should take an individual approach to evaluate which outcome would generate the most savings for them.

What Providers, Patients, Pharmacists Want

Providers, pharmacists, and patients are all asking for better access to biosimilars. Biosimilars offer the entire health care system, not just payers, the opportunity to save money on expensive biologics, including Humira.

They are asking for more options, easier access, realigned incentives, and lower cost products. Many providers have indicated that they’ll prioritize interchangeable biosimilars, and many patients will be seeking a high-concentration formulation, especially those who are already using high-concentration Humira.

Many clinicians are looking to have better communication with payers and are looking for payers to provide more transparency on drug pricing, formulary placement, and point-of-care information on cost savings.

One indication that providers and beneficiaries want biosimilar access is automatic substitution policies, which allow reference products to be substituted for a biosimilar regardless of interchangeability status. Some practices may implement automatic substitution policies to make switching patients to biosimilars easier and cut costs. While these policies will not get around prior authorization requirements, these policies could be viewed as a sign that providers and patients are willing to take action to ensure biosimilar use and lower drug costs.

Payers should also keep an eye on the growing cries for Congress and government agencies to step in and create frameworks that safeguard access to biosimilars. Employers have called on Congressional leaders to make drug coverage more affordable for American workers. The American College of Physicians have urged policy makers to reform the regulatory and market systems to remove barriers to biosimilars. A group of 16 advocacy groups called for HHS to make zero co-pays for all biologics as part of a drug price reform program. Also, the Federal Trade Commission is investigating PBM business practices and their impact on formulary decisions and patient outcomes.

Payers have much at stake in the adalimumab game and have a lot of power to change things to make biosimilars accessible, affect market dynamics, and generate savings across the health care industry. But the question remains, will they take a chance on adalimumab biosimilars, thus playing a massive part in how the market will develop, or will they choose to sit back and let the potential savings pass by?

References

- Biosimilar interchangeability laws by state. Cardinal Health. Updated July 2021. Accessed August 5, 2021. https://www.cardinalhealth.com/content/dam/corp/web/documents/publication/Cardinal-Health-Biosimilar-Interchangeability-Laws-by-State.pdf

- La Noce A, Ernst M. Switching from reference to biosimilar products: an overview of the European approach and real-world experience so far. EMJ. 2018;3(3):74-81.

- Coghlan J, He H, Schwendeman AS. Overview of Humira® biosimilars: current European landscape and future implications. J Pharm Sci. 2021;110(4):1572-1582. doi:10.1016/j.xphs.2021.02.003

- Parekh KD, Wong WB, Zullig LL. Impact of Co-pay Assistance on Patient, Clinical, and Economic Outcomes. Am J Manag Care. 2022;28(5):e189-e197. doi:10.37765/ajmc.2022.89151

- Griffith N, McBride A, Stevenson JG, Green L. Formulary selection criteria for biosimilars: considerations for US health-system pharmacists. Hosp. Pharm. 2014;49(9):813-825. doi:10.1310/hpj4909-813

- Okoro RN. Biosimilar medicines uptake: the role of the clinical pharmacists. Explor Res Clin Soc Pharm. 2021;1:100008. doi:10.1016/j.rcsop.2021.100008

- Oskouei ST, Kusmierczyk AR. Biosimilar uptake: the importance of healthcare provider education. Pharmaceut Med. 2021;35(4):215-224. doi:10.1007/s40290-021-00396-7

- Arad N, Staton E, Lopez MH, et al. Realizing the benefits of biosimilars: biosimilars and rebate walls. Duke Margolis Center for Health Policy. Published March 2022. Accessed August 31, 2022. https://healthpolicy.duke.edu/sites/default/files/2022-03/Biosimilars%20-%20Overcoming%20Rebate%20Walls.pdf

Newsletter

Where clinical, regulatory, and economic perspectives converge—sign up for Center for Biosimilars® emails to get expert insights on emerging treatment paradigms, biosimilar policy, and real-world outcomes that shape patient care.